How To Apply For Jobkeeper As A Sole Trader

You are a sole trader nominating as an eligible business participant. Coronavirus SME Guarantee Scheme If your business turnover is less than 50 million you may be eligible to access a loan to help your business recover.

Can I apply for JobKeeper as a Sole Trader.

How to apply for jobkeeper as a sole trader. A sole trader is a business structure where the individual owner is legally responsible for all aspects of the business including any debts and losses and day-to-day business decisions. Download the Treasurygovau factsheet frequently asked questions You can use either months of March or April 2020 to qualify. Check actual decline in turnover.

Visit the ATOs JobKeeper guide for sole traders This document merely provides a broad outline of the subject and is necessarily general in nature. Applications for JobKeeper Payments are now openHeres a step-by-step tutorial for those who are Sole Traders or self-employed using the ATO Business Porta. JobKeeper guide employers reporting through STP.

A sole trader is a business structure where the individual owner is legally responsible for all aspects of the business including any debts and losses and day-to-day business decisions. Do I need to qualify for the stimulus package package. JobKeeper guide employers not reporting through STP.

Sole traders will need to elect to participate in the JobKeeper payment scheme by applying through the Australian Taxation Office. The ATOs JobKeeper portal - including new sole trader information By booking a free 10 minute Airtax chat if you have an Airtax account and have started a service with us. A sole trader may or may not employ other people in their business.

Confirm no eligible employees. If you require specific advice which is tailored to your specific circumstances please do not hesitate to contact us fees would apply. Make a business monthly declaration.

If you received the JobKeeper Payment between 4 January and 28 March 2021 you may be eligible to apply for a business loan. Sole traders with no employees. Indicate that you are enrolling as a sole trader and that you are the eligible business participant.

Schedule of JobKeeper fortnights. As a sole trader without employees you will answer zero to the question regarding employees. Who is an eligible business participant.

Identify your eligible employees. Sole traders may be eligible to receive the JobKeeper Payment if their turnover has fallen. Your STP-enabled payroll software has JobKeeper functionality.

If youre a sole trader we use all your business income minus allowable deductions. If you or your business got JobKeeper Payment its part of your gross business income. Payments will then be made to the individuals bank account.

JobKeeper Payment for sole traders. Sole traders with employees. Each month youll need to reconfirm yourself as a sole trader through the ATO portal on myGov in the Business Portal.

After this you should receive JobKeeper payments within five business days. Find out how to enrol and get JobKeeper payments. Log in to complete the online form.

You will need to pay your eligible employees at least the JobKeeper amount that applies to them each JobKeeper fortnight. Yes see Sole Trader Eligibility on the ATO website. JobKeeper guide sole traders.

Log in to ATO online services or the Business Portal. Update each eligible employee in your payroll software and submit. An employer is not entitled to the JobKeeper payment if any of the following apply.

The JobKeeper guide for sole traders will help you through Steps 1-3 of your JobKeeper application. Enrol for the JobKeeper payment. For JobKeeper Fortnight 20 which falls within JobKeeper extension 1 this will be either 1200 for tier 1 or 750 for tier 2.

A sole trader may or may not employ other people in their business. This document merely provides a broad outline of the subject and is necessarily general in nature. If youre in a business partnership we use your share of the business income minus allowable deductions.

Confirm eligible business participant. If there are additional checks required or any errors made on your form it. Yes you need to establish that as a sole trader your current turnover has been reduced by at least 30 percent.

Business owners will need to provide an ABN nominate an individuals tax file number and provide a declaration of recent business activity.

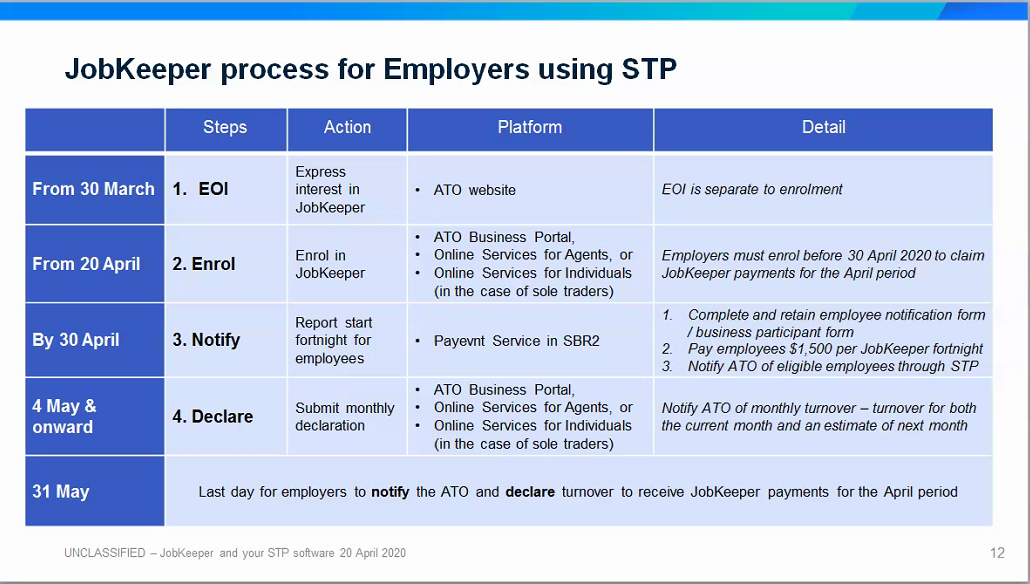

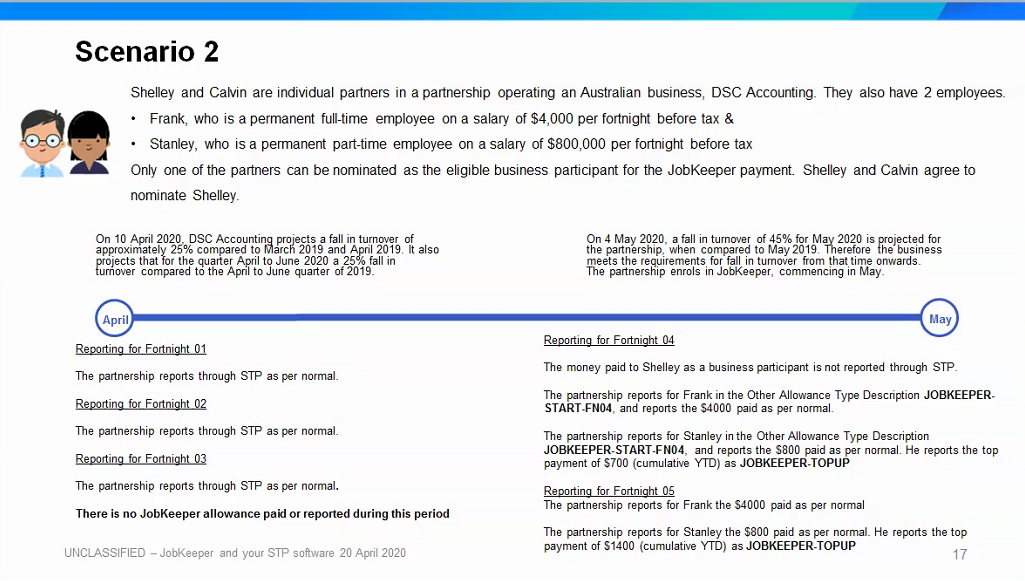

Jobkeeper Payment Setup Entirerecruit Help Centre

Jobkeeper Payment Setup Entirerecruit Help Centre

Jobkeeper Payment Setup Entirerecruit Help Centre

Jobkeeper Payment Setup Entirerecruit Help Centre

Covid 19 Jobkeeper Update Whyte Group

Covid 19 Jobkeeper Update Whyte Group

Jobkeeper Payment Setup Entirerecruit Help Centre

Jobkeeper Payment Setup Entirerecruit Help Centre

Jobkeeper Payment How To Get Ready In Xero Australia Xero Youtube

Jobkeeper Payment How To Get Ready In Xero Australia Xero Youtube

Jobkeeper Extension Explained Jobkeeper 2 0 Youtube

Jobkeeper Extension Explained Jobkeeper 2 0 Youtube

Jobkeeper 2 0 What We Know So Far Pmwplus

Jobkeeper 2 0 What We Know So Far Pmwplus

Applying For Jobkeeper A Step By Step Guide For Sole Traders Part 1 Youtube

Applying For Jobkeeper A Step By Step Guide For Sole Traders Part 1 Youtube

Job Keeper Payments Incl Sole Trader Assistance Youtube

Job Keeper Payments Incl Sole Trader Assistance Youtube

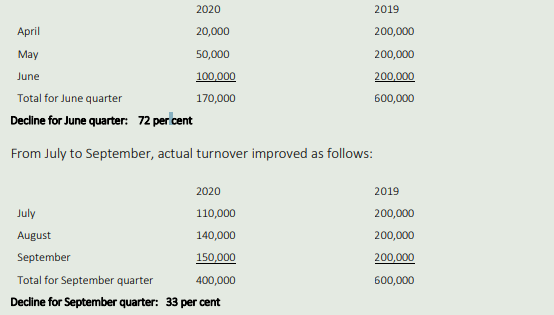

Jobkeeper Phase Two Are You Eligible

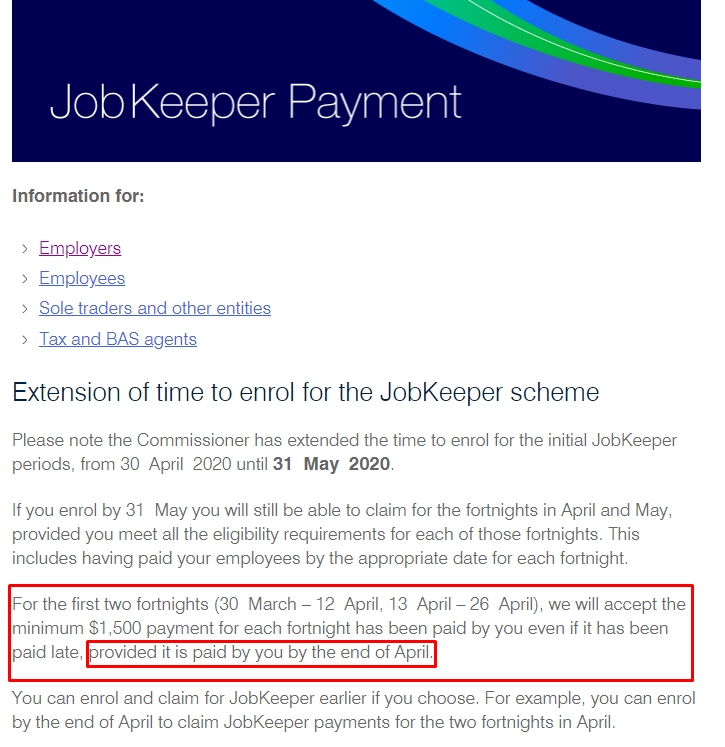

Claiming Jobkeeper Updated Information And How We Can Help You Bewise Accounting Wealth Solutions

Claiming Jobkeeper Updated Information And How We Can Help You Bewise Accounting Wealth Solutions

Jobkeeper Employee Nomination Notice Pdf Templates Jotform

Jobkeeper Employee Nomination Notice Pdf Templates Jotform

How Do I Apply For Jobkeeper Payments Youtube

How Do I Apply For Jobkeeper Payments Youtube

New Jobkeeper Payment Eligibility Of Sole Traders Without Employees Uber Drivers Forum

Jobkeeper Extension 1 2 Thrive Advice Govt Stimulus

Jobkeeper Extension 1 2 Thrive Advice Govt Stimulus

How To Process Jobkeeper Payments In Sapphireone Payroll Hr

How To Process Jobkeeper Payments In Sapphireone Payroll Hr

Jobkeeper Deadline Extended Here Business

Jobkeeper Deadline Extended Here Business

Job Keeper Payment Update What You Need To Know Youtube

Job Keeper Payment Update What You Need To Know Youtube