Formula To Value Business For Sale

Discretionary Earnings are the Net Earnings of the business before Interest Taxes Depreciation and Amortization plus Managers Salary and other non-recurring expenses. When valuing a business you can use.

Pin By Marketing Tips On Investing Business Skills Business Ideas Entrepreneur Finance Investing

Pin By Marketing Tips On Investing Business Skills Business Ideas Entrepreneur Finance Investing

This number is known as a multiplier of earnings.

Formula to value business for sale. Now you can distribute all of your balance sheet lines into the appropriate category and use the formula below to come to an estimated business value. Industry calculations typically express business value as a multiple of annual sales or profits. There are two methods of quickly approximating the value of a business.

Business Estimated Value SDE Industry Multiple Real Estate Accounts Receivable Cash on Hand Other Assets Not in SDE or Multiplier Business Liabilities. This is a 05x sales multiple. Tally the value of assets.

Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk and possible adjustments for. Value selling price net annual profitROI x 100 Say you wanted a ROI of at least 50 for the sale of your business. Compare the companys revenue to the sale prices of other similar companies that have sold recently.

Add to this the current market value of your assets and you arrive at a total price of 906000 for the business 626000 280000 906000. Shows a businesss future profitability accounting for cash flow annual ROI and expected value. 1 applying a multiple to the discretionary earnings of the business and 2 applying a percentage to the annual gross revenue of the business.

These methods determine value by comparing the soon-to-be-for-sale business to others in the same industry of the same size and within the same area. There are two methods of quickly approximating the value of a business. For example a competitor has sales of 3000000 and is acquired for 1500000.

Subtract any debts or liabilities. The market approach is perhaps the most subjective Zwilling says as it tries to factor the size of the opportunity market conditions that control comparables and goodwill associated. Our calculator will give you an approximate value for your business by taking the annual sales and multiplying it by the appropriate industry multiplier.

For example if you are selling a law firm that made 100000 in annual sales the industry sales multiplier is 103 and the approximate value is 100000 x 103 103000. Add up the value of everything the business owns including all equipment and inventory. Selling price 10000050 x 100.

For example a company with a share price of 40 per share and earnings per share after tax of 8 would have a PE ratio of five 408 5. Rate of 20 percent the value of your excess earnings is 626000. This method extends calculations for a single period into the future.

How to Value a Business. If your business net profit for the past year was 100000 you could work out the minimum selling price you should set. Similar to bond or real estate valuations the value of a business can be expressed as the present value of expected future earnings.

Only adjust for expenses listed on financial statements used for your valuation. Determine the Cash Flow of the business. These multiples vary by industry and take into account billings collections.

1 applying a multiple to the discretionary earnings of the business and 2 applying a percentage to the annual gross revenue of the business. The price earnings ratio PE ratio is the value of a business divided by its profits after tax. There are a number of ways to determine the market value of your business.

Another way to value a business is to multiply the annual earnings based on how long you think the company will operate. Shows the present value of a businesss future cash flow discounted according to the risk involved in purchasing the business.

Discount Rate Formula How To Calculate Discount Rate With Examples

Discount Rate Formula How To Calculate Discount Rate With Examples

Time Value Of Money Formulas Infographic Covering Perpetuity Growing Perpetuity Annuity Growing Annuity Annuity Time Value Of Money Annuity Annuity Formula

Time Value Of Money Formulas Infographic Covering Perpetuity Growing Perpetuity Annuity Growing Annuity Annuity Time Value Of Money Annuity Annuity Formula

Core Value Proposition Example For Customers Unique Selling Proposition Core Values Start Up

Core Value Proposition Example For Customers Unique Selling Proposition Core Values Start Up

Getting Ready To Sell Increase Your Home Value With My Proven Formula Sell Your House Fast Real Estate Real Estate Website

Getting Ready To Sell Increase Your Home Value With My Proven Formula Sell Your House Fast Real Estate Real Estate Website

A Super Simple Formula For Writing Product Descriptions That Sell Thierry Augustin Ecommerce Copywriting Mistakes Ecommerce Marketing

A Super Simple Formula For Writing Product Descriptions That Sell Thierry Augustin Ecommerce Copywriting Mistakes Ecommerce Marketing

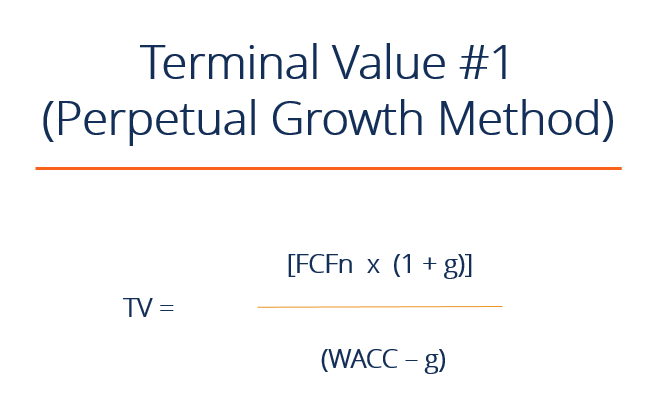

Dcf Terminal Value Formula How To Calculate Terminal Value Model

Dcf Terminal Value Formula How To Calculate Terminal Value Model

Craft Pricing Formula And Downloadable Calculator Craft Pricing Craft Pricing Formula Craft Pricing Calculator

Craft Pricing Formula And Downloadable Calculator Craft Pricing Craft Pricing Formula Craft Pricing Calculator

Pin By Paul Yang On Business Economics Stocks Intrinsic Value Value Investing Value Stocks

Pin By Paul Yang On Business Economics Stocks Intrinsic Value Value Investing Value Stocks

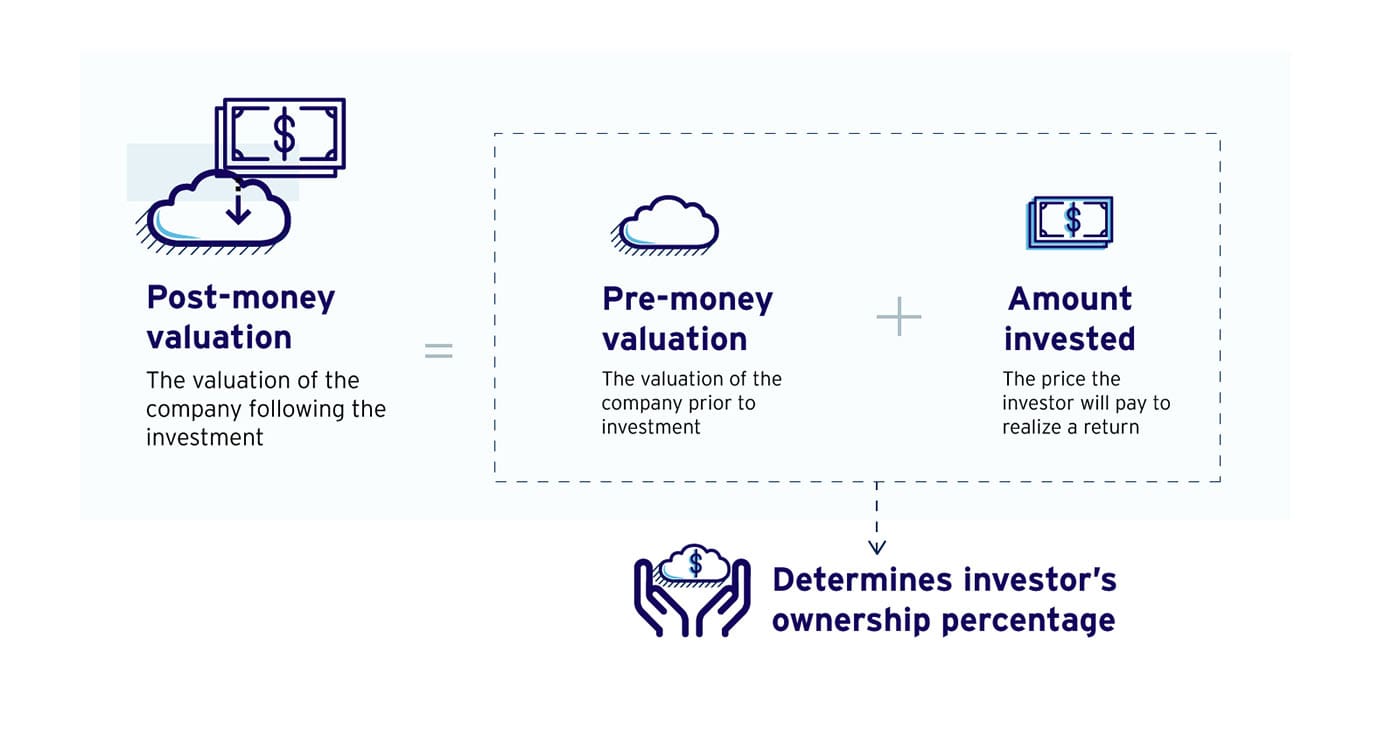

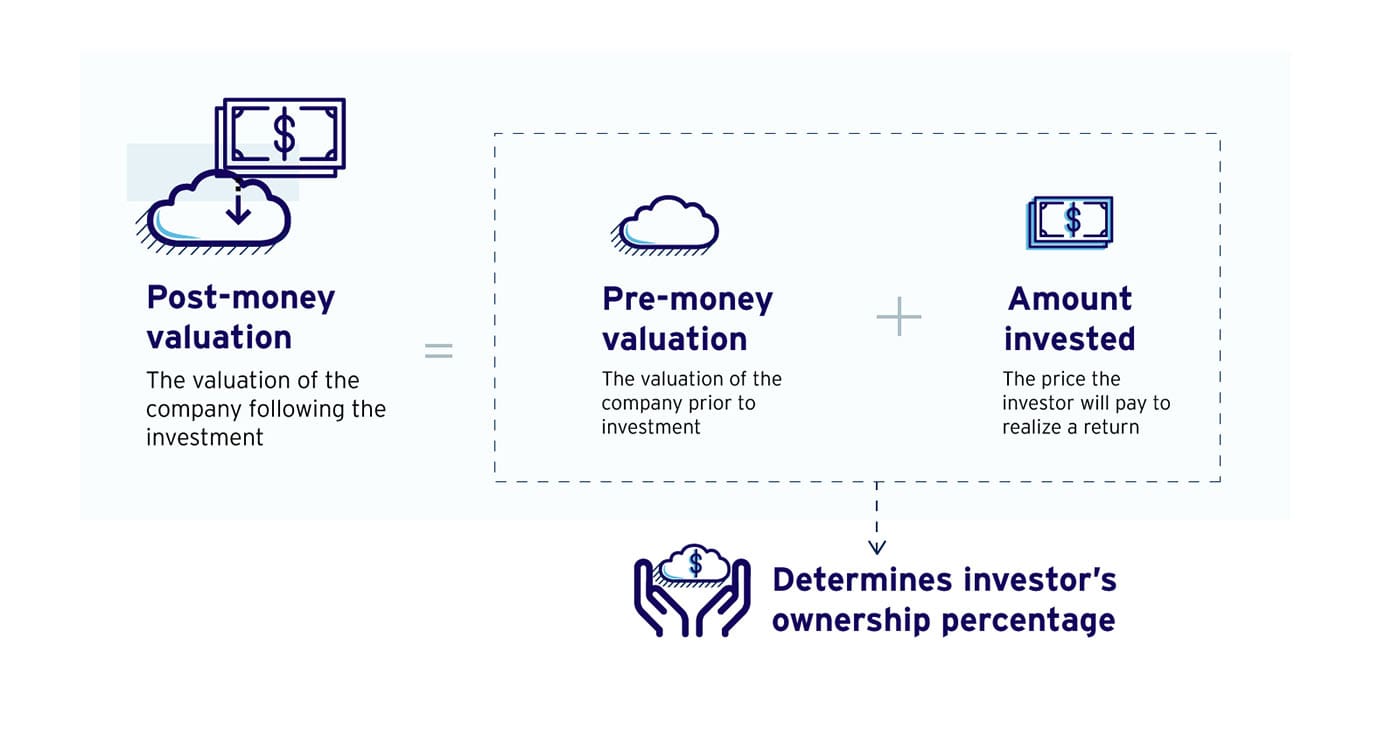

Business Valuation How Investors Determine The Value Of Your Business Entrepreneur S Toolkit

Business Valuation How Investors Determine The Value Of Your Business Entrepreneur S Toolkit

4 Pillars Of Selling Business Management Ideas Of Business Management Businessmanagement Busi Business Ideas Entrepreneur Business Mentor Business Skills

4 Pillars Of Selling Business Management Ideas Of Business Management Businessmanagement Busi Business Ideas Entrepreneur Business Mentor Business Skills

7 Business Valuation Methods You Should Know Business Valuation Structured Finance Debt Solutions

7 Business Valuation Methods You Should Know Business Valuation Structured Finance Debt Solutions

Formulas Are An Important Part Of Business A Formula Qualifies As Such When It Consistently Give Accounting Classes Accounting And Finance Business Management

Formulas Are An Important Part Of Business A Formula Qualifies As Such When It Consistently Give Accounting Classes Accounting And Finance Business Management

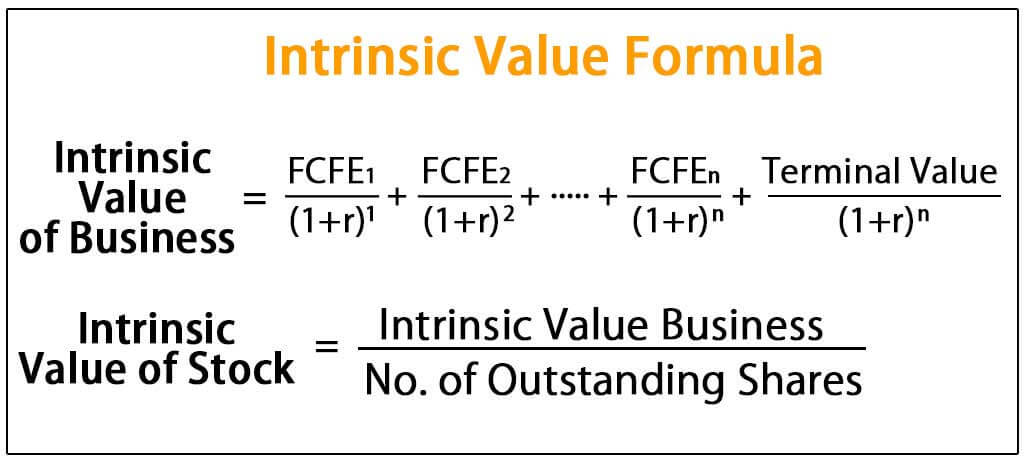

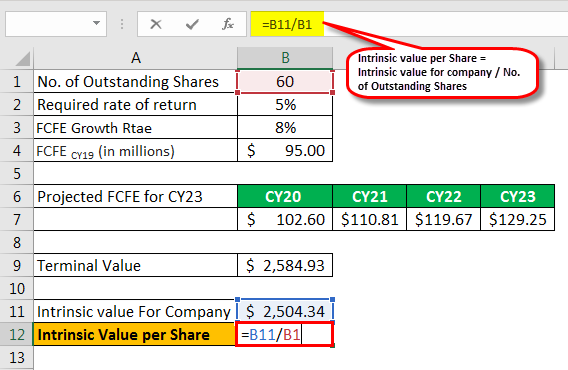

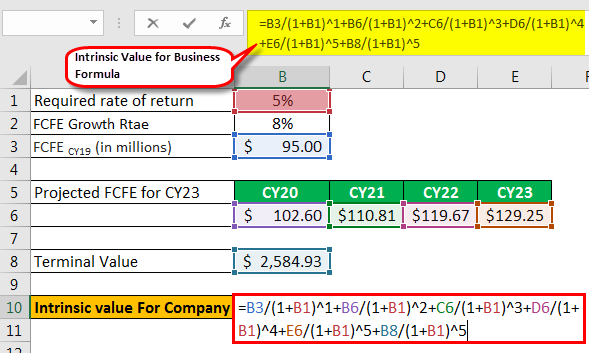

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

What Is An Elevator Pitch In 2021 Elevator Pitch Examples Pitch Direct Response Marketing

What Is An Elevator Pitch In 2021 Elevator Pitch Examples Pitch Direct Response Marketing

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Determine The Value Of Your Sponsorship Inventory And Define Your Own Sponsorship Valuation Formula To Get The Sale Guaranteed

Determine The Value Of Your Sponsorship Inventory And Define Your Own Sponsorship Valuation Formula To Get The Sale Guaranteed

Time Value Of Money Financial Mathematics Icezen Time Value Of Money Accounting And Finance Finance

Time Value Of Money Financial Mathematics Icezen Time Value Of Money Accounting And Finance Finance

What Is After Repair Value How To Calculate Arv Formula Money Making Schemes Repair Money Management Books

What Is After Repair Value How To Calculate Arv Formula Money Making Schemes Repair Money Management Books