How To Get W2 From Ex Employer

Getting Prior Years W2s If you file a prior-year tax return there may be complications such as missing W-2s and other forms. They are not sending W2 out electronically until Jan 15th and current employees have until the 14th to opt in to receive it by email.

Is Your Employer Legally Obligated To Give You Your W2 Form Quora

Enter the employer ID Number EIN if you know it.

How to get w2 from ex employer. Enter the e-mail address where you would like your W-2 sent and click on e-mail W-2. Youll need the following when you call. Visit the W-2 area of TurboTax and choose Work on my W-2 now 2.

The IRS will send a letter to your employer on your behalf. Please do not submit a request until this date. The most important thing is to get the proper website so you can get a copy of your W2 forms online which is the most ideal way.

When we ask for your W-2 info enter all the info that should be. To Get your W2 online. To make it easier for the IRS give them your previous companys Employer Identification Number.

Reprint requests will begin on February 15 2021. You will need to contact your former company HR or Payroll department to request a copy of your W-2. Complete and mail Form 4506 Request for Copy of Tax Return along with the required fee.

Your Former Employer would have set something up with one of the many Services If they didnt do it themselves They would email or some how send you a link to logon to that site and getdownload the W2. There is no Central W2 online service that would provide all W2s that would be searchable by EIN or SSN. If you have previously logged into the ADP portal to get your paystub or W-2 from your former employer you can try and access your information.

Taxpayers who are unable to get a copy from their employer by the end of February may call the IRS at 1-800-829-1040 for a substitute W-2. 1 USPS Options If you opted to receive your W-2 form electronically log in to PostalEase the USPS employee extranet and go to the W-2 module to view and print the form. Be sure they have your correct address.

There are many reasons why you might not receive an IRS W-2 including administrative glitches and simple oversights. Leave it blank if you dont. To request a reprint of a W-2 complete the W-2 Reprint Request form and fax the completed form to 210-938-4797.

If not you have to wait until they mail it to you which I think is the end of the month. If your employer no longer exists or cant provide you with the W-2 in a timely manner you can call the IRS directly at 800-829-1040. If your former employer does not act on your request for following up on your W-2 or you are unable to reach them then it is time to reach out to the IRS.

Heres how to fill out Form 4852. Name address Social Security number and phone number. The IRS will send a letter to the employer on taxpayers behalf.

If you are one of these people you should try obtaining your W2 from your local IRS office. There is no charge for W-2 reprints. Call the IRS.

Employers name address and phone number. Provide the IRS with. You can find this in your last pay stub or last years W-2 if you received one from the company.

Enter Employer Pin EAT the word is case sensitive - enter using all capital letters and DO NOT include quotations Select View Copy of W-2 2013-2020 You do not need to consent to receive a reprint of your W-2. Be sure you request a transcript of your tax account and not a transcript of your tax. You can do this by calling them and requesting a copy.

You can however get the information that is on the W2 by going to the IRS at Welcome to Get Transcript. The IRS is the next alternative if you cant reach the employer or you do not wish to contact them again. If you are unable to log in your former employer may have removed your online account.

Ask your employer or former employer for a copy. There is no way to get the actual W2 without asking the ex employer. Contacting a current or former employer is the easiest way to get a W2 from a previous employer.

If you cant get your Form W-2 from your employer and you previously attached it to your paper tax return you can order a copy of the entire return from the IRS for a fee. You can call your ex-employer to request your W-2 form. If you did not opt for electronic W-2 delivery go to the W-2 module and click on the button for request mailed W-2 reprints.

When they call taxpayers need their. If you are unable to get a copy from your employer you may call the IRS at 800-829-1040 after Feb. Where Is My W-2.

The IRS will then send a reminder notice to your previous employer. Allow 75 calendar days for us to process your request. Your name address Social Security number and phone number.

File Your Taxes No Matter What.

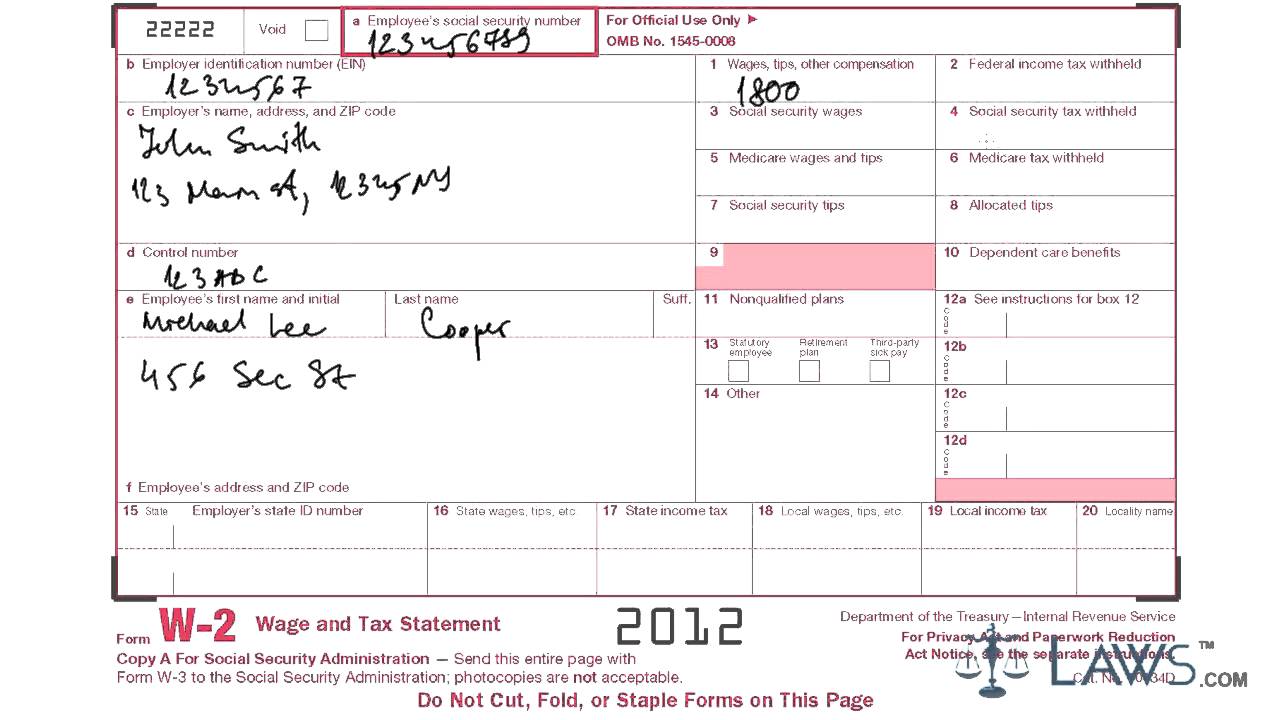

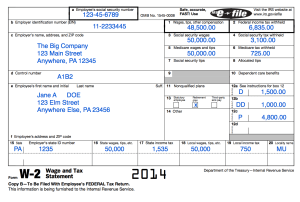

Wage Tax Statement Form W 2 What Is It Do You Need It

Wage Tax Statement Form W 2 What Is It Do You Need It

Fake Chase Bank Statement Template Fresh How To Not Get F Ked By Your Bank While Traveling Business Template Ex In 2021 Statement Template Bank Statement Chase Bank

Fake Chase Bank Statement Template Fresh How To Not Get F Ked By Your Bank While Traveling Business Template Ex In 2021 Statement Template Bank Statement Chase Bank

W2 Instructions Can Be A Little Confusing Hopefully This Blog Helps

W2 Instructions Can Be A Little Confusing Hopefully This Blog Helps

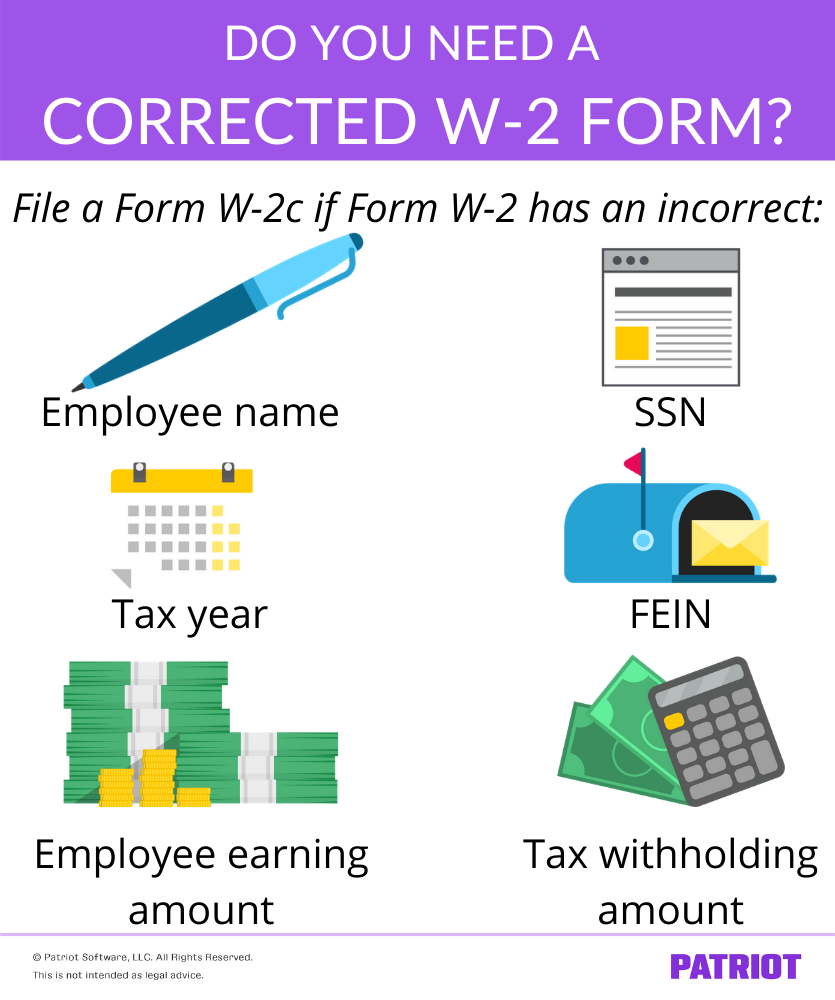

How To Correct A W 2 Form Irs Form W 2c Instructions

How To Correct A W 2 Form Irs Form W 2c Instructions

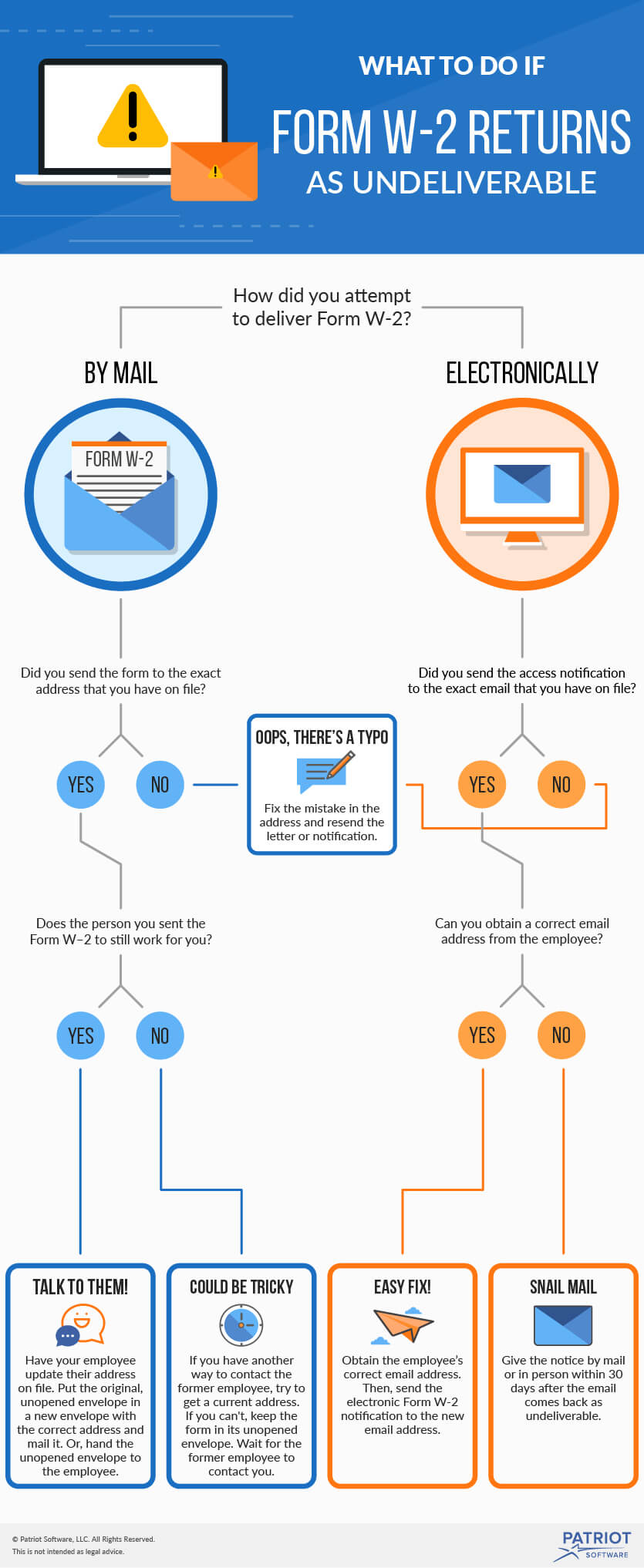

Form W 2 Returned To Employer Follow These Steps

Form W 2 Returned To Employer Follow These Steps

How To Correct A W 2 Form Irs Form W 2c Instructions

How To Correct A W 2 Form Irs Form W 2c Instructions

Two Websites To Get Your W2 Form Online For 2020 2021

Two Websites To Get Your W2 Form Online For 2020 2021

Simple Project Plan Template Word Lovely Munications Plans In Swiftlight Making Your L In 2021 Communication Plan Template Project Timeline Template Proposal Templates

Simple Project Plan Template Word Lovely Munications Plans In Swiftlight Making Your L In 2021 Communication Plan Template Project Timeline Template Proposal Templates

Two Websites To Get Your W2 Form Online For 2020 2021

Two Websites To Get Your W2 Form Online For 2020 2021

Learn How To Fill W 2 Tax Form Youtube

Learn How To Fill W 2 Tax Form Youtube

Getting To Know Your W 2 Form R G Brenner

Getting To Know Your W 2 Form R G Brenner

Learn How To Fill W 2 Tax Form Youtube

Learn How To Fill W 2 Tax Form Youtube

Two Websites To Get Your W2 Form Online For 2020 2021

Two Websites To Get Your W2 Form Online For 2020 2021

Two Websites To Get Your W2 Form Online For 2020 2021

Two Websites To Get Your W2 Form Online For 2020 2021

Didn T Get Your W2 Here S What To Do Now The Motley Fool

Didn T Get Your W2 Here S What To Do Now The Motley Fool

Phishers Make Off With W2 Tax Forms For Several Thousand Seagate Employees Tax Forms W2 Forms Power Of Attorney Form

Phishers Make Off With W2 Tax Forms For Several Thousand Seagate Employees Tax Forms W2 Forms Power Of Attorney Form

What And Where Is Box D In A W2 Form Quora