How To Get 1099 Forms From Previous Years

If you havent e-filed them to IRS using QBO youll have the option to print them when you select the Ill file myself button. Preview and print sample.

/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Downloadable 1099 forms are for information only.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

How to get 1099 forms from previous years. The transcript should include all of the income that you had as long as it was reported to the IRS. Click View past forms. You can simply list any income on your tax return without the 1099 form.

To get a copy of the Form W-2 or Form 1099 already filed with your return you must use Form 4506 and request a copy of your return which includes all attachments. If you havent e-filed them to IRS using QBO youll have the option to print them when you select the Ill file myself button see screenshot below. To use this system you must be able to create a file in the proper format.

Heres how to print the forms. How Do I Get 1099 Forms for Past Years. 26 rows Prior Year Products.

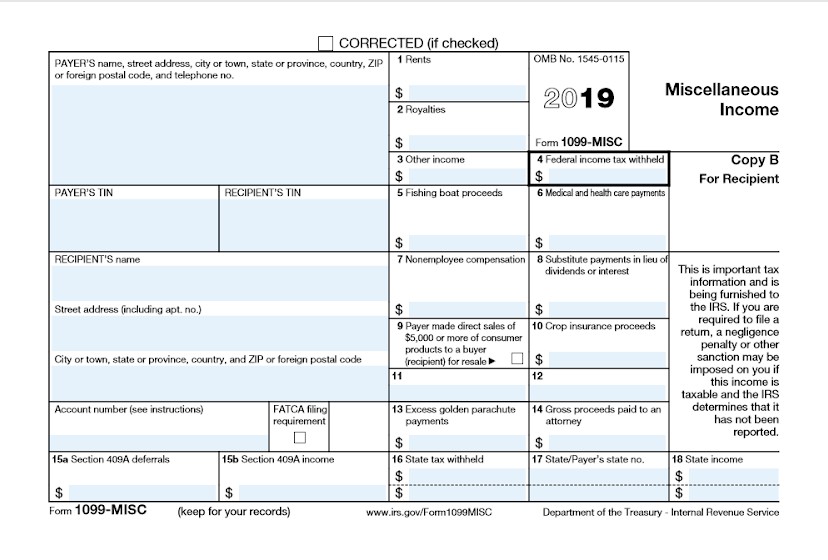

Select the 1099 forms you want to print. Go to number 8 Form W-2 Form 1099 series Form 1098 series or Form 5498. See instructions for details Note.

You may also save money if your accountant or tax company charges you based on the number of 1099s you file. You can purchase your 1099 kit for the pre-printed forms. Contact the IRS to request a free Transcript of a previous years 1099.

File this form for each person to whom you made certain types of payment during the tax year. You cant use a scanned or PDF copy. These transcripts are available for the past ten tax years but information for the current tax year may not be complete until July.

You can get this transcript in four ways. Call IRS at 1-800-829-1040 or 1-800-829-0922 or 1-800-829-8374 and ask for you Wage information to be sent to you or visit IRS website. Enter a term in the Find Box.

Obtain IRS Form 4506-T. Heres how to print the forms. Click View past forms.

Instructions for Form 1099-MISC 2019 PDF. It may take up to 75 calendar days for the IRS to process your. But what you have to do to add income to a previous years tax return is amend that return.

You can file 1099 forms and other 1099 forms online with the IRS through the FIRE System Filing Electronic Returns Electronically online. First contact the issuing company. Simply click start filing to create a new account or login to access your existing account.

This form allows you to request the wage and income transcript and a transcript. If your earnings were. It should show all Forms 1099 issued under your Social Security number.

You must provide your name social security number birth date and mailing address to receive a transcript. If your earnings were less than 600 the company was not required to issue you a 1099 even though you were required to report the amount to the IRS as taxable income. However state or local information isnt included with the Form W-2 information.

This form reflected your annual earnings. There are several ways to get a copy of your 1099 tax document when your original form is lost or destroyed. This can be done by calling 800-908-9946.

Provide your personal identification information in boxes 1 through 4. PlayPause SPACE Step 2. Use IRS Get Transcript.

June 1 2019 1221 PM You have not mentioned what kind of 1099 you have from the past year. Form 1099-MISC 2019 PDF. If you are looking for 1099s from earlier years you can contact the IRS and order a wage and income transcript.

All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS. This requires a fee of 50. Mail Form 4506-T Request for Transcript of Tax Return to the IRS.

It shows the data reported to us on information returns such as Forms W-2 Form 1099 series Form 1098 series and Form 5498 series. Wwwirsgov download form 4506 and request W210991098 to. Order your transcript by phone or online to be delivered by mail.

The forms SSA-1099 and SSA-1042S are not available for people who receive Supplemental Security Income SSI. As long as you report it youre in the clear. There are many different kinds of 1099s.

A replacement SSA-1099 or SSA-1042S is typically available for the previous tax year after February 1. An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS. Note that you do not necessarily need a 1099 form if your previous employer cannot or will not supply it.

Often the easiest and quickest way to get a copy of a past-years 1099 is simply to contact the company that issued the 1099 to you. Next enter the form data checkout create your recipient copies and youre done. If you dont have access to a printer you can save the document on your computer or laptop and email it.

You can purchase your 1099 kit for the pre-printed forms. Once youre logged in create a New Company and enter the tax year for which you want to file along with the company issuing the W-2 or 1099-MISC form.

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) Form 1099 Oid Original Issue Discount Definition

Form 1099 Oid Original Issue Discount Definition

Schwab Moneywise Calculators Tools Understanding Form 1099

Schwab Moneywise Calculators Tools Understanding Form 1099

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

W9 Vs 1099 Irs Forms Differences And When To Use Them

W9 Vs 1099 Irs Forms Differences And When To Use Them

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It