How Do I Change My Nonprofit Business Name With The Irs

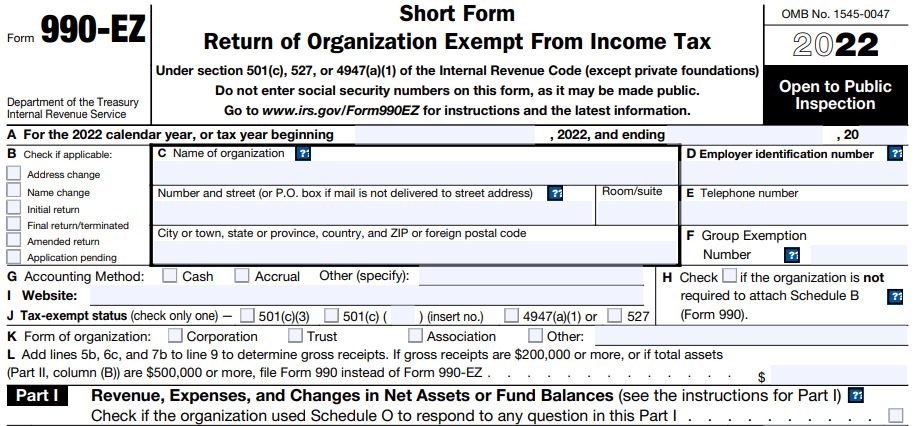

To do this check the Name Change box in box B at the top of the form and write your new nonprofit name in box C. In addition attach a copy of the amended articles of incorporation.

What Is Ein How To Get Ein For A Nonprofit Organization

What Is Ein How To Get Ein For A Nonprofit Organization

The letter or fax reporting the change of name must include your organizations full name both the prior name and the new name Employer Identification Number and authorized signature an officer or trustee The individual signing the letter must state the capacity in which he or she is signing for example John Smith President.

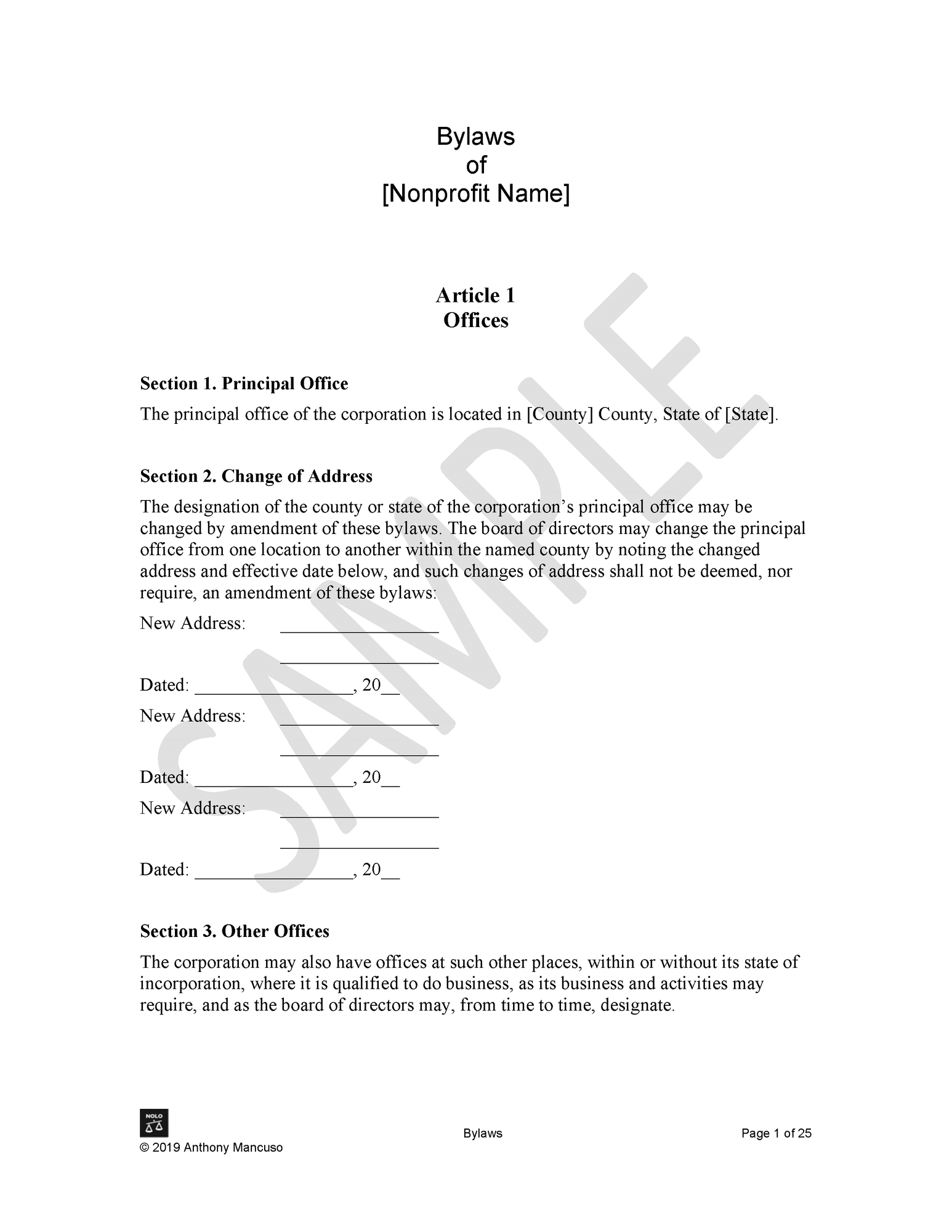

How do i change my nonprofit business name with the irs. Include the new name of the nonprofit where appropriate. Changing Your Name. Thus any subsequent legal name change should be appropriately amended on the articles of incorporation and filed with the state for a.

Most of the time you wont need to change your EIN when you change your name. An incorporated nonprofit organization files articles of incorporation with the Secretary of State in its state of incorporation. Corporation Name Change If your organization changed its name because it was converted from a corporation to a limited liability company it needs a new EIN.

Review the IRSs current procedures for a name change. A nonprofit must notify the IRS of its name change particularly if the nonprofit has tax-exempt status. This name change notification must also be signed by a corporate officer.

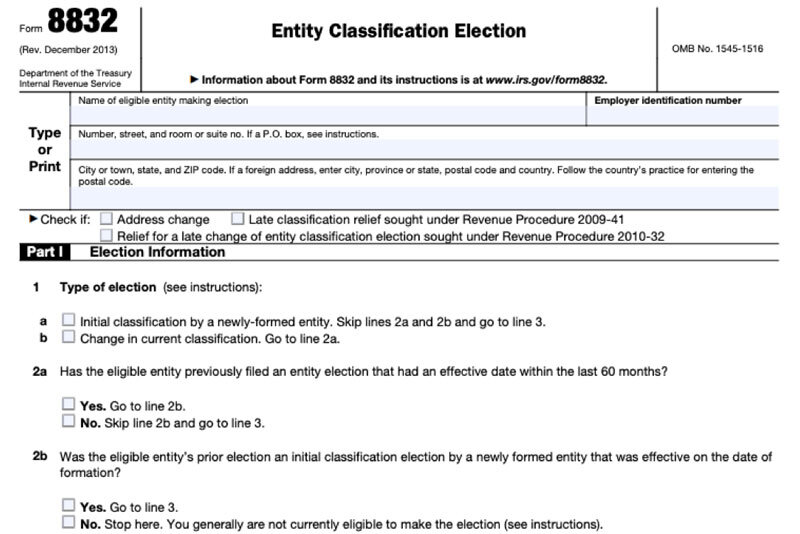

As a corporation you can file an annual Form 1120 by checking Name Change on page 1 line E. The name on the articles of incorporation is the business name kept on file with the state. You do not have to request a waiver from the requirement to e-File because your inability to file is a limitation of the e-File system.

In most cases this is done by submitting the states confirmation of the name change to the IRS along with the nonprofits federal tax ID number and exemption details. Exempt Organizations e-File - Name Change. An authorized person from your company must sign the letter.

Changing your business name may require you to notify the IRS in addition to changing your EIN. If an organization files an annual return such as a form 990 or 990-EZ it must report the changes on its return. The letter or fax reporting the change of name must also include your organizations 1.

The filing is not to be sent along with another return but rather sent on its own. Write to us at the address where you filed your return informing the Internal Revenue Service IRS of the name change. If you are filing a current year return mark the appropriate name change box of the Form 1120 type you are using.

The other way you can change your address on file with the IRS is to prepare and mail Form 8822-B. However after you file your return on paper. You must include a copy of your Certificate of Amendment and proof that you filed the amendment with your Secretary of State.

My organization is required to e-File its Form 990 but cant because it changed its name. An authorized representative or the owner of the business must sign the document. When you change your business name you generally do not have to file for a new EIN.

If the organization needs to report a change of name see Change of Name- Exempt Organizations. Sole proprietorships need to send a signed notification to the IRS. Can we get something in writing.

The notification must be signed by the business owner or authorized representative. Authorized signature an officer or trustee The individual signing the letter must state the capacity in which he or she is signing for example John Smith President. On Item B of page one of Form 990 Return of Organization Exempt from Income Tax check the name change box.

One of the big concerns that comes up has to do with a businesss name. Find information on annual reporting and filing using Form 990 returns and applying and maintaining tax-exempt status. Instead you submit an EIN name change.

How you give notice depends on your business type. Obtain documented proof that the registrar received and accepted your nonprofits amended articles. If you change the name of your partnership or corporation you must include a copy of the Articles of Amendment that you filed with your state to authorize the name change.

To request a new EIN send an application through the IRSs online EIN assistant. Send a letter signed by the business owner or an authorized representative to the same address where you file your tax returns notifying them of your name change. The EO Determinations Office can issue an affirmation letter showing an organizations new name andor address and affirming the section of the Internal Revenue Code under which IRS.

Do we have to request a waiver from the requirement to e-File the Form 990. File your 501 c 3s tax return and inform the IRS of the name change using that return. If it needs to report a change of address see Change of Address - Exempt Organizations.

Full name both the prior name and the new name 2. Next time the nonprofit files its annual Form 990 alert the IRS to your name change. When and How to Change a Name.

This includes filing your 501 c 3 corporations tax return and indicating on the return that you are changing the name of your business. The process you take depends on your entity type. Since the EIN locks in a business record in perpetuity its vital that you understand how your business name affects your EIN.

Employer Identification Number and. You can change your name with the IRS when you file taxes by including the change on your tax forms or through other written correspondence. Also it is not recommended to use this form AND marking the change of.

How To Change The Name Of Your Llc Incfile

How To Change The Name Of Your Llc Incfile

How Do I Update Or Change My Organization S Details Network For Good

How Do I Update Or Change My Organization S Details Network For Good

3 13 2 Bmf Account Numbers Internal Revenue Service

3 13 2 Bmf Account Numbers Internal Revenue Service

Changing A Business Name How Do I Change My Business Name

Changing A Business Name How Do I Change My Business Name

Start A Nonprofit In Tennessee Fast Online Filings

Sample Nonprofit Articles Of Incorporation Template For 501c3

Sample Nonprofit Articles Of Incorporation Template For 501c3

Http Www Publiccounsel Org Tools Publications Files 0241 Pdf

Irs Form 990 Ez Instructions 2019 990ez Filing Requirements For Nonprofits

Irs Form 990 Ez Instructions 2019 990ez Filing Requirements For Nonprofits

How To Set Up G Suite For Nonprofits Email For Your Domain Ecatholic Help Center

How To Set Up G Suite For Nonprofits Email For Your Domain Ecatholic Help Center

Lovely Irs Ein Name Change Form Models Form Ideas

Lovely Irs Ein Name Change Form Models Form Ideas

Start A Nonprofit In Florida Fast Online Filings

Irs Instructions For A Business Name Change Legalzoom Com

Irs Instructions For A Business Name Change Legalzoom Com

W 9 Form For Non Profits How To Fill It And Purpose Of The W 9 Form Form Applications In United States Application Gov

W 9 Form For Non Profits How To Fill It And Purpose Of The W 9 Form Form Applications In United States Application Gov

How To Change The Name Of A Nonprofit Organization Bizfluent Nonprofit Organization Non Profit Organization

How To Change The Name Of A Nonprofit Organization Bizfluent Nonprofit Organization Non Profit Organization

Form 990 A Guide For Newcomers To Nonprofit Research

Form 990 A Guide For Newcomers To Nonprofit Research

Change Your Business Name With The Irs Harvard Business Services

Change Your Business Name With The Irs Harvard Business Services

Nonprofit Bylaws Sample Nonprofit Bylaws Nolo

Nonprofit Bylaws Sample Nonprofit Bylaws Nolo

Start A Nonprofit In Washington Fast Online Filings