Does Robinhood Give You A 1099

It can be that an updated form is sent to you. We partner with our clearing firm - Apex Clearing - to process your tax forms automatically.

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Securities trading is offered to self-directed customers by Robinhood Financial.

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

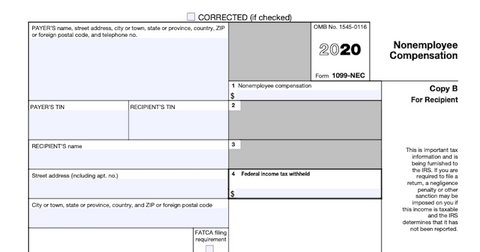

Does robinhood give you a 1099. You will receive an email once your Tax Documents are available. Robinhood as well as other online investing platforms is required by federal law to report your profit and losses to the IRS annually. Any information found on Forms 1099-DIV 1099-MISC 1099-INT and 1099-B.

When you open a Robinhood investing account you give them your social security number which will be used. But Robinhood reported it to you on Form 1099-MISC and if you had basis in it meaning you paid Robinhood something in exchange for this stock then follow the link to read what TurboTax Expert DavidS127 advised. If youve earned income from dividends or selling shares of stocks be on the lookout for a 1099 tax document.

When you receive shares of stock not cash then it should be reported as a stock transaction even though you received Form 1099-MISC. You wont need any 1099 forms from Robinhood this year so you dont need to wait on us to start filing your taxes. A few companies like Microsoft and apple paid some dividends quarterly throughout 2018.

My friends have all gotten theres over a month ago with other brokerages. Robinhood means Robinhood Markets and its in-application and web experiences with its family of wholly owned subsidiaries which includes Robinhood Financial Robinhood Securities and Robinhood Crypto. Robinhood had promised to deliver the 1099 forms which detail investors earnings and losses through the previous calendar year by the IRS deadline of Tuesday but many customers still hadnt.

I cant wait to receive form and transfer they are such a bad company. Your Consolidated 1099 Form will be available for download in your Robinhood App in late February. No one has gotten their 2020 Robinhood 1099 yet.

You will not receive a 1099 for your dividend income if your proceeds are less. As a Robinhood client your tax documents are summarized in a consolidated Form 1099. People who have sold stocks options or cryptocurrencies in 2020 must file a 1099 an IRS form that banks and brokerages send to customers documenting their earnings losses and.

With tax season just around the corner you might be awaiting all sorts of documentation and forms. Robinhood Crypto IRS Form 1099 For any cryptocurrency activity that took place last year an accompanying PDF and CSV file will be sent to you. Robinhood sent me a consolidated 1099 which contains information about the 1099-DIV 1099-MISC and 1099-B.

The purchase and subsequent sale of crypto must be recorded on the Robinhood Crypto IRS Form 1099. Obamas Kenyan granny dies aged 99 Robinhood the popular free trading platform that felt the wrath of Hades last month after abruptly restricting GameStop trading is. All investments involve risk and loss of capital.

I received a total of 16 in dividend from these companies but Robinhood told me that I will not receive a 1099div from them because they had a split between Apex and Rhs last year and my dividends were less than 10 from each. Robinhood the company thats become synonymous with the retail investing phenomenon over the past year said that because its a self-directed brokerage its not authorized to give. Everything is zero on the 1099-MISC and 1099-B forms.

Youll receive your Form 1099.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

1099 Misc Forms The What When How Buildium Irs Forms 1099 Tax Form Fillable Forms

1099 Misc Forms The What When How Buildium Irs Forms 1099 Tax Form Fillable Forms

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

How To File Robinhood 1099 Taxes

How To File Robinhood 1099 Taxes

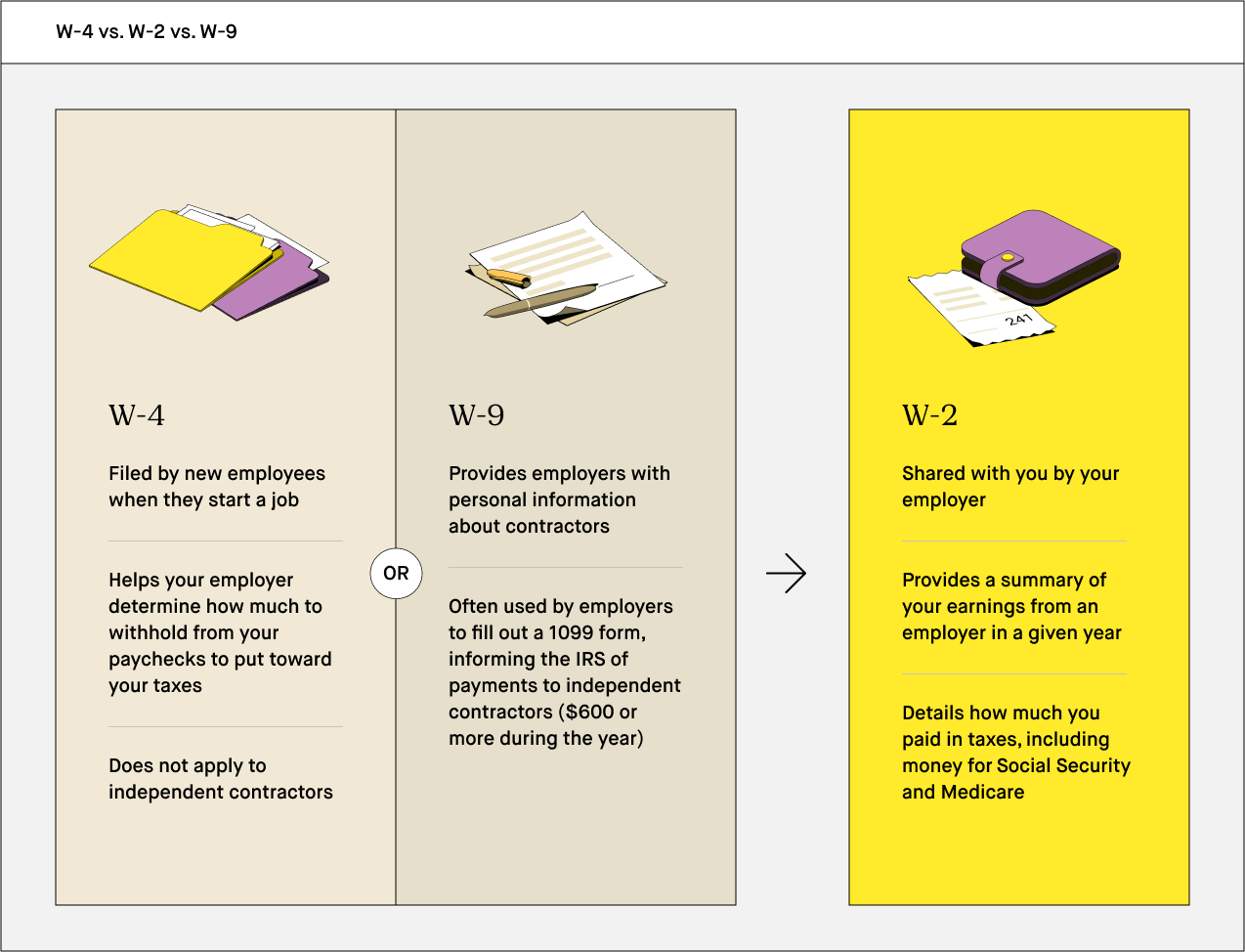

What Is A W 9 Form 2020 Robinhood

What Is A W 9 Form 2020 Robinhood

1099 Income Amazon Ebay And Google Give You A 1099 If You Earn Over 600 That Doesn T Mean You Don T Have To D Adsense Google Adsense Money Google Adsense

1099 Income Amazon Ebay And Google Give You A 1099 If You Earn Over 600 That Doesn T Mean You Don T Have To D Adsense Google Adsense Money Google Adsense

How To Prepare And File A 1099 For Contract And Freelance Workers

How To Prepare And File A 1099 For Contract And Freelance Workers

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

What Us Taxpayers Have To Do With Regards To Form 1099 Nec 1096

What Us Taxpayers Have To Do With Regards To Form 1099 Nec 1096

Pin By Shannon O Neill On Robin Hood Umbrella Robin Hood Image

Pin By Shannon O Neill On Robin Hood Umbrella Robin Hood Image

How Do You Pay Taxes On Robinhood Stocks

How Do You Pay Taxes On Robinhood Stocks

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) Form 1099 Oid Original Issue Discount Definition

Form 1099 Oid Original Issue Discount Definition

How To Read Your Brokerage 1099 Tax Form Youtube

How To Read Your Brokerage 1099 Tax Form Youtube

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Deciphering Form 1099 B Novel Investor

Deciphering Form 1099 B Novel Investor

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition