What Is A K1 Form For An Llc

It shows income dividend receipts and losses. An LLC with more than one member may.

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

The K-1 form really only provides for two options.

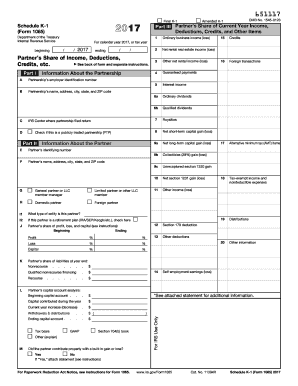

What is a k1 form for an llc. A Schedule K-1 is a tax form that reports how much income losses deductions and credits were passed through to your companys shareholders or partners based on how much of your business they own. The K-1 Form The LLCs K-1 form tells you how much profit or loss you made from the company this year. The K-1 is prepared by the entity to distribute to ownersshareholders to outline their portion of the income loss and deductions.

All Schedule K-1 Form 1120-S Revisions. If you are an owner of a partnership LLC S-corp or other entity that passes through taxes to its owners in most cases you will receive a K-1 form each year. K-1 Forms for business partnerships For businesses that operate as partnerships its the partners who are responsible for paying taxes.

The Schedule K-1 is the form that reports the amounts that are passed through to each party that has an interest in the entity. If the limited liability company LLC conducted a commercial cannabis activity licensed under the California MAUCRSA or received flow-through income from another pass-through entity in that business attach a schedule to the Schedule K-1 568 showing the breakdown of the following information. Filed with Form 1065.

Youll fill out Schedule K-1 as part of your Partnership Tax Return Form. Simple questions about Form 1065 and K-1 for an LLC started this year. How Is the K-1 Used.

Instructions for Schedule K-1 Form 1120-S Print Version PDF. Schedule K-1 is the tax form used by partners and shareholders to report to the Internal Revenue Service their income losses dividends or capital gains during the fiscal year. None at this time.

Information about Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc including recent updates related forms and instructions on how to file. If the member manager box is checked software will most likely subject all earnings to SE tax. Members must include this schedule with their personal tax returns when they file.

The S corporation K-1 form also known as a Schedule K-1 is used to report the amount of profit passed through to each party in business entities such as LLCs and S corporations. The purpose of the Schedule K-1 is to report each partners share of the partnerships. Either subject to SE or not subject to SE.

It lists your share of the various types of income or loss the LLC might have received such as regular business income rental income dividends or royalties. Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS. About Publication 535 Business Expenses.

Return of Partnership Income. These items transfer to each partner owner or shareholders personal tax return. With this tax form the business can also track the participation of each partner in the business performance depending on how much capital was invested.

Realize too that you might receive a K-1 form if you are invested in a fund or an Exchange Traded Fund that operates as a partnership. Similar to a 1099 form received that highlights contractor income you do not have to file the K-1 with. Schedule K-1 is an Internal Revenue Service IRS tax form issued annually for an investment in a partnership.

Schedule K-1 Form 1065 is used for reporting the distributive share of a partnership income credits etc. If youre required to file a Schedule K-1 with the IRS its important to understand what it is when its due how it works and how to include it with your personal tax return. The schedule is used to report each members share of the partnerships income loss and deductions.

Schedule K-1 is also known as Form 1065 US. Basically its a schedule that allows you to see what income you received during the tax year and the Schedule K-1 is used for pass through entities. As part of filing their tax returns multiple-member LLCs are required to file Internal Revenue Service IRS tax form Schedule K-1 each tax year.

A Schedule K-1 is used by partners in a business LLC members and S corporation shareholders to report their income deductions and credits for the tax year. CA both members are CA residents - Answered by a verified Tax Professional. Other Items You May Find Useful.

This result depends on which box is checked in Part II line G.

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Irs Tax Forms Irs Taxes

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Irs Tax Forms Irs Taxes

Pin By Dde Innovative Enterprises Llc On Impulse K1 Phone Vobp Karatbars Blockchain Viral Marketing

Pin By Dde Innovative Enterprises Llc On Impulse K1 Phone Vobp Karatbars Blockchain Viral Marketing

Knit Stitch Pattern Book By Kristen Mcdonell Knit Stitch Patterns Stitch Patterns Knit Stitch

Knit Stitch Pattern Book By Kristen Mcdonell Knit Stitch Patterns Stitch Patterns Knit Stitch

I Received A K 1 What Is It The Turbotax Blog

What Is A Schedule K 1 Form Zipbooks

Adjustment Of Status X2f Aos From A K1 Visa Life As Mrs Presson Cover Letter Sample Sample Cover Cover Letter

Adjustment Of Status X2f Aos From A K1 Visa Life As Mrs Presson Cover Letter Sample Sample Cover Cover Letter

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

K1 Form Fill Out And Sign Printable Pdf Template Signnow

K1 Form Fill Out And Sign Printable Pdf Template Signnow

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms