Irs Business 1099 Transcript

This form allows you to request the wage and income transcript and a transcript of your tax return or tax account activity. A tax account transcript shows basic data such as return type marital status adjusted gross income taxable income and all payment types.

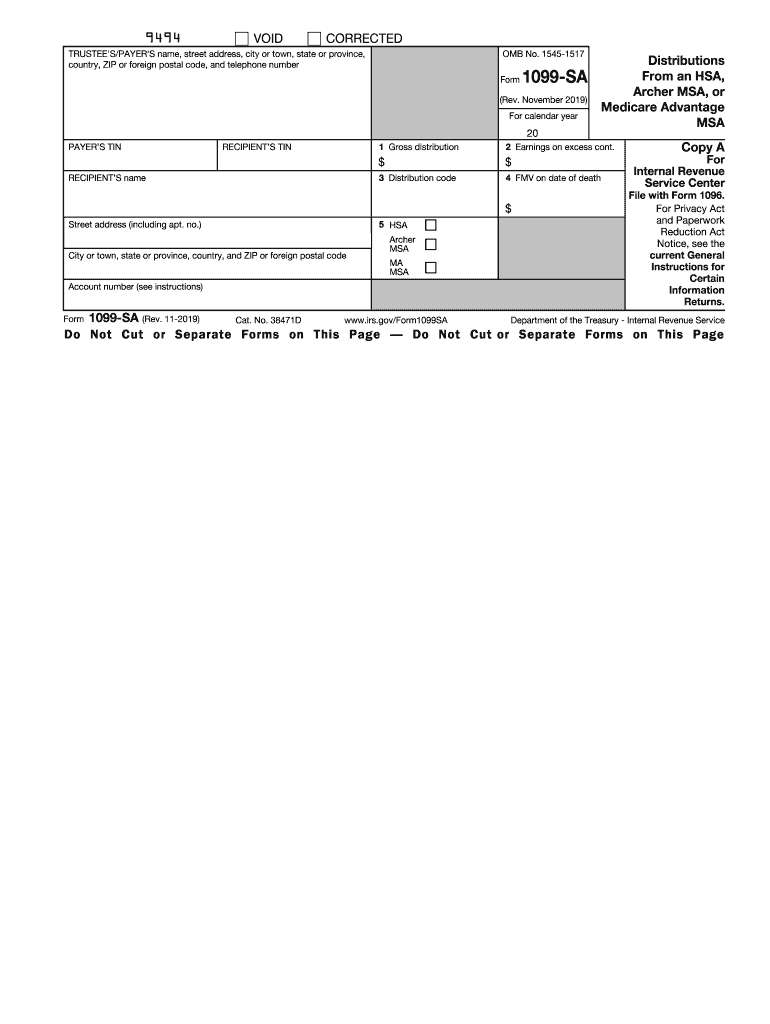

Irs 1099 Sa 2019 Fill And Sign Printable Template Online Us Legal Forms

Irs 1099 Sa 2019 Fill And Sign Printable Template Online Us Legal Forms

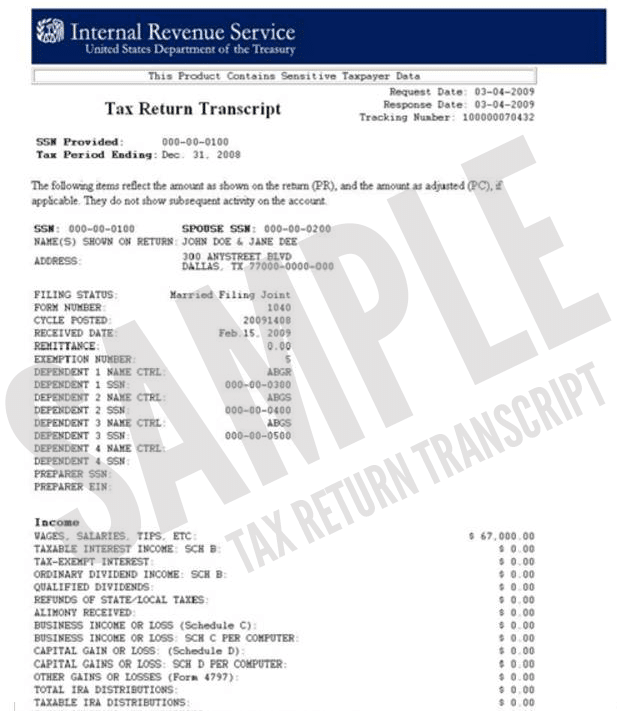

Get your original AGI or adjusted income for the given tax year via a tax return transcript.

Irs business 1099 transcript. To get a transcript people can. Alaska Hawaii follow Pacific Time Services. You can use this transcript to help with your research to accurately file a late or extended tax return verify employment or keep a personal record of income.

The transcripts will arrive in about three weeks. The the box you check for the TYPE of transcript will be box 8 where it says Form W-2 Form 1099 series Form 1098 series or Form 5498 series transcript. Several transcript types available.

Last four digits of any EIN listed on the transcript. To request an individual tax. To order by phone call 800-908-9946 and follow the prompts.

This transcript includes data it receives about various IRS forms used for informational wage reporting such as Form W-2 and 1099s. Last four digits of any account or telephone number. Report payment information to the IRS and the person or business that received the payment.

With the Secure Access process you must prove your identity by answering specific questions related to yourself or your business. Order your transcript by phone or online to be delivered by mail. Report payments of 10 or more made in the course of a trade or business in gross royalties or payments of 600 or more made in the course of a trade or business in rents or for other specified purposes Form 1099-MISC.

Find line by line tax information including prior-year adjusted gross income AGI and IRA contributions tax account transactions or get a non-filing letter. Business and Specialty Tax Line and EIN Assignment 800-829-4933 Regular Hours of Operation Hours. The IRS system is often slow to be updated so going on extension just to keep checking your.

This transcript is available for the current tax year and returns processed during the prior three years using Get Transcript Online or Form 4506-T. There is a link to it under the red TOOLS bar on the front page. Wage and Income Transcript - shows data from information returns we receive such as Forms W-2 1099 1098 and Form 5498 IRA Contribution Information.

Verification of Non-filing Letter. So for 2020 you can get your wage and income transcript in. Set up an IRS account and download your transcripts.

A wage and income transcript provides a listing of information statements Forms W-2 1099 that show income reported to the IRS under your Taxpayer Identification Number. Wage and Income Wage and Income transcripts show the information from documents the IRS receives from people who have either paid you income like wages or received money from you like mortgage interest. Last four digits of any SSN listed on the transcript.

Do I Need to File a Form 1099 MISC for Payments to an Attorn. Another way to order a transcript is by calling the IRS hotline 1-800-908-9946. Keep in mind the information for the current filing tax year might not be up-to-date until July in the following year.

Transcripts will arrive in about 10 days. Its important to remember that the prior years transcript isnt available until after the April income tax filing deadline. To order a transcript online and have it delivered by mail go to IRSgov and use the Get Transcript tool.

However youll probably be put. W-2 Wage Income Data The Wage Income section will provide you with your W-2 1099 andor 1098 data as it was reported to the IRS by employers banks etc. It also shows changes made after the filing of the original return.

Like filing 1099s to show income paid to a law firm. Current tax year information may not be complete until July. Im trying to understand the question.

Call 800 908-9946 or go to Get Transcript by Mail. Use IRS Get Transcript. For Businesses Corporations Partnerships and Trusts who need information andor help regarding their Business Returns or Business BMF Accounts.

Heres what is visible on the new tax transcript. There are several TYPES of transcripts. 1 day agoTo be sure that you know about all Forms 1099 an IRS transcript can be a useful cross-check.

Get your tax transcript online or by mail. Use the Get Transcript tool available on IRSgov. Find tax information and tools for businesses including Employer ID Number EIN Employment Tax Estimated Tax and the Foreign Account Tax Compliance Act FATCA.

There are three ways to request a transcript and the easiest way is to order it online. The IRS offers a tool called Get Transcript on its website IRSgov. First four characters of the last name for any individual first three characters if the last name has only four letters First four characters of a business name.

IRS Forms W-2 1099 and 1098. The partnership would have a wage and income transcript issued to the EIN of the partnership.

Irs Announces End To Faxed Transcripts This Article From Pisenti Brinker Provides Great Insight Into This Recent Change And What Irs Transcript Business Tax

Irs Announces End To Faxed Transcripts This Article From Pisenti Brinker Provides Great Insight Into This Recent Change And What Irs Transcript Business Tax

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

What If I Missed A 1099 Budgeting Money Irs Taxes Income

What If I Missed A 1099 Budgeting Money Irs Taxes Income

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Best Practices For Reporting Information Returns To The Irs Irs Independent Contractor Best Practice

Best Practices For Reporting Information Returns To The Irs Irs Independent Contractor Best Practice

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Irs 1099 Form Download Uber Tax Form Irs Email Signature Templates Form

Irs 1099 Form Download Uber Tax Form Irs Email Signature Templates Form

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Irs Takes Additional Steps To Protect Taxpayer Data The Irs Will Stop Faxing Transcripts In February 2019 This Is Another Step Taken By The Irs To Protect Tax

Irs Takes Additional Steps To Protect Taxpayer Data The Irs Will Stop Faxing Transcripts In February 2019 This Is Another Step Taken By The Irs To Protect Tax

Starting Your Business Make Sure You Ace These 5 Tax Questions Tax Questions This Or That Questions Creative Small Business

Starting Your Business Make Sure You Ace These 5 Tax Questions Tax Questions This Or That Questions Creative Small Business

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

How To Get Your Irs Tax Transcript Online Shared Economy Tax

How To Get Your Irs Tax Transcript Online Shared Economy Tax

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Business Tax Small Business Tips

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Business Tax Small Business Tips

Unfiled Tax Returns 101 Tax Return Tax Help Tax

Unfiled Tax Returns 101 Tax Return Tax Help Tax