How To File Late 1099

Its 110 per form if you correctly file more than 30 days after the due date but by August 1. If youre more than 60 days late the minimum penalty is 100 or 100 of the tax due with the return whichever is less.

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

If the tax filing deadline is near the representative will let you know how to file your tax return by the deadline so you dont have to pay a late-filing penalty.

How to file late 1099. Call the IRS at 800-829-1040 to start the ball rolling by reporting your late 1099. However since January 31 2021 is a Sunday the 2020 tax year deadline is moved to Monday February 1 2021. Complete your return in minutes and get your filing status instantly.

Youll need to either file online or order the forms you need Copy A of 1099-MISC and Form 1096. IncomeStatementsEWTtaxstateohus or by calling. Unless the tax filer proves with a reasonable cause for missing or incorrect Form 1099 correction the tax filer would be fined for filing late failing to add the required information.

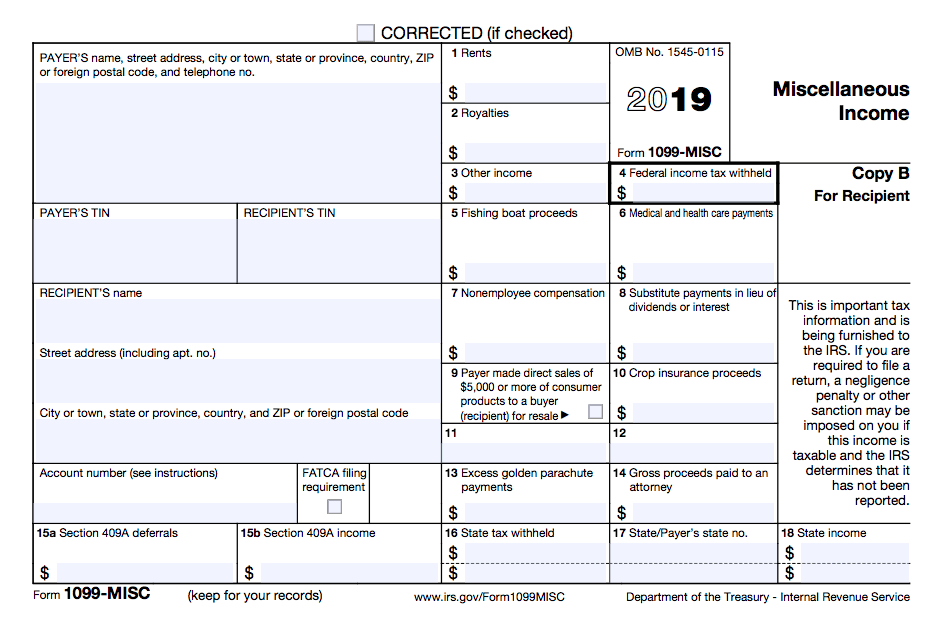

If you miss the Form 1099-MISC deadline but still file your return correctly after the deadline these are the IRS penalties you could be up against. 1099 Upload Frequently Asked Questions Questions regarding the W-21099 Upload Feature can be directed to the Employment Tax Division at. Whenever Forms 1099 arrive dont ignore them.

For example if you owe 2500 and are three months late the late-filing penalty would be 375. You can download and print the form you need Copy B of 1099-MISC from the IRS website. Most Forms 1099 arrive in late January or early February but a few companies issue the forms throughout the year when they issue checks.

It may be too late to file 1099 form 2018 on time but you can ensure an on-time 2020 or 2021 filing with the help of our software. Easy File allows individuals to file and pay their Columbus Annual Income Tax Returns IR-25 via credit card debit card or electronic check. The penalty is 50 per W-2 form or 1099-NEC form if you correctly file within 30 days of the due date for filings due after December 31 2019 including the January 31 2020 due date.

Filing for the extension wipes out the penalty. After you receive your refund sign back in and file the amendment to add the 1099-G. Contact the payer source of the income to request a corrected Form W-2 or 1099.

Attach the corrected forms when you send us your completed tax returns. Keep employee and contractor data within a single software for ease of filing then file directly from the program. You can apply for a 30-day extension for filing a 1099 form by completing Form 8809 an Application for Extension of Time to File Information Returns.

The later a return is the more your business will owe the IRS. Contact the IRS to Report a Late 1099 An IRS representative will contact a late payer for you. When you need to file a Form 1099 correction and failed to do so you will be subject to the same penalties similar to Form 1099 late filers.

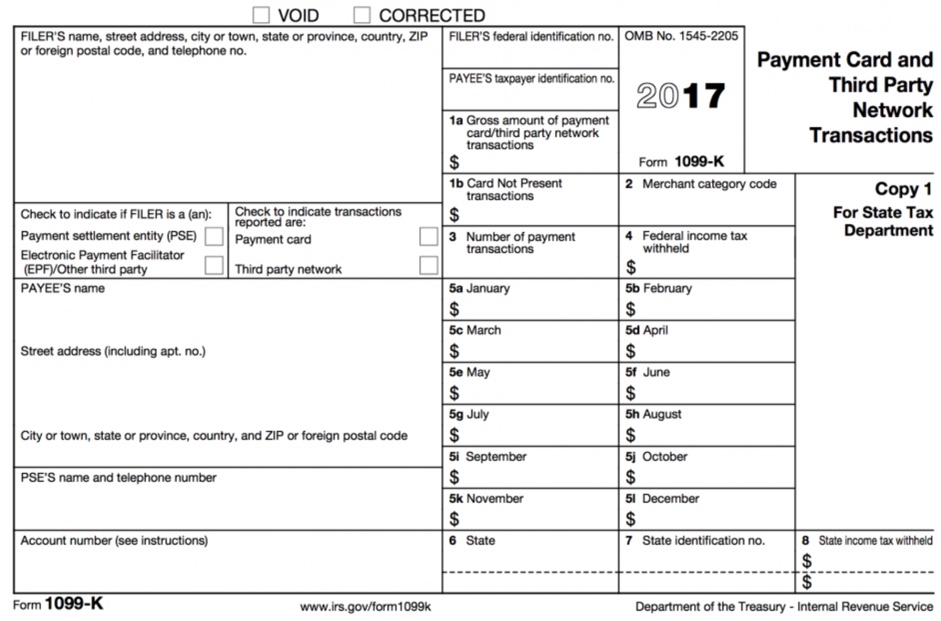

Beginning with the 2020 tax year the Form 1099-MISC deadline is March 1 if you file on paper and March 31 if you file electronically. Next you must submit your 1099-MISCs to the IRS. If the IRS files a substitute return it is still in your best interest to file your own tax return to take advantage of any exemptions credits and deductions you are entitled to receive.

Payments to Independent Contractors If you are reporting payments made to indepedent contractors during a tax year you must fill out forms 1099-MISC or form 1099-NEC non-employee compensation and file it by January 31st of the following calendar year. If you have an active City tax account you may request a PIN by sending an email to email protected. Its also critical that you understand that the penalties apply to each return and that both the IRS Copy A and the Recipient Copy B each count as a separate return.

The penalties for missing the Form 1099-NEC deadline get more expensive the longer employers wait to file. In order to use Easy File you must be assigned a PIN to initially access your account. The penalty for late filing of forms 1099-MISC is 50 per form if late for 30 days or less and 100 per form if late more than 30 days.

There will be no interest on the penalty if you pay the penalty by the date indicated in the IRS. The tax filer can correct the mistakes in the Form 1099 before the due date of every tax year. Since your federal return was accepted go ahead and wait until the IRS fully processes your tax return.

If you file Form 1099. The deadline for filing Form 1099-NEC with the IRS and sending recipient copies for the 2020 tax year is Feb 01 2021. Beginning with tax year 2020 Form 1099-NEC must be filed by January 31 of the following year whether you file on paper or electronically.

You have a couple of years to file the amendment so it. The statutory penalties are administered by Section 6722 and Section 6723 of the Internal Revenue Code. 2500 x 005 x 3 375.

With ExpressEfile you can easily E-File Form 1099-MISC for the lowest price 149form. Look to Avoid Double Penalties for Late 1099 Filings. In other words much of the time if youre filing late youre facing two.

You can wait to receive a letter from the IRS to pay the penalty.

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Irs 1099 Misc Vs 1099 Nec Inform Decisions

2020 Reviews Of W2 And 1099 Compliance Programs Cpa Practice Advisor

2020 Reviews Of W2 And 1099 Compliance Programs Cpa Practice Advisor

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

Form 1099 Penalties Late Filing Penalties For 1099 Forms

Form 1099 Penalties Late Filing Penalties For 1099 Forms

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

What Is A 1099 Misc Form Financial Strategy Center

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

It S Time To File 1099s Avoid 50 100 Plus Late Penalties Per Form Opelika Observer

It S Time To File 1099s Avoid 50 100 Plus Late Penalties Per Form Opelika Observer

What Is 1099 Misc Form How To File It Complete Guide

What Is 1099 Misc Form How To File It Complete Guide

I Forgot To Send My Contractors A 1099 Misc Now What

I Forgot To Send My Contractors A 1099 Misc Now What

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements