How To Create A K1 For An Llc

How to Start an LLC in 5 Steps. Then you do a journal entry to distribute net profit to the partners.

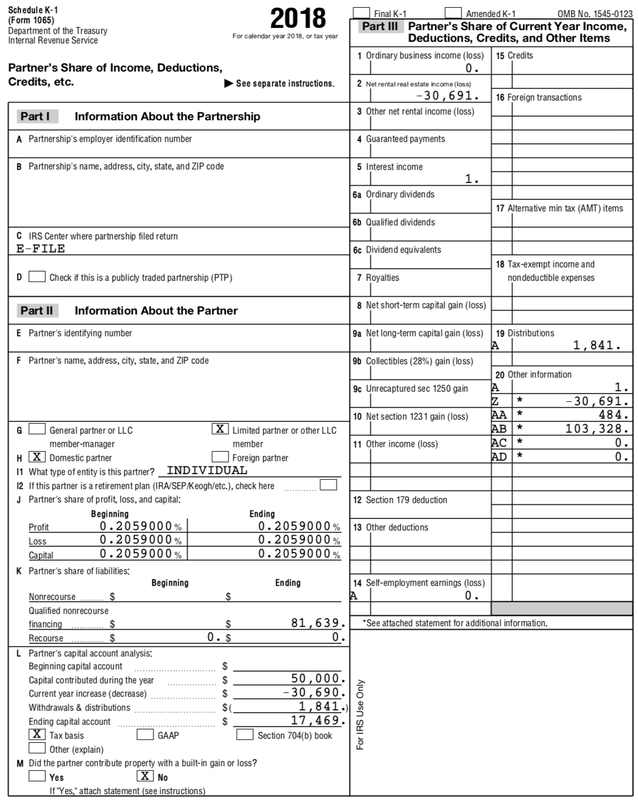

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

The easiest thing to do is to submit the form electronically by using IRS Free File or tax prep software.

How to create a k1 for an llc. In this instance the LLC must issue K-1s to all the members reporting all income credits and deductions based on the members share of ownership. Credit partner 2 equity for 50. Partners in an LLC can take their earnings as draws much like a single-member LLC.

When an LLC has more than one member the IRS considers it as a partnership. A Schedule K-1 form is used to report individual partner or shareholder share of income for a partnership or S corporation. How to pay yourself from a multi-member LLC.

This tax return can be prepared using Turbo Tax Business. Because partnerships are so-called pass-through entitiesthey let the profits or losses of a business. Preparing a K-1 For Shareholders.

Enter information about the shareholder. The limited liability company LLC has in recent years become the most popular legal structure for small businesses seeking personal liability protection and flexibility. Each state may use different regulations you should check with your state if you are interested in starting a Limited Liability Company.

You will include the Schedule K-1 in your personal tax return. File the Articles of Organization. The foreign partner of an US LLC will be deemed to be engaged in a US trade or business and the LLC must withhold 35 of its profits for taxes paid and filed on a quarterly basis to the IRS.

Include LLC or some variation in your name. The LLC is a hybrid form that combines corporation-style limited liability with partnership-style flexibility. Schedule K-1 is also known as Form 1065 US.

A multi-member LLC must file their own tax return. Owners of an LLC are called members. But one-member LLCs must report as if they were a sole proprietorship using Schedule C.

To file your taxes you must submit Form 1065 and Schedule K-1. The Limited Liability Company Law governs the formation and operation of an LLC. This means that the LLCs income and expenses are distributed to the members using a Form K-1.

You can truncate the shareholders tax identification or Social Security number in the K-1 you send to that shareholder by using asterisks or Xs for the first 5 digits. You can file your Schedule K-1 form when you submit your Form 1065 or 1120S to the IRS. FULL DISCLAIMER We are not attorneys at law and do not practice law of any sort.

Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS. Heres where to send the different K-1 forms. Information about Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc including recent updates related forms and instructions on how to file.

You must fill out a separate K-1 for each shareholder. In these businesses income tax returns are prepared by the business and then the profit or. Most states do not restrict ownership so members may include individuals corporations other LLCs and foreign entities.

A partnership does not pay income taxes the partners receive a form K-1 which is created as part of the form 1065. In Part II enter that shareholders name address and tax identification or Social Security number. The exact requirements vary slightly from state to state but setting up an LLC is a relatively simple process that can usually be done in one to four hours depending on the complexity of your organizational structure.

The IRS treats this type of LLC as a partnership. By default the IRS treats every multi-member LLC as a partnership. Even though the partnership itself does not pay income taxes it.

How members of a multi-member LLC get paid depends on whether its a partnership or a corporation. Paying yourself with a partnership LLC. Debit RE for the full amount in the account.

A Limited Liability Company LLC is a business structure allowed by state statute. An LLC may organize for any lawful business purpose or purposes. Schedule K-1 Form 1065 is used for reporting the distributive share of a partnership income credits etc.

Return of Partnership Income. Once your own K-1 is ready you can use TurboTax to prepare your personal tax return 1040. When an LLC has more than one member the IRS automatically treats it as a partnership for tax purposes.

How do I create a K-1 1065 for an LLC partnership Youll need to use TurboTax Business to prepare Form 1065 for the partnership and issue K-1 1065 forms for the partners. Choose a Registered Agent. Credit partner 1 equity for 50.

You can also file the form by mail. Please consult with a licensed attorney f. S corporations partnerships and LLCs are considered pass-through business types because the businesss income passes through to the owners on their personal tax returns.

We are simply giving advice. The tax form reports the participation of each member in the business income deductions and tax credit items. Create an Operating Agreement.

Most states require you to include as part of your companys name the letters LLC LLC or Limited Liability Company Even after you create your companys name do not omit these identifying letters on marketing materials advertisements or business transactions. Filed with Form 1065. While a K-1 form is easy if youre just the recipient needing to record income or losses the process is a bit more detailed for owners of an S-corp LLC or partnership who are responsible for distributing the K-1 forms to members.

Youll fill out Schedule K-1 as part of your Partnership Tax Return Form 1065 which reports your partnerships total net income.

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

What Is A Multi Member Llc Advantages Disadvantages Explained Gusto

How To Fill Out An Llc 1065 Irs Tax Form

How To Fill Out An Llc 1065 Irs Tax Form

2020 Form Irs 1065 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1065 Fill Online Printable Fillable Blank Pdffiller

Dissecting And Understanding A Schedule K 1

Dissecting And Understanding A Schedule K 1

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

3 Ways To Fill Out And File A Schedule K 1 Wikihow

3 Ways To Fill Out And File A Schedule K 1 Wikihow

Understanding The 1065 Form Scalefactor

Understanding The 1065 Form Scalefactor

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

How To Fill Out An Llc 1065 Irs Tax Form

How To Fill Out An Llc 1065 Irs Tax Form

How To Complete 2020 Form 1065 Schedule K 1 Part 1 Youtube

How To Complete 2020 Form 1065 Schedule K 1 Part 1 Youtube

What Is A K 1 And Does My Llc Need To Issue One

What Is A K 1 And Does My Llc Need To Issue One

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

How To Fill Out An Llc 1065 Irs Tax Form

How To Fill Out An Llc 1065 Irs Tax Form