How Do I Register My Business For Vat In South Africa

Register as a CIPROZA user. Tick the System Default box and click on Continue.

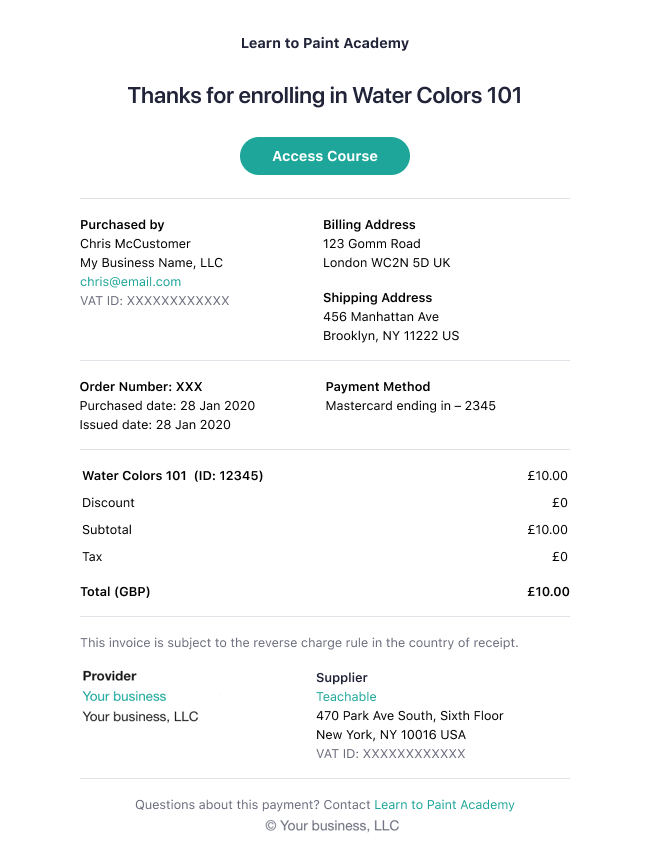

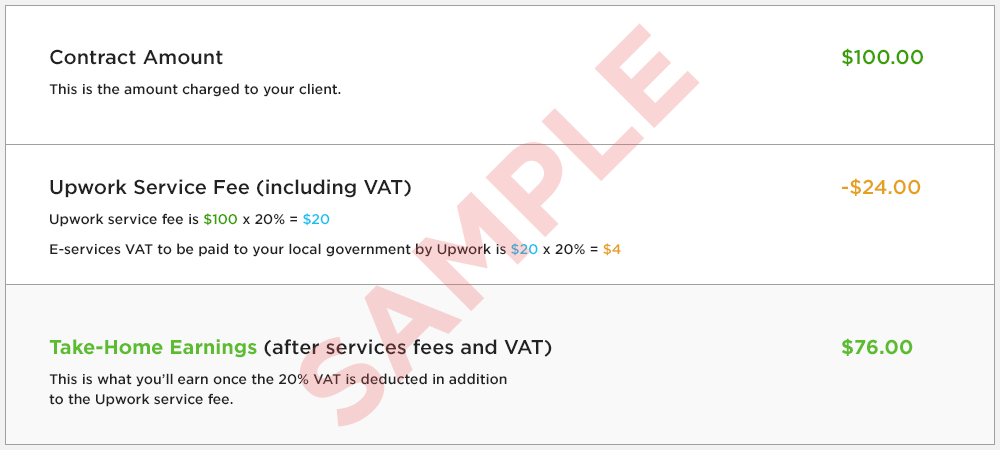

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

When a company is registered without a reserved name its registration number automatically becomes the company name with South Africa as the suffix.

How do i register my business for vat in south africa. Click SARS Registered details on the side menu 5. The information will remain confidential. Once completed click on Register.

A company is a legal person which has capacity and powers to act on its own. Follow these easy steps. It can either be manually or electronically via the SARS eFiling system.

Do not enter the characters LTD CC or PTY as the database does not recognize them. However you may voluntarily register for VAT. Login to SARS eFiling 3.

If you have not yet reached the R1m threshold you will need to consider from a business strategy point of view if you should voluntarily register for VAT. CIPC or contact CIPC on 086 100 2472. Go to the Organizations main menu 4.

Private company may be registered with or without a company name while a not for. For these businesses there may also be tax benefits to registration as registered businesses have a lower tax rate than individuals. After successfully completing it submit it to a SARS branch near you.

This means your business must be registered with the CIPC Companies and Intellectual Property Commission. If you choose to do it manually you can download a VAT 101- Application for a Registration Form from the SARS website. The following are needed for application to register.

VAT vendors can also request and obtain a VAT Notice of Registration on eFiling. With the Companies and Intellectual Property Commission CIPC. In terms of the Companies Act 2008 a for profit company eg.

A business may also register voluntarily if the income earned in the past 12-month period exceeded R50 000. If you are registered for VAT you need to add 15 VAT to your selling price. Go to the Organizations main menu 4.

Login to SARS eFiling 3. You can register for this number in one of two ways. Follow these easy steps.

Note that the timeframes above are the official timeframes from SARS but during the Covid Pandemic these timeframes may differ as SARS builds up a backlog each time their. There are several VAT registration requirements to be met before registering for a VAT number for your business in South Africa. Company Registration number Immediately.

VAT is an indirect tax on the consumption of goods and services in the economy. A VAT Number is a 10-digit number and starts with 4. If you experiencing problems finding the correct VAT registration information email us at helpvatsearchcoza.

And then you should click on the Register New button on the left of the screen. Any business who employs at least one employee or any salaried director must register for PAYEUIF and pay over monthly the employee taxes PAYE andor UIF. By doing this youll register for VAT and create a VAT.

This is the quickest way to register a company. The law sees a company in the same light as a natural person. Confirming the correct VAT Number.

How do I register for a VAT number in South Africa. The business must be a registered company. Register for VAT Most businesses can register online - including partnerships and a group of companies registering under one VAT number.

Not every business has to register for VAT. In order to register for VAT an application form must be completed and a specific process must be. There are two reasons to.

Select Notice of Registration 6. Completed and signed PAYE application EMP101 form Certified copies of registration document COR143. Select Notice of Registration 6.

Get Your VAT Company Now. Confirm your registration via your email by clicking on the confirmation link that is sent to you. 1 ID Documents Passport 2 South African Business Address.

How Does VAT Work in South Africa. According to SARS a small business that is registered as a micro business under the Sixth Schedule of the Income Tax Act may also register for VAT and may elect to submit returns and payments every four months ending on the last day of June October and February. For instance if you sell a product of R100 you need to add R15 to the price 10015 so the inclusive price which your customers have to pay is R115.

Select and complete the details of your business as shown below. 28 March 2020 - VAT vendors can now request and obtain a VAT Notice of Registration on eFiling if they are registered on SARS eFiling. This search will only return a result if an exact match is found.

A business bank account. Click on the status search bar and enter the first few letters of your company of interest. Even though you may not be registered with the CIPC you will still have to be registered with the South African Revenue Services and will still be liable for tax if your turnover exceeds the prescribed threshold.

Submit the registration form to your local SARS branch within 21 days from date of exceeding R1 million. A company is only required to register for VAT once it has reached a turnover of R1m for a period of 12 months. The effects of being a VAT vendor.

Click SARS Registered details on the side menu 5. When your business has registered as a VAT vendor it is obliged to charge VAT or output tax at 15 on all goods sold and services rendered to your. VAT is levied at a standard rate of 15 on the supply of goods and services by registered vendors.

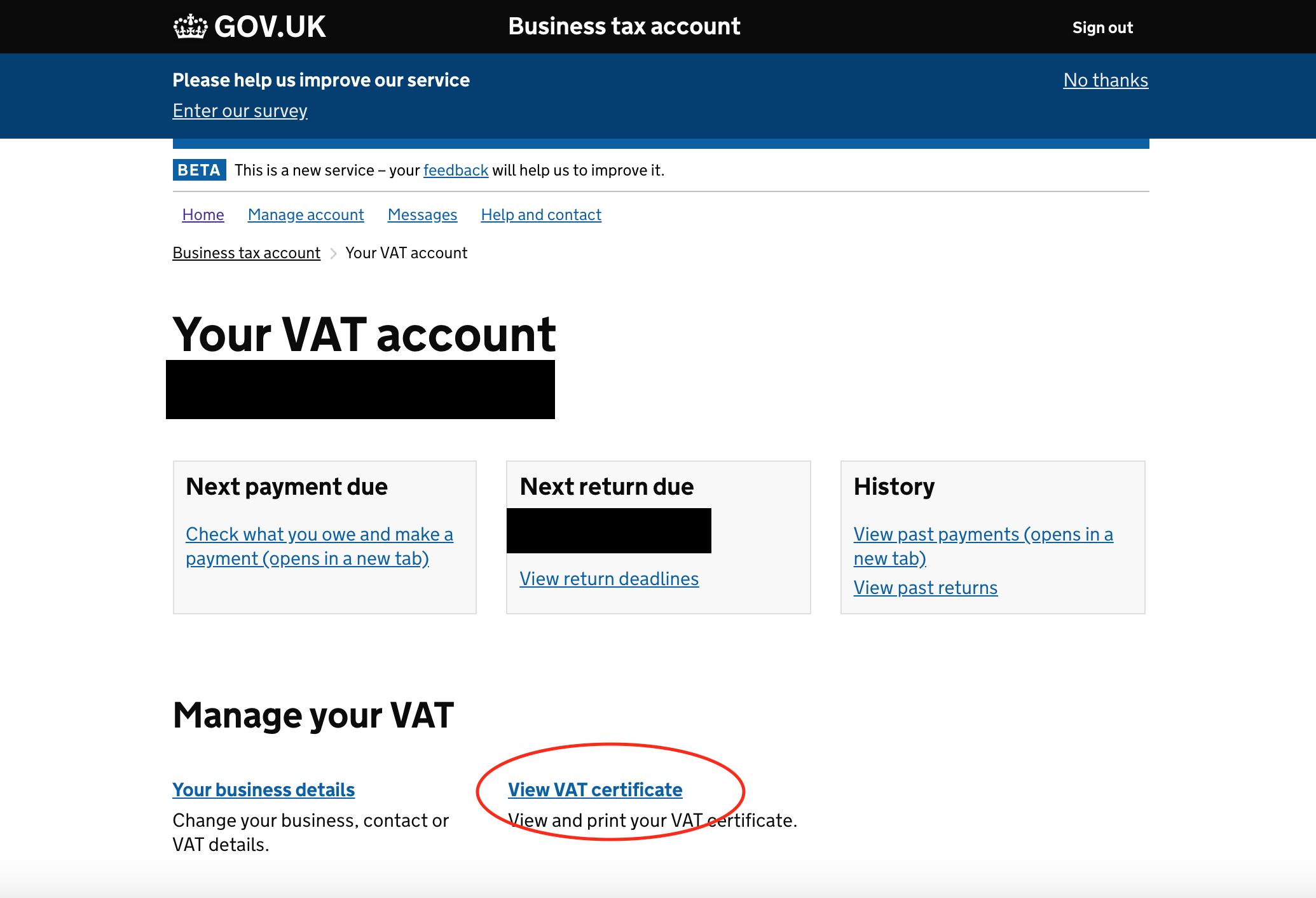

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

Value Added Tax Definition Formula Vat Calculation With Examples

Value Added Tax Definition Formula Vat Calculation With Examples

Discover The Quickest And Easiest Online Company Registration Services In South Africa Find Bee Certificate Application To Bee Certificate Lettering Business

Discover The Quickest And Easiest Online Company Registration Services In South Africa Find Bee Certificate Application To Bee Certificate Lettering Business

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

I M American Do I Have To Pay Vat To The Eu Small Business Help Business Savvy Creative Business

I M American Do I Have To Pay Vat To The Eu Small Business Help Business Savvy Creative Business

Discover The Quickest And Easiest Online Company Registration Services In South Africa Find Bee Certificate Abstract Grey Wallpaper Grey Wallpaper Background

Discover The Quickest And Easiest Online Company Registration Services In South Africa Find Bee Certificate Abstract Grey Wallpaper Grey Wallpaper Background

Vat Registration Requirements List In South Africa 2021

Vat Registration Requirements List In South Africa 2021

Quickbooks Accounting Invoice Estimate Expense By Intuit Inc Quickbooks Small Business Accounting Software Quickbooks Online

Quickbooks Accounting Invoice Estimate Expense By Intuit Inc Quickbooks Small Business Accounting Software Quickbooks Online

Vat Auditing And Accounting Services Blog Dubai Based Audit Firm In 2020 Accounting Services Dubai Bookkeeping Services

Vat Auditing And Accounting Services Blog Dubai Based Audit Firm In 2020 Accounting Services Dubai Bookkeeping Services

Register For Vat In Canada Updated For 2021

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To Claim A Vat Refund Everything You Need To Know

How To Claim A Vat Refund Everything You Need To Know

Shelf Pty Available For Sale 0723711083 Stanger Gumtree South Africa 145755324 Income Tax Return Income Tax Bee Certificate

Shelf Pty Available For Sale 0723711083 Stanger Gumtree South Africa 145755324 Income Tax Return Income Tax Bee Certificate

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting