Do Small Businesses Have To Pay Back Coronavirus Loan

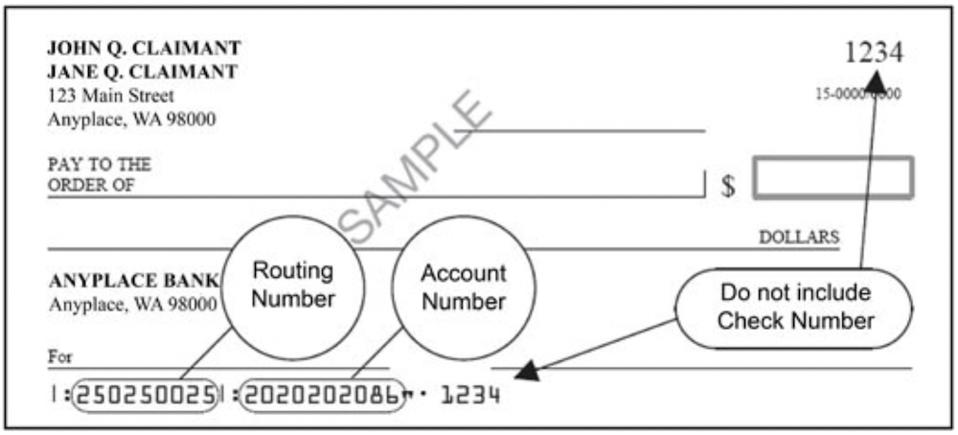

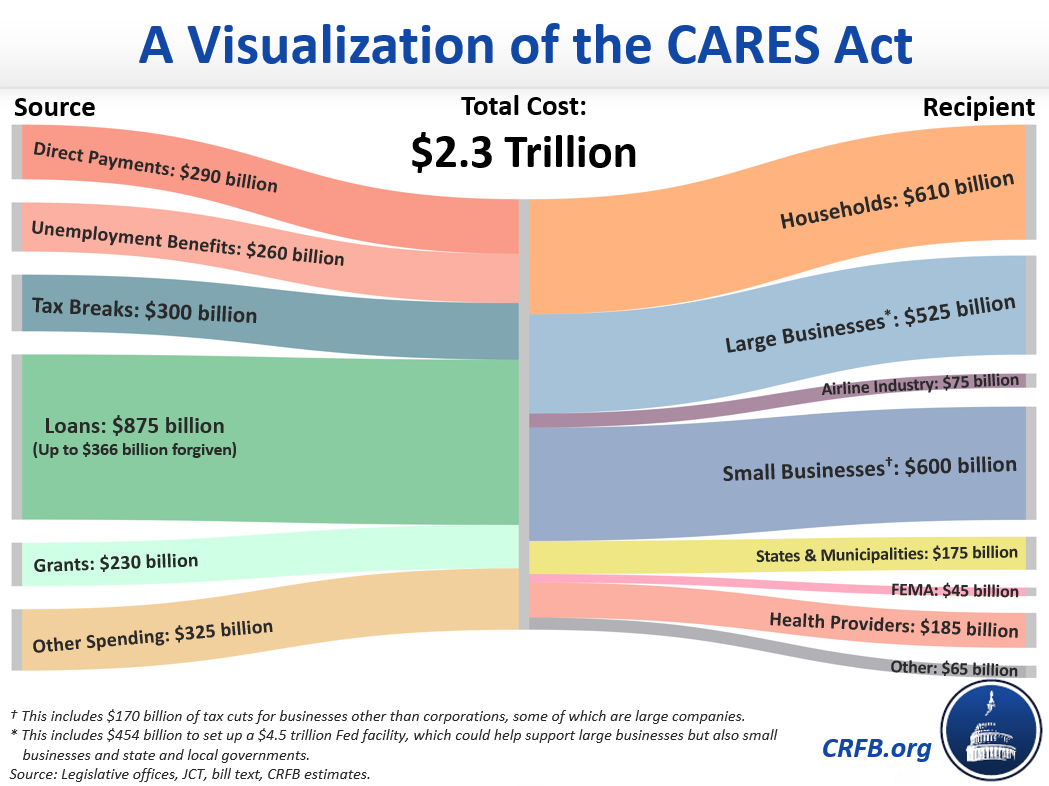

The PPP loans small businesses 25 times their average monthly payroll costs excluding pay in excess of 100000 per employee up to 10 million. Coronavirus Small Business Loan Application Process Heres how small businesses can apply for an EIDL.

Big Concerns About Small Business Loan Pitches Federal Trade Commission

Big Concerns About Small Business Loan Pitches Federal Trade Commission

The law says borrowers dont have to repay the loans if the money is spent on payroll plus.

Do small businesses have to pay back coronavirus loan. The interest rate for PPP loans are 1. Payments may be deferred for a. Yes Congress has said it will offer simplified PPP forgiveness for any business that took out a loan of less than 150000.

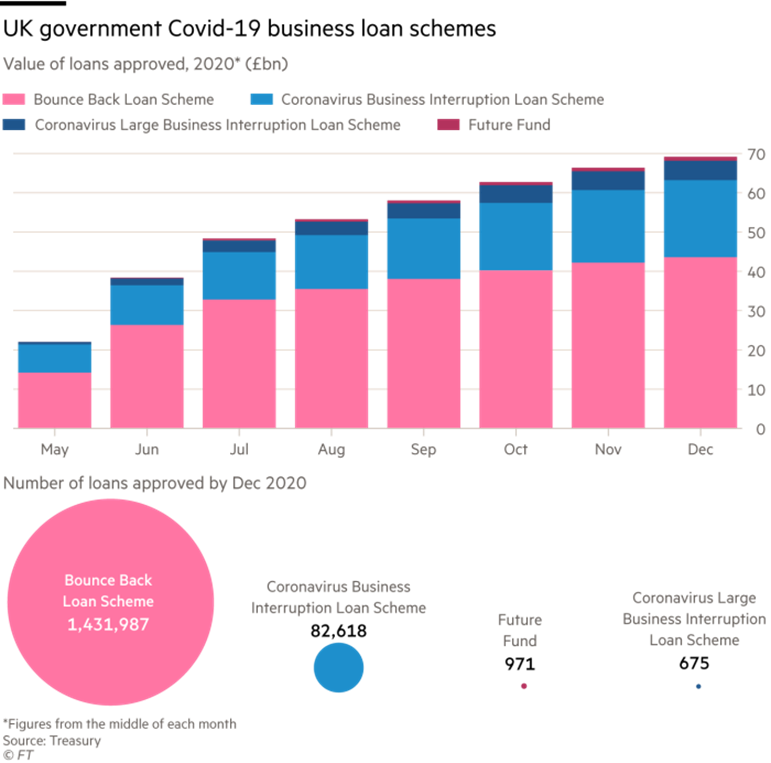

But unlike the PPP which is entirely forgivable if you meet requirements you will. Forty-three per cent of businesses that have taken out either Bounce Back Loans or Coronavirus Business Interruption Loans say they do not believe the government will chase the debt or that they will be unable to repay the loan according to the Business Banking. Importantly as many businesses have already slashed jobs companies will rely on payroll numbers from before the crisis.

If you are able to rehire some workers and you spend 60 of funds on payroll you should be able to get most or all of the loan forgiven. The forgivable loans aim to incentivize small businesses to maintain their head count and payroll read more. The program provides loans of as much as 10 million to small businesses affected by the outbreak.

The EIDL can give business owners fast relief through emergency grants up to 10000 that do not have to be paid back. COVID-19 Economic Injury Disaster Loan. Paycheck Protection Program PPP Loans.

While business owners may have a portion of their PPP loan forgiven coronavirus hardship loans will need to be paid back. Launched on April 9 2020 CEBA provided a 40000 zero-interest partially forgivable loan to small businesses that experienced diminished revenues due to COVID-19 and faced ongoing non-deferrable costs such as rent utilities insurance taxes and employment costs. The only way you will have to pay back all or part of a PPP loan is if you dont use it for the specific items outlined above.

Those affected can describe their losses Eligible small businesses must complete an Economic Injury Worksheets detailing the economic losses they have suffered due to the coronavirus. The loan designed to cover eight weeks of expenses does not have to be paid back if at least 75 of the money is spent keeping or rehiring workers. The loan is intended to provide businesses that have 500 or fewer employees subject to certain exceptions with a loan equal to 25 times each business average total monthly payroll costs.

Nearly half of small businesses that have taken out government emergency coronavirus loans do not intend to repay them. Do businesses with smaller PPP loans have to do less paperwork. If you do not fully repay the loan within 2 years you will be charged interest for the entire term of the loan.

Voluntary payments can still be made at any time. 1 day agoBounce Back Loans were introduced to make it easier for small businesses to access the finance they needed because the larger Coronavirus Business Interruption Loan Scheme CBILS was. After 24 months youll be required to make regular payments for both the principal and interest.

This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue. You CAN use your funding for any legitimate business expense but if you use your loan for anything other than PPP-approved payroll costs mortgage rent and utilities expect to pay back at least that portion of your loan. The Small Business Administrations Paycheck Protection Program and Economic Injury Disaster Loans are back and heres how you can try to get.

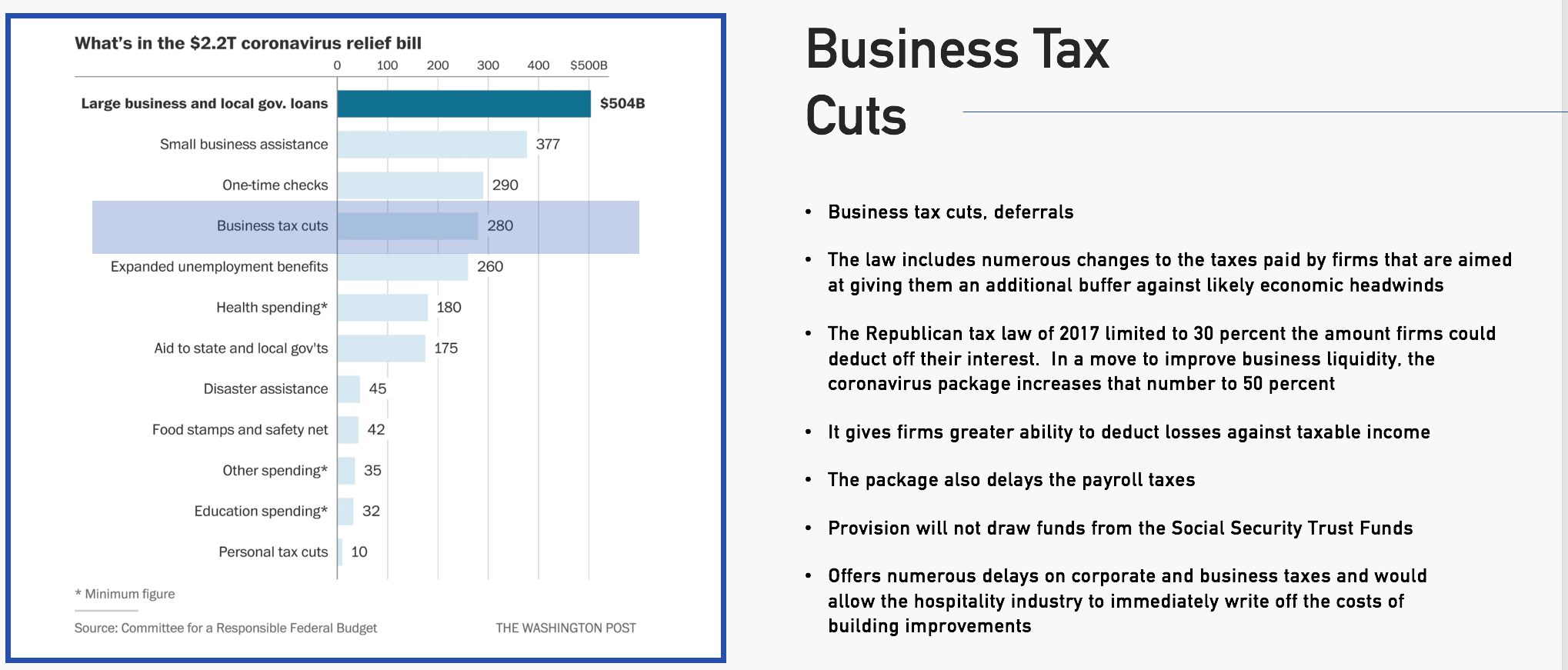

The PPP authorizes up to 349 billion in forgivable loans to small businesses to prevent more layoffs and allow companies keep their employees on the payroll during the COVID-19 pandemic. The Small Business Administration has. Business owners have to use at least 75 percent of their PPP loan on employees and spend the same amount on payroll as they did before for.

The Families First Coronavirus Response Act the FFCRA signed by President Trump on March 18 2020 provides small and midsize employers refundable tax credits that reimburse them dollar-for-dollar for the cost of providing paid sick and family leave wages to. Repayments are not compulsory in the first 24 months.

How Is The Government Supporting Small Businesses During The Coronavirus Pandemic

How Is The Government Supporting Small Businesses During The Coronavirus Pandemic

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Sba Opens Up New Grants And Loans For Small Businesses And Independent Contractors The Eidl Program

Sba Opens Up New Grants And Loans For Small Businesses And Independent Contractors The Eidl Program

Paycheck Protection Program How It Works Funding Circle

Paycheck Protection Program How It Works Funding Circle

How To Fill Out The Sba Disaster Loan Application Youtube

How To Fill Out The Sba Disaster Loan Application Youtube

Millions Of Small Businesses May Struggle To Tap Emergency Sba Loans

Millions Of Small Businesses May Struggle To Tap Emergency Sba Loans

Paycheck Protection Program How It Works Funding Circle

Small Business Loan Assistance Possible

Small Business Loan Assistance Possible

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

A Wave Of Covid Related Bankruptcies Is Coming To The Uk What Can We Do About It Lse Business Review

A Wave Of Covid Related Bankruptcies Is Coming To The Uk What Can We Do About It Lse Business Review

How To Get An Sba Disaster Loan Eidl Bench Accounting

How To Get An Sba Disaster Loan Eidl Bench Accounting

Sba Opens Up New Grants And Loans For Small Businesses And Independent Contractors The Eidl Program

Sba Opens Up New Grants And Loans For Small Businesses And Independent Contractors The Eidl Program

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation