Do Material Vendors Get A 1099

You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent. If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business.

Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099.

Do material vendors get a 1099. You may deduct the cost of these materials on Schedule C. The exception to this rule is with paying attorneys. Please note that the 1099-MISC form is generally issued for payment of services provided.

If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. This is referenced in the instructions to form 1099-MISC and IRC Section 6041. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099.

At least 10 in royalties see the instructions for box 2 or. Career CounselorLev Retiredreplied 14 years ago Assuming you have a purchase contract to back up the transaction and this is a payment for merchandise supplied either by physical person or corporation there is no need to issue 1099misc form - this is clear said in the instructions. Not only do employers have to keep the new 1099-NEC on their radars but they also need to mark their calendars for a new nonemployee compensation due date.

Starting in 2021 send copies of Form 1099-NEC to workers you paid nonemployee compensation to during the year by January 31 or the next business day if it falls on a weekend. If the following four conditions are met you must generally report a payment as nonemployee compensation. Vendors who operate as C- or S-Corporations do not require a 1099.

You will need to provide a 1099 to any vendor who is a. 2 The net effect of these two transactions will result in you not being taxed on materials included in your 1099 ie. How do I record a non-taxable reimbursement for a contractor.

You are taxed on labor only. If they are not part of the service provided you do not need to report payments for equipment supplies or other tangible goods including inventory. This requirement applies to persons who in the course of a business sell consumer.

I understand properly recording the taxable 1099 wages but I dont know how to record non-taxable reimbursement items. That business the service recipient must file Form 1099 MISC if the payment is 600 or more for the year unless the service provider is a Corporation. Actually in the instructions for the Form 1099-MISC the IRS provides this guidance.

When issuing a 1099 misc does it include only labor or include expenses reimbursed to contractor. You made the payment to someone who is not your employee. Direct Sales The law requires information reporting on Form 1099 MISC for certain direct sellers.

If You Pay A Vendor More Than 600 Or 10 In Royalties A 1099-MISC is the form any business sends anyone they pay to do a service who isnt an employee such as those loyal workers who signed a W-2 at the start of their contract and already get their taxes removed from their paychecks. A 1099 vendor is a designation listed in each of the records in the vendor master file that is part of an accounting software package. The person you pay must be providing a service to your business and not selling you something.

File Form 1099-MISC Miscellaneous Income for each person in the course of your business to whom you have paid during the year. 3 To Vendors Many construction companies think of sub-contractors when they prepare 1099s and thats correctto an extent. The BIDaWIZ Teams Answer.

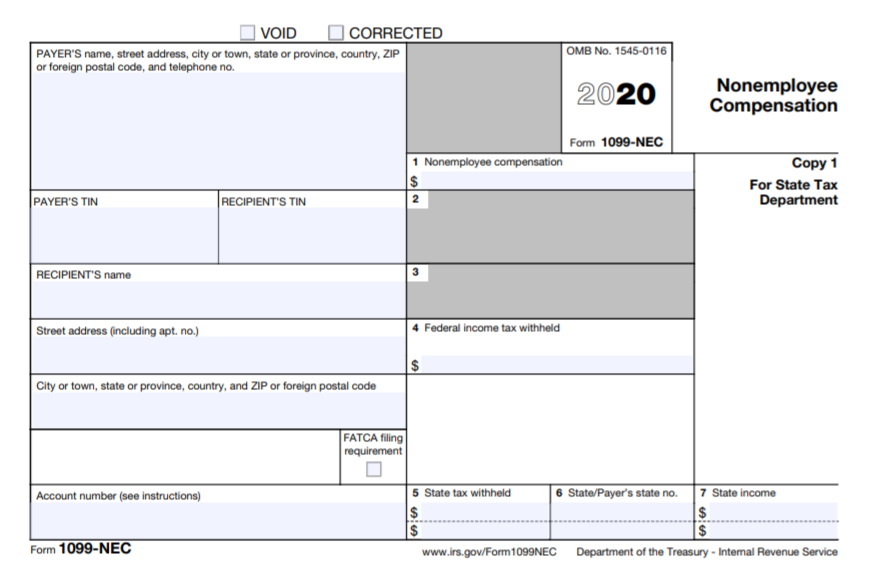

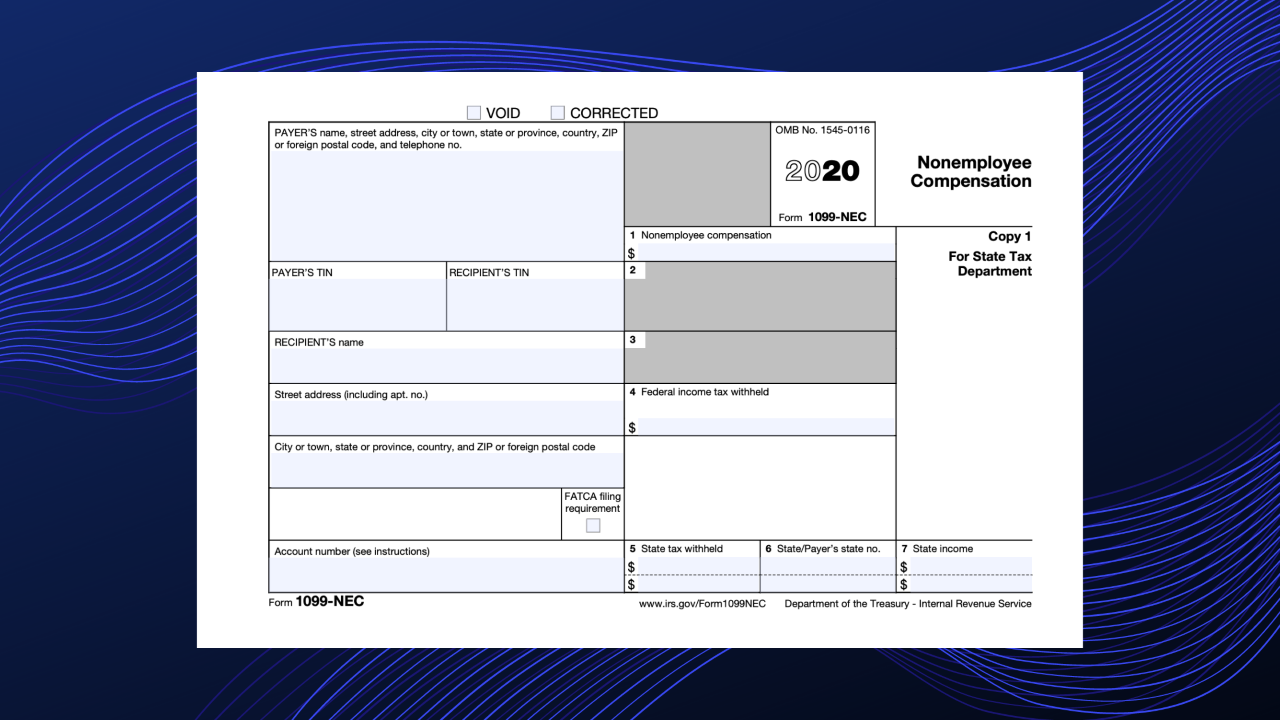

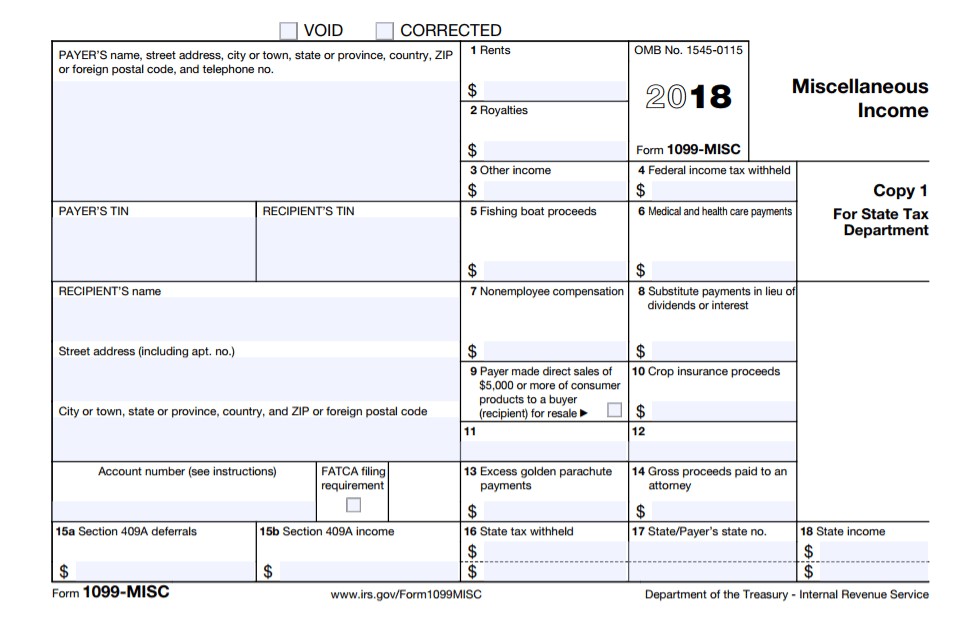

Starting in 2020 the IRS now requires payments to independent contractors are shown on a new form 1099-NEC non-employee compensation instead of the 1099-MISC miscellaneous. The 1099-Misc listed royalties rents and other miscellaneous items but its most common use was for payments to independent contractors. 6 Who Should Not Receive a 1099-MISC Dont use Form 1099-MISC to report payments to employees.

Labor parts and materials should be included in your 1099. 1 There is no need to worry though. Use Form 1099-MISC to report direct sales of at least 5000 of consumer products to a buyer for retail except for permanent retail establishments.

Therefore you dont prepare 1099s for the purchase of materials insurance or newspaper advertising for instance. However if the goods and supplies are part of the services provided by the independent contractors LLCs they would be included in the 1099-MISC form. You were correct to issue the 1099-MISC for both the cost of the services as well as for the parts and materials.

Thus trucking companies need not issue Form 1099s to owner-operators. You might need to pay sales tax for this purchase. If you designate a supplier as a 1099 vendor the system will print a Form 1099 for the supplier as part of the 1099 batch processing that follows the end of.

In example - I have an 1099 Independent Contractor who earned 15k but their 1099 states an taxable income of 18k. I do not use Quickbooks Payroll. 16041-3 c exempts payments for freight services from the general requirement for payors to issue Form 1099 to independent contractors and others with which they do business.

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneous Online Taxes Income Tax Irs Tax Forms

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneous Online Taxes Income Tax Irs Tax Forms

Amazon Com Tops 1099 Nec Forms 2020 Tax Forms Kit For 26 Recipients 5 Part Nec Tax Form Sets With Self Seal 1099 Envelopes And 3 1096 Forms Tx22905kit Ne20 Office Products

Amazon Com Tops 1099 Nec Forms 2020 Tax Forms Kit For 26 Recipients 5 Part Nec Tax Form Sets With Self Seal 1099 Envelopes And 3 1096 Forms Tx22905kit Ne20 Office Products

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Amazon Com Irs Approved 1099 Misc Copy A Bulk Discount Tax Form 1 Carton Office Products

Amazon Com Irs Approved 1099 Misc Copy A Bulk Discount Tax Form 1 Carton Office Products

Form 1096 Sample Templates Invoice Template Word Template

Form 1096 Sample Templates Invoice Template Word Template

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Form 1099 Nec Non Employee Compensation Replaces 1099 Misc For Reporting Payments To Non Employees S J Gorowitz Accounting Tax Services P C

Form 1099 Nec Non Employee Compensation Replaces 1099 Misc For Reporting Payments To Non Employees S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Ready For The 1099 Nec Murray Roberts Otto Cpa Firm S C

Ready For The 1099 Nec Murray Roberts Otto Cpa Firm S C

Amazon Com Adams 1099 Misc Continuous Forms For 2019 20 Carbonless 4 Part Forms Dot Matrix Compatible 3 1096 Summary Transmittals Txa2299 White Office Products

Amazon Com Adams 1099 Misc Continuous Forms For 2019 20 Carbonless 4 Part Forms Dot Matrix Compatible 3 1096 Summary Transmittals Txa2299 White Office Products

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Amazon Com Egp Irs Approved 1099 R Laser Tax Form Government Payments Federal Copy A Quantity 100 Recipients Tax Record Books Office Products

Amazon Com Egp Irs Approved 1099 R Laser Tax Form Government Payments Federal Copy A Quantity 100 Recipients Tax Record Books Office Products

Vendor Information Form Luxury Vendor Registration Driverlayer Search Engine List Of Jobs Form Beaufort County

Vendor Information Form Luxury Vendor Registration Driverlayer Search Engine List Of Jobs Form Beaufort County

Choosing 1099 Box Types 1099 Nec And 1099 Misc

Choosing 1099 Box Types 1099 Nec And 1099 Misc