How To Fill Itr For Proprietorship

The income tax return must be filed and paid on or before April 15 of each year at any BIR-Authorized Agent Bank of the RDO where you registered. E verify ITR with.

How Do Tax Brackets Work How To File Taxes Ageras Filing Taxes Tax Tricks Tax Brackets

How Do Tax Brackets Work How To File Taxes Ageras Filing Taxes Tax Tricks Tax Brackets

Instructions to Form ITR-5 AY.

How to fill itr for proprietorship. 3 Company has to get its books Audited under Companies Act and File ITR 6. One of the documents that are acceptable as entity proof is the copy of the income tax return filed by the proprietor for the previous year where the income from the sole proprietorship is shown under the head Income From Business and Profession and the in the business description section the name of the sole proprietorship is mentioned in the ITR Form filed for the proprietorship. You have to report this income in your tax return.

Hence the income tax return filing of the proprietor and the proprietorship are the same. Fill details in Income Tax Return form. This VIDEO contains information on filing ITR-4 for.

Use eBIR or eFPS to file and dont forget to also filesubmit your attachments via. Tax rebate is applied to the total tax before adding Surcharge and Health and Education Cess. Under Income Tax Act all proprietors below the age of 60 years are required to file income tax return if total income exceeds Rs.

This video shows how a businessman can file his. 1 Crore For both AY 2016-17 and 2017-18 and file ITR 34 as the case may be. Item by Item Instructions to fill up the Return Form Part-A General Information Field Name Instruction PERSONAL INFORMATION Name Enter the Name as per PAN card.

Proprietorship firms file the Proprietor income tax return just like the LLPs and the Companies registered in India. You as a proprietor have to get your books Audited only if your turnover was above Rs. In the legal sense the proprietorship and the proprietor are considered to be one.

Steps For Sole Proprietorship Firm Income Tax Return. Prepare Computation sheet of firm. 22 September 2020 Narasimha Rao K If you are a proprietor then you can not take a salary from proprietorship businessSo you cant file ITR-1.

Proprietor of the firm is HUF Till last year the proprietor HUF was filling ITR3 for himself and this year he have started an sole proprietorship firm so I am confuse how to fill return for both or how to merge there balance sheet and which ITR will be filled ITR3 or not. If you have received full-time or part-time income from trade business vocation or profession you are considered a self-employed person. Now select the e-filing menu and then select Income Tax Return.

Proprietorship income comes under business. The annual compliances of a Sole Proprietorship include the filing of Income Tax Return ITR and preparing the Tax Audit. 2019-20 Page 2 of 62 Electronic City Office Bengaluru560500 Karnataka.

Sole Proprietorship Firm is one of the best popular legal entity in India but when income tax season is coming in the month of July or Sept in every year that time some entrepreneurs confuse about the How to file the income tax return as a Sole Proprietorship Firm in India. BIR Form 1701Q Quarterly Income Tax Return This must be accomplished by entrepreneurs professionals freelancers and mixed-income earners. ITR Filing for Business.

4 Audit under Income Tax Act will be required only if the Companys Turnover exceeds Rs. On this page you have to select the following- Assessment year ITR form Filing type originalrevised Select prepare and submit in the submission mode Select continue. ITR of Proprietor With Firm Name.

This video explains how a small businessman can file his own income tax return by using very simple method. You have to use either ITR-3ITR-4. Income Tax return filing.

Deadline for filing BIR Form 1701. Let me know your turnover. Heres a guide on how to file ITR income tax rates and the due date for e-filing for Business.

Tax rebate is available only to the resident individual proprietor earning net taxable income up to 5 Lakhs. As there is his personal income also in his balance sheet. Prepare Financial statements of firm.

The other copy may be retained by the assessee for his record. Since proprietorship firms are considered to be one and same as the proprietor the income tax return filing of the proprietorship firm is the same that of the proprietor. So in this guide we learn about How How Sole Proprietorship Firm Income Tax Return Works.

The income tax return of a proprietorship firm in specified Form ITR 3 or ITR 4 Sugam can easily be filed online on the e-filing portal of the government by using the digital signature of the proprietor or by generating a CV or generating an Aadhar OTP or by sending a signed copy of the ITR-V to Post Bag No. This page shows the relevant information to help you prepare and file your tax return. Validate tax return form generate xml file.

Hello everyone I need you help to understand this problem. A sole proprietorship needs to file. Download Income Tax Return Form.

The new page is where you need to fill out all the details that are asked for carefully. You have to file this on or before April 15 of each year. ITR filing forms as applicable to the sole proprietorship firm is detailed hereunder.

1 Electronic City Office Bengaluru 560100 Karnataka. HOW To File INCOME TAX RETURN ITR For SMALL BUSINESSMAN The old ITR-4S tax form has been renamed ITR-4. Upload xml file at income tax site.

BIR Form 1701 Annual Income Tax Return for Self-Employed Individuals Estates and Trusts This is for your annual income tax return.

Instructions To Fill Itr 3 Legalraasta Negative Numbers Instruction Tax Rules

Instructions To Fill Itr 3 Legalraasta Negative Numbers Instruction Tax Rules

Itr A Short Guide To Various Income Tax Returns Find Out What Itr Form Applies To You For The Financial Year Ay 2 Income Tax Return Tax Return Rental Income

Itr A Short Guide To Various Income Tax Returns Find Out What Itr Form Applies To You For The Financial Year Ay 2 Income Tax Return Tax Return Rental Income

Itr Filing Deadline Nears How To File Income Tax Return Online Income Tax Return Tax Return Income Tax

Itr Filing Deadline Nears How To File Income Tax Return Online Income Tax Return Tax Return Income Tax

Learning How To Fill The Easiest Tax Return Form Itr 1 Early Will Help You Go Over Your Declarations In A Breeze Read Income Tax Return Tax Forms Tax Return

Learning How To Fill The Easiest Tax Return Form Itr 1 Early Will Help You Go Over Your Declarations In A Breeze Read Income Tax Return Tax Forms Tax Return

10 Things You Need To Know About Filing Income Tax Returns Income Tax Return Tax Return Income Tax

10 Things You Need To Know About Filing Income Tax Returns Income Tax Return Tax Return Income Tax

Aiat Gst Suvidha Kendra Filing Taxes Income Tax Return Income Tax Return Filing

Aiat Gst Suvidha Kendra Filing Taxes Income Tax Return Income Tax Return Filing

Pin By Saksham Sharma On Itr 3 Form Income Tax Return Taxraahi Tax Return Income Tax Income Tax Return

Pin By Saksham Sharma On Itr 3 Form Income Tax Return Taxraahi Tax Return Income Tax Income Tax Return

Proprietorship Compliances Sole Proprietorship Regulatory Compliance Compliance

Proprietorship Compliances Sole Proprietorship Regulatory Compliance Compliance

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

How To Check Refund Status Income Tax Filing Taxes Income Tax Return

How To Check Refund Status Income Tax Filing Taxes Income Tax Return

Here S All You Need To Know On Filing Your Income Tax Return Before 31st July 2019 Income Tax Return Income Tax Tax Return

Here S All You Need To Know On Filing Your Income Tax Return Before 31st July 2019 Income Tax Return Income Tax Tax Return

The Income Tax Department S Message For Those Who Skipped Filing Itr Income Tax Income Tax Return Income

The Income Tax Department S Message For Those Who Skipped Filing Itr Income Tax Income Tax Return Income

File Income Tax Return Online Tax Return Income Tax Return File Income Tax

File Income Tax Return Online Tax Return Income Tax Return File Income Tax

Partnership To Limited Liability Private Limited Company Public Limited Company Bookkeeping Services

Partnership To Limited Liability Private Limited Company Public Limited Company Bookkeeping Services

Do You Understand The 1099 Misc Ageras Irs Taxes Irs Tax Forms Tax Tricks

Do You Understand The 1099 Misc Ageras Irs Taxes Irs Tax Forms Tax Tricks

Types Of Itr Forms Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

Types Of Itr Forms Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

Filling Of Income Tax Return For Sole Proprietorship

Filling Of Income Tax Return For Sole Proprietorship

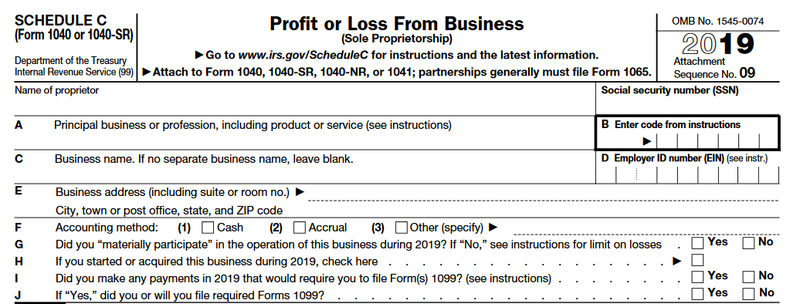

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

Indie Authors Should Consider Using Schedule C Irs Tax Forms Irs Taxes Tax Forms

Proprietorship Company Registration Tradenfill Sole Proprietorship Business Format Income Tax Return

Proprietorship Company Registration Tradenfill Sole Proprietorship Business Format Income Tax Return