How To Create A 1099 Form 2019

Amounts shown may be subject to self-employment SE tax. You cant use a scanned or PDF copy.

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

You can create 1099 online easily by filling in the required information to the best of your abilities.

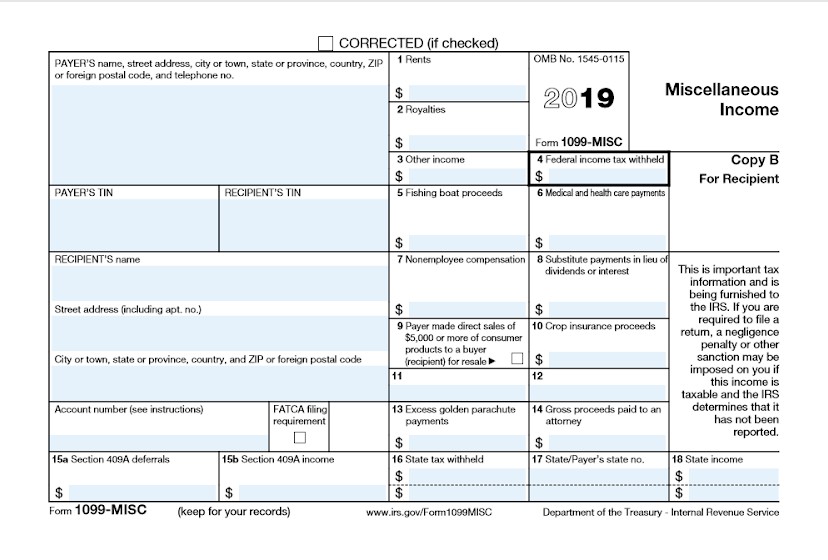

How to create a 1099 form 2019. Payers use Form 1099-MISC Miscellaneous Income or Form 1099-NEC Nonemployee Compensation to. Crop insurance proceeds are reported in. Keep reading to uncover more information about how to file 1099 online.

The guidelines below will help you create an e-signature for signing 2019 form 1099 misc irsgov in Chrome. Miscellaneous Income Info Copy Only 2019 Inst 1099-MISC. Form filed when one should not have been filed.

At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest. Do not enter an X in the CORRECTED box at the top of the form. Miscellaneous Income Info Copy Only 2020 Inst 1099-MISC.

The way to complete the Ma 1099 hc 2017-2019 form on the internet. Instructions for Form 1099-MISC Miscellaneous Income 2020 Form 1099-MISC. The name address and taxpayer ID number of the company or individual who issued the form 3.

To use this system you must be able to create a file in the proper format. You can order physical blank 1099 forms online or from an office supply store. Form Pros offers online generators for legal tax business personal forms.

Prepare a new information return. If you file 250 or more information returns in a year you must file online using the FIRE system. See the Instructions for Form 8938.

Original filing using wrong type of form for example a Form 1099-DIV was filed when a Form 1099-INT should have been used W-2 Forms. Prepare a new transmittal Form 1096. If you hire an independent contractor you must report what you pay them on Copy A and submit it to the IRS.

To start the form use the Fill Sign Online button or tick the preview image of the document. 247 Customer Support 1. Report payments made of at least 600 in the course of a trade or business to a person whos not an employee for services Form 1099-NEC.

Payments made with a credit card or payment card and certain other types of payments including third-party network transactions must be reported on Form 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-MISC. The advanced tools of the editor will lead you through the editable PDF template. Prepare the new return as though it is an original.

A freelancers favorite easy online tool. You then fill out and print both forms yourself and mail it out. 36th Street New York NY 10018.

A Social Security 1099 or 1042S Benefit Statement also called an SSA-1099 or SSA-1042S is a tax form that shows the total amount of benefits you received from Social Security in the previous year. Include all the correct information on the form including the correct TIN name and address. See the separate Instructions for Form 1099-K.

Incorrect or no payee TIN SSN EIN QI-EIN or ITIN Incorrect payee name. Fees paid to informers. Click on the link to the document you want to e-sign and select Open in signNow.

Find the extension in the Web Store and push Add. You can file 1099 forms and other 1099 forms online with the IRS through the FIRE System Filing Electronic Returns Electronically online. Use our 1099 Form generator to create and customize your 1099-MISC Form document.

How to file a 1099 form There are two copies of Form 1099. File Form 1099-MISC for each person to whom you have paid during the year. The 1099 creator will then automatically fill the boxes with the calculations so you dont have to worry anymore about anything.

Copy A and Copy B. Changes in the reporting of income and the forms box numbers are listed below. It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return.

Payer is reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement. Incorrect money amounts code or checkbox. You also may have a filing requirement.

Your name address and taxpayer ID number 2. Form 1098 1099 5498 or W2G. Due to the creation of Form 1099-NEC we have revised Form 1099-MISC and rearranged box numbers for reporting certain income.

Enter your official identification and contact details. If your net income from self-employment is 400 or more you must file a return and. Instructions for Form 1099-MISC Miscellaneous Income 2019 Form 1099-MISC.

A freelancers favorite easy online tool. You must report the same information on Copy B and send it to the contractor. Payer made direct sales of 5000 or more checkbox in box 7.

Use our 1099 Form generator to create and customize your 1099-MISC Form document. The 1099-MISC Form generally includes. Youll need at a minimum Form 1099-MISC and Form 1096.

You then print it out yourself and mail it. At least 600 in. The amount of income paid to you during the year in the appropriate box based on the type of income you received 4.

Log in to your registered account.

2015 Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

2015 Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

W9 Vs 1099 Irs Forms Differences And When To Use Them

W9 Vs 1099 Irs Forms Differences And When To Use Them

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

All You Need To Know About The 1099 Form 2020 2021

All You Need To Know About The 1099 Form 2020 2021

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Understanding 1099 Form Samples

Understanding 1099 Form Samples

Example 1099 Misc Form Filled Out Vincegray2014

Example 1099 Misc Form Filled Out Vincegray2014

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

Instant Form 1099 Generator Create 1099 Easily Form Pros

Instant Form 1099 Generator Create 1099 Easily Form Pros

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver