Does Mileage Reimbursement Count As Income

Of the Code of Federal Regulations 4161123 How we count unearned income. A reimbursement that results in a taxable benefit to the individual under the Income Tax Act the ITA is in reality remuneration or income of the individual.

Mileage Reimbursement For Employees Considered Taxable Wages

Mileage Reimbursement For Employees Considered Taxable Wages

If its not an accountable plan the mileage reimbursement can count as taxable wages.

Does mileage reimbursement count as income. Mileage reimbursement In California is critical. While it is permitted to reimburse employees at any rate reimbursements in. In particular you seek clarification of 4161123b3 which reads in part We include less than you actually receive if part of the payment is for an expense you had in getting the payment ow we count unearned income provides when a Supplementål Securi 416.

You can claim 17. There is no required mileage reimbursement rate companies have to pay. Reimbursements based on the federal mileage.

A car allowance is considered as taxable income but the mileage driven may be tax-deductible. Get every deduction you deserve TurboTax Deluxe searches more than 350 tax deductions and credits so you get your maximum refund guaranteed. After all there are several things the IRS classifies as taxable income including things like lottery winnings and jury duty fees.

Since an independent contractor is deemed to have their own business that expense is theirs to deduct. For 2020 the federal mileage rate is 0575 cents per mile. Meal and entertainment expenses are only reimbursable if it can be demonstrated they had a clear business purpose.

The IRS sets a standard mileage reimbursement rate. N Earned income tax credit EITC refund payments received on or after January 1 1991 including advanced earned income credit payments 26 USC. Payments by an employer that are reimbursement specifically for travel expenses of the employee and are so identified by the employer at the time of payment.

Is mileage reimbursement required by law. But theres a silver lining. For figuring base pay earnings is straightforward -- the full amount of compensation that your former employer paid you.

Although you will pay income tax on your reimbursements you can deduct all mileage expenses despite receiving reimbursements. Answer The mileage tax deduction rules generally allow you to claim 0575 per mile in 2020 if you are self-employed. The IRS requires employers to maintain proof of reimbursement expenses deducted on company tax returns.

If the employee receives expense reimbursement from the employer and cannot provide receipts or other documentation to back up the reimbursement the IRS will consider the reimbursement taxable income for the employee. You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons. Care or reimbursement for costs incurred for such care under the Child Care and Development Block Grant Act of 1990 42 USC.

You will need to pay income tax on it and theres always the possibly it pushes you into a higher tax bracket. In the case of mileage reimbursement the dollar amount received is not taxable as income as long as it does not exceed the IRS limit which is 55 cents per mile in 2009. It depends on your employers reimbursement arrangement based on the two IRS allowable accountable and non-accountable plans.

Mileage accrued when driving to and from doctor visits the pharmacy and the hospital can all count toward a medical deduction. Therefore if your actual expenses exceed the standard IRS rate you should itemize your deductions to deduct the excess. Note that for reimbursements above the IRS mileage rate the IRS considers the excess as taxable income.

State unemployment insurance departments consider earnings to be reportable income for both figuring initial benefits and deducting part-time work and other earnings from weekly benefits. To have the reimbursement not hit their tax reporting first they must have provided substantial documentation and the payer must then make a full accounting of it on the business return. Just know that any reimbursement above the standard mileage rates is taxable.

Taxable income can be reduced especially when it comes to mileage reimbursement. The non-accountable plan counts the money as income. If your employer reimburses mileage they can use a reimbursement rate thats higher or lower than the federal guidelines.

The IRS hasnt set any official mileage reimbursement rules. The following types of earnings income or losses do not count as earnings from employment or self-employment under the earnings test. If the mileage is a valid business expense and has not passed this test the person deducts the mileage.

Here at Motus we understand that taxable income is a tricky thing to wrap your head around. Standard mileage reimbursement rate is exceeded. As income the payment is not subject to the GSTHST and hence not eligible for purposes of determining an input tax credit ITC or rebate entitlement under the Act.

Nonetheless states like California and Massachusetts do have a mileage reimbursement rate rule.

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

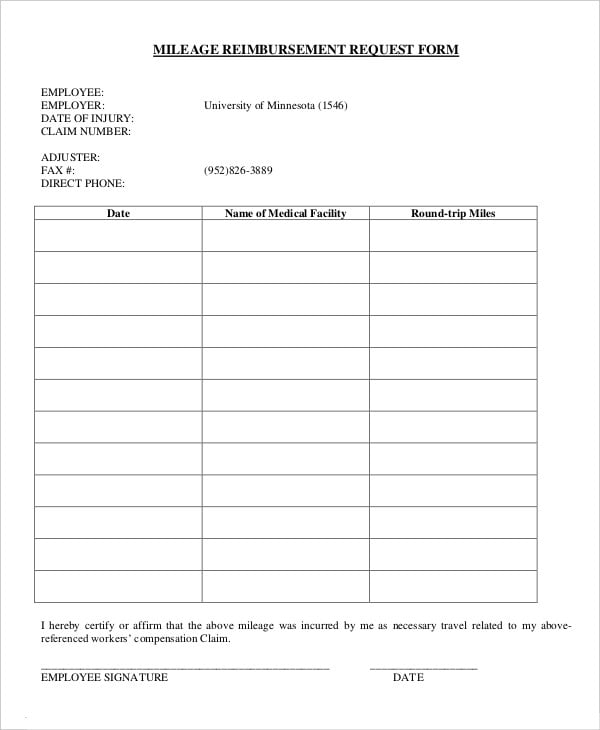

Mileage Reimbursement Form 9 Free Sample Example Format Free Premium Templates

Mileage Reimbursement Form 9 Free Sample Example Format Free Premium Templates

How To Record Mileage Help Center

How To Record Mileage Help Center

How Much To Reimburse For Employee Mileage Timesheets Com

How Much To Reimburse For Employee Mileage Timesheets Com

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

The Basics Of Employee Mileage Reimbursement Law Companymileage

The Basics Of Employee Mileage Reimbursement Law Companymileage

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

Policy Considerations For Mileage Reimbursement I T E I Fyle

Policy Considerations For Mileage Reimbursement I T E I Fyle

Mileage Reimbursement For Employees Info Free Download

Mileage Reimbursement For Employees Info Free Download

Mileage Reimbursement Rules For Uber Drivers And Turo Owners

Mileage Reimbursement Rules For Uber Drivers And Turo Owners

Is A Mileage Reimbursement Taxable

Is A Mileage Reimbursement Taxable

%20(1).jpeg) 2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

Taking A Mileage Deduction After Reimbursement Mileiq

Taking A Mileage Deduction After Reimbursement Mileiq

What Do Most Companies Pay For Mileage Reimbursement

What Do Most Companies Pay For Mileage Reimbursement

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Is A Car Allowance Or Mileage Reimbursement Taxable Income