Can I Claim Business Expenses Without Receipts

If your expenses are more than your income the difference is a net loss. You need to be able to demonstrate that the expense is solely for business use and the amounts have been recorded and.

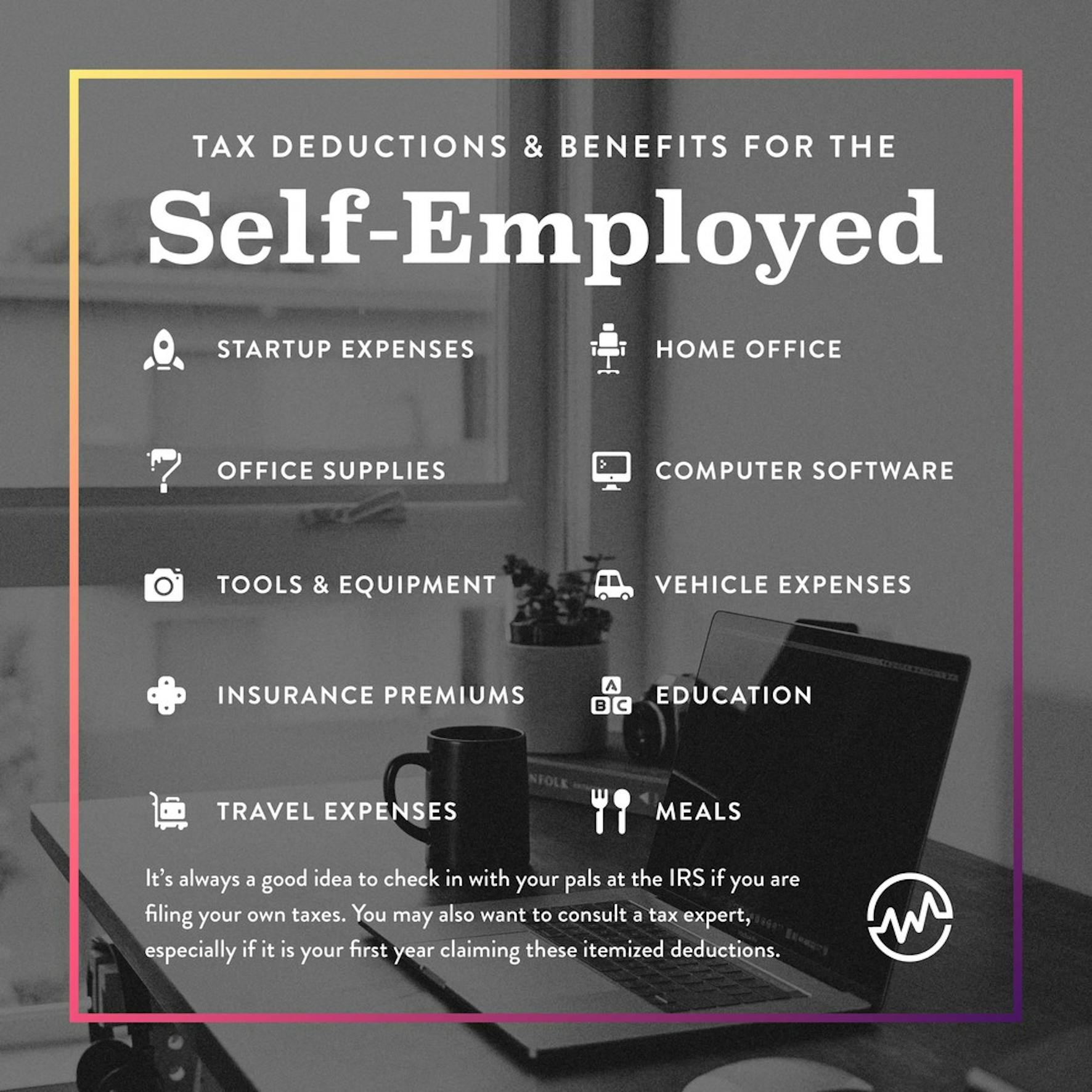

Small Business Tax Prep Kit Tax Forms Tax Logs Tax Cheat Sheet Tax Write Offs Small Business Tax Business Tax Business Tax Deductions

Small Business Tax Prep Kit Tax Forms Tax Logs Tax Cheat Sheet Tax Write Offs Small Business Tax Business Tax Business Tax Deductions

You just need to be able to satisfy a tax inspector by showing that you did make the purchase.

Can i claim business expenses without receipts. Expenses can potentially be claimed if they are not receipted but they must be genuine business expenses which you have actually incurred. You have to be clear about the date your business started. This is especially true if its a small expense or you can.

For the rest you can claim the proportion of your house that you use for work. For example if you buy a laptop and you only use it for your business you can claim a deduction for the full purchase price. Any items valued over 150 and youll need a receipt.

This could boost your tax refund considerably. You can also claim for any dry-cleaning fees youve incurred to keep work-related clothing clean. Mar 07 2019 Claiming expenses without receipts has long been thought of as a no-no but if youre self-employed you may be able to get away with it.

You must have records to prove it. If you are not able to prove the expense then the CRA will disallow it and reduce the amount of expenses that you have deducted. To claim for this purchase as a business expense keep a thorough record including information about the item who you bought it from and how much it.

Without the evidence from receipts for your claimed business expenses the Canada Revenue Agency CRA may decide to reduce the number of expenses you have deducted. The ATO generally says that if you have no receipts at all but you did buy work-related items then you can claim them up to a maximum value of 300. However with no receipts its your word against theirs.

The IRS provides some flexibility and can take your word that you had allowable expenses. Jun 01 2019 If your expenses are less than your income the difference is net profit and becomes part of your income on page 1 of Form 1040. In this example the house is 100 square metres and the office 10 square metres 10 of the total area.

Jan 03 2020 Generally you cant make tax claims without receipts. How much can I claim with no receipts. You have to be clear about the date your business started.

All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts. If you choose to claim an expense without a receipt make sure you have other proof of the transaction either on a bank statement or as detailed notes. Commissioner says that you might just be OK.

Chances are you are eligible to claim more than 300. Can I claim on expenses without receipts. You never received a receipt.

While its always best to hold on to any receipt you may still be able to claim on tax-deductible expenses if you dont have one. However if you use the laptop 50 of the time for your business and 50 of the time for private use you can only claim 50 of the amount as a deduction. All business expense claims need to be supported by original documents such as receipts.

Jan 01 2017 To deduct a business expense you need to have carried on the business in the fiscal period in which the expense was incurred. May 16 2018 You can claim up to 150 each year on clothing you buy for work. Sometimes you dont receive a receipt for example if you purchase an item through Gumtree or Facebook.

Jun 28 2018 Dont panic you may still be able to claim for some expenses without a receipt. The Internal Revenue Service does allow taxpayers to deduct some expenses without keeping receipts and the agency allows credit card records and paid bills to serve as proof of expenses. You can claim 100 of expenses that are soley for business purposes eg a business phone line.

Mar 06 2017 But if you cant find a receipt are you out of luck as the IRS might like you to believe. You usually can deduct your loss from gross income on page 1. For example you may travel on a tube and be unable to keep the ticket or obtain a receipt.

A famous tax case Cohan v. If youre a business that deducted expenses and you no longer have receipts it may be logical that you would have expenses that the IRS should allow even though you dont have a receipt. Nowadays most people file their taxes online and do not send their expense receipts to the CRA however you still need to be able to produce them if asked.

This includes the cost of buying branded uniforms protective gear such as boots or sunglasses and high-visibility clothing.

Home Office Expense Costs That Reduce Your Taxes Home Office Expenses Work From Home Business Business Expense

Home Office Expense Costs That Reduce Your Taxes Home Office Expenses Work From Home Business Business Expense

Top 25 1099 Deductions For Independent Contractors

Top 25 1099 Deductions For Independent Contractors

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Tax Printables Receipt Organization Tax Deductions

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Tax Printables Receipt Organization Tax Deductions

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Tax Deductions Small Business Tax Tax Prep Checklist

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Tax Deductions Small Business Tax Tax Prep Checklist

Keep Track Of Your Business Expenses With This Free Excel Template Download You Can Get This Do Expense Tracker Excel Excel Templates Business Expense Tracker

Keep Track Of Your Business Expenses With This Free Excel Template Download You Can Get This Do Expense Tracker Excel Excel Templates Business Expense Tracker

The Art Of Keeping Receipts For Your Taxes Turbotax Tax Tips Videos

The Art Of Keeping Receipts For Your Taxes Turbotax Tax Tips Videos

Can I Take The Standard Deduction And Deduct Business Expenses

Can I Take The Standard Deduction And Deduct Business Expenses

Full Time Job And Side Business Taxes Top 10 Tax Deductions Wealthfit

Full Time Job And Side Business Taxes Top 10 Tax Deductions Wealthfit

1099 Excel Template Keeper Tax

1099 Excel Template Keeper Tax

Tax Deductions For Your Online Business Expenses

Tax Deductions For Your Online Business Expenses

What Are Business Expenses What Expenses Can I Claim

What Are Business Expenses What Expenses Can I Claim

Free Expense Reimbursement Form Templates

Free Expense Reimbursement Form Templates

Home Office Deduction Worksheet Excel

Home Office Deduction Worksheet Excel

Form 2106 Instructions Information On Irs Form 2106

Form 2106 Instructions Information On Irs Form 2106

Keep Track Of Your Business Expenses With This Download Techrepublic

Keep Track Of Your Business Expenses With This Download Techrepublic

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Small Business Tax Business Tax Business Tax Deductions

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Small Business Tax Business Tax Business Tax Deductions

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png) Schedule C Profit Or Loss From Business Definition

Schedule C Profit Or Loss From Business Definition

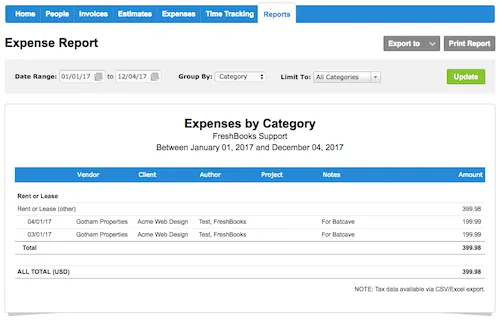

What Is An Expense Report And Why They Re Important For Small Businesses

What Is An Expense Report And Why They Re Important For Small Businesses

How To File Your Small Business Taxes Free Checklist Gusto

How To File Your Small Business Taxes Free Checklist Gusto