What Are The Three Major Alternative Forms Of Business Ownership

A business owned by only one person. Limited partnerships limited liability companies and Subchapter S corporations are also alternative forms of business organization.

4 Levels Of Strategy Types Of Strategic Alternatives

4 Levels Of Strategy Types Of Strategic Alternatives

THREE FORMS OF BUSINESS T-1.

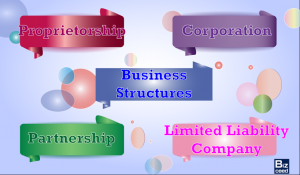

What are the three major alternative forms of business ownership. There are few drawbacks. In addition to the three commonly adopted forms of business organizationsole proprietorship partnership and regular corporationssome business owners select other forms of organization to meet their particular needs. Profits stay with the owner.

Discuss the advantages andor disadvantages these organizations offer relative to sole proprietorships general partnerships and C corporations. Start studying Three Major Forms Business Ownership. Well look at two of these options.

In addition a well drafted financial compensation and earnings allocation clause can minimize the overall tax burden borne by all partners. In the United States most business enterprises are organized as sole proprietorships partnerships or corporations. Forms of Business Organisation.

9 Different Forms of Business Organisation Forms of Business Organisation Sole Proprietorship Partnership Firm Limited Liability Partnership Joint Stock Company and One Person Company With Merits and Demerits Form 1. Is an organization of people legally bound together by a charter to conduct some type of business. Is a form of business in which there is one owner.

Partnerships are uniquely the most flexible of all business forms of ownership as it is simple to negotiate changes to the agreement. An association of two or more people operating the business as co-owners and sharing in the profits and loss according to a written agreement. Generally accepted accounting principles can be applied to the financial statements of all three forms of organization.

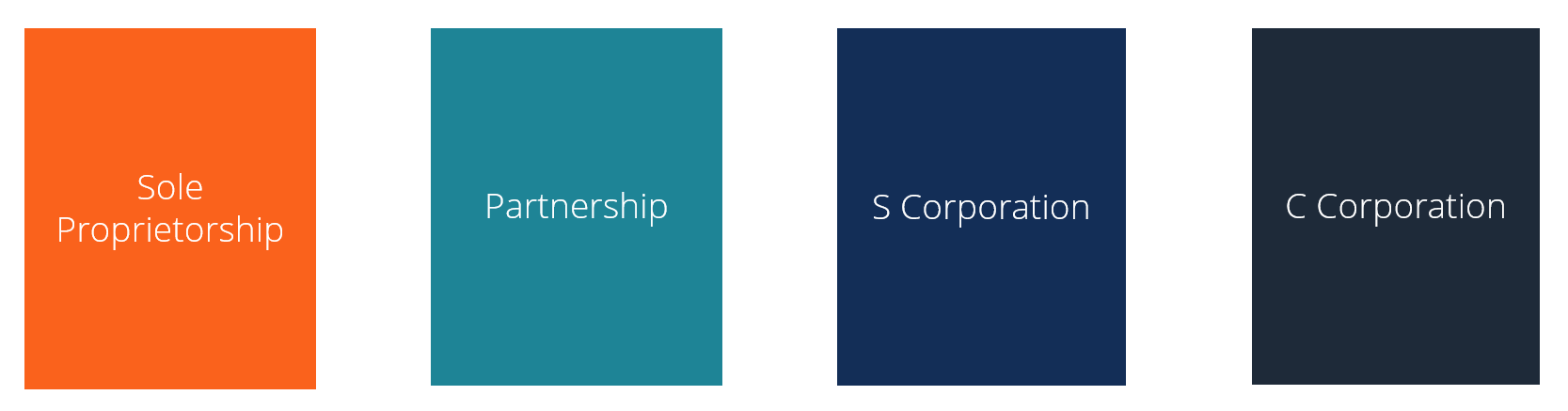

There are three types of corporations. Is a type of business organization in which there are two or more owners. A person who became an owner of a corporation by buying stock.

C-corporation A C-corporation is a corporation that is taxed separately from its owners. C-corporation S-corporation and Limited Liability Company. Learn vocabulary terms and more with flashcards games and other study tools.

Business Plan Tutorial Types Of Business Ownership Livecareer

Business Plan Tutorial Types Of Business Ownership Livecareer

Lease Renewal Process Why It S Important And How To Manage It More Effectively Process Street Checklist Workflow And Sop Softwa Decision Tree Renew Lease

Lease Renewal Process Why It S Important And How To Manage It More Effectively Process Street Checklist Workflow And Sop Softwa Decision Tree Renew Lease

Business Structures For Startups Founder S Guide

Business Structures For Startups Founder S Guide

Types Of Businesses Overview Of Different Business Classifications

Types Of Businesses Overview Of Different Business Classifications

Business Structures For Startups Founder S Guide

Business Structures For Startups Founder S Guide

Advantages And Disadvantages Of Limited Liability Company

Advantages And Disadvantages Of Limited Liability Company

Business Structures For Startups Founder S Guide

Project Management Diagram Business Functional Areas Broken Down Into Their Major Com Project Management Templates Project Management Project Management Tools

Project Management Diagram Business Functional Areas Broken Down Into Their Major Com Project Management Templates Project Management Project Management Tools

Uml Tutorial Diagram Types Business Process Management Activity Diagram Optimization

Uml Tutorial Diagram Types Business Process Management Activity Diagram Optimization

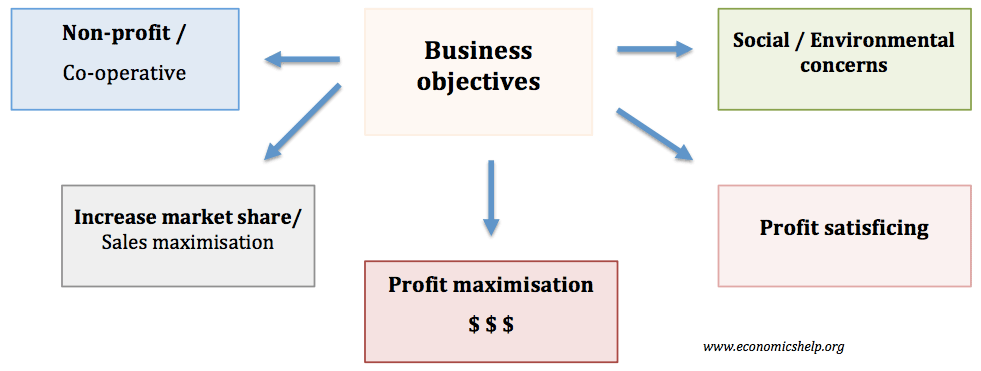

Business Objectives Economics Help

Business Objectives Economics Help

The Leanlaunch Pad At Stanford Class 5 Customer Relationship Hypotheses Business Model Canvas Customer Relationships Hypothesis

The Leanlaunch Pad At Stanford Class 5 Customer Relationship Hypotheses Business Model Canvas Customer Relationships Hypothesis

Take The Best Heuristic In A Nutshell Fourweekmba In A Nutshell Decision Making Bounded Rationality

Take The Best Heuristic In A Nutshell Fourweekmba In A Nutshell Decision Making Bounded Rationality

Pin On Business Strategy Powerpoint Templates

Pin On Business Strategy Powerpoint Templates

Free Printable Business Plan Template Form Generic Sample Within Startup Business Marketing Plan Template Strategic Marketing Plan Business Marketing Plan

Free Printable Business Plan Template Form Generic Sample Within Startup Business Marketing Plan Template Strategic Marketing Plan Business Marketing Plan

6 Powerful Business Growth Strategies For Small Businesses Act Crm

6 Powerful Business Growth Strategies For Small Businesses Act Crm

Interesting Small Business Facts Sabrina S Admin Services Small Business Infographic Small Business Resources Small Business

Interesting Small Business Facts Sabrina S Admin Services Small Business Infographic Small Business Resources Small Business

Value Of Solar Energy Alternative Energy Solar Energy Renewable Energy

Value Of Solar Energy Alternative Energy Solar Energy Renewable Energy

Step 3 Alternatives Structured Decision Making

Biz2credit Institutional And Big Bank Lending Both Up Bank Lending Small Business Loans Lending

Biz2credit Institutional And Big Bank Lending Both Up Bank Lending Small Business Loans Lending