Independent Contractor Mileage Deduction 2019

You can also deduct mileage for other work-related travel such as. This is the standard mileage deduction for all independent contractors.

![]() Free Mileage Tracking Log And Mileage Reimbursement Form

Free Mileage Tracking Log And Mileage Reimbursement Form

No matter which method you choose youll need to keep track of how many business and personal miles.

Independent contractor mileage deduction 2019. Yes they areYour deductible miles depend on where your primary place of business is located. Runzheimer International an independent contractor conducted the study for the IRS. From one work location to another.

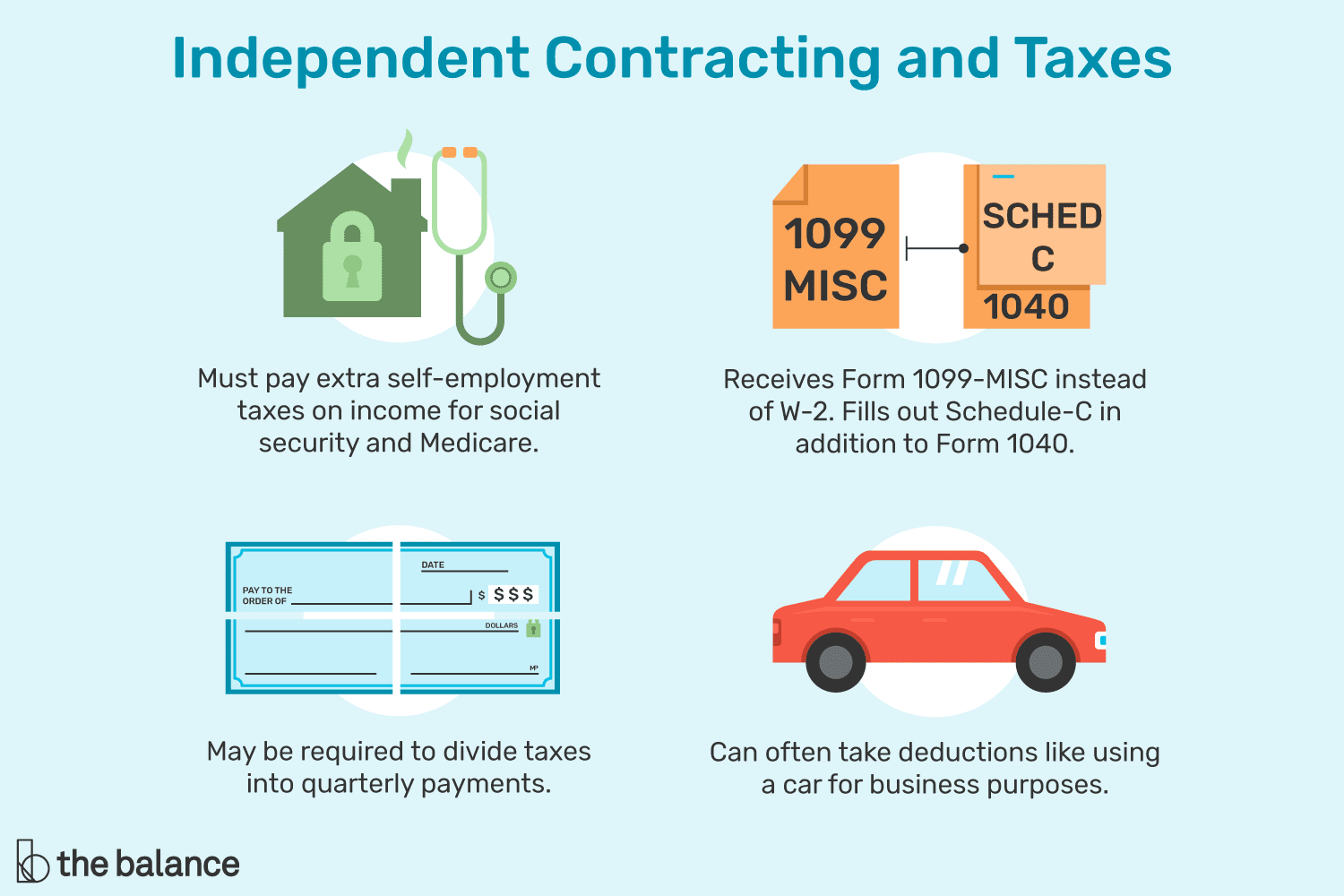

Mileage Could Be Your Biggest Tax Deduction. Also be aware that being an Independent Contractor involves you paying self employment tax in addition to income taxes. If you maintain an office at home all your miles are typically deductible from the time you get behind the wheel and drive away to deal with anything related to your business.

The IRS mileage rate for 2019 is 58 cents per mile. Answer The mileage tax deduction rules generally allow you to claim 0575 per mile in 2020 if you are self-employed. As a side note for tax purposes you dont get a mileage reimbursement.

Opting to use this mileage deduction could be useful if you put a lot of miles on the car. The time you spend traveling back and forth between your home and your business is considered commuting and the expenses associated with commuting standard mileage or actual expenses are not deductible as a business expense. You track your business mileage and then multiply the total number by the rate set by the IRS for that tax year.

You cannot deduct commuting expenses no matter how far your home is from your place of work. Home office deduction. Independent contractors generally have no limit on the ability to deduct work related expenses.

An independent contractor conducts an annual study for the Internal Revenue Service of the fixed and variable costs of operating an automobile to determine the standard mileage rates for business medical and moving use reflected in this notice. Deduct your mileage Employees are not allowed to deduct the cost of driving to and from home to work. In other words you dont receive the actual cost of mileage back in refunds but rather you dont pay taxes on that amount.

The standard rate for medical and moving purposes is based on the variable costs as determined by the same study. You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons. Deduct a standard rate on each business mile driven for the year.

For 2020 the standard mileage rate is 575 center per mile driven for business use down from 58 cents per mile in 2019. To meet with clients. But if you are self-employed and your home is your principal place of business you can deduct the cost of driving from home to see a client or to go to another work location.

Independent contractors who use a portion of their home for work and no other purpose can deduct either 5 per square foot up to 300 square feet or the actual expenses. The driving that you do while going to and from job sites can be a deductible expense. It is a mileage deduction.

If you drive to meet with a client then return directly home the entire trip is business-related. The standard mileage rate for charitable use is set by 170i. The standard mileage rate for business is based on an annual study of the fixed and variable costs of operating an automobile.

Taxes For Independent Contractors Definitive Guide On When And How To File

Taxes For Independent Contractors Definitive Guide On When And How To File

How To Do Taxes As A 1099 Contractor Per Diem Nurse Clipboard Health

How To Do Taxes As A 1099 Contractor Per Diem Nurse Clipboard Health

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

Top 10 1099 Tax Deductions Zipbooks

What Can Independent Contractors Deduct

Tax Basics For Independent Artists Part 2 Business Expenses Shannon Dooling Dances

Tax Basics For Independent Artists Part 2 Business Expenses Shannon Dooling Dances

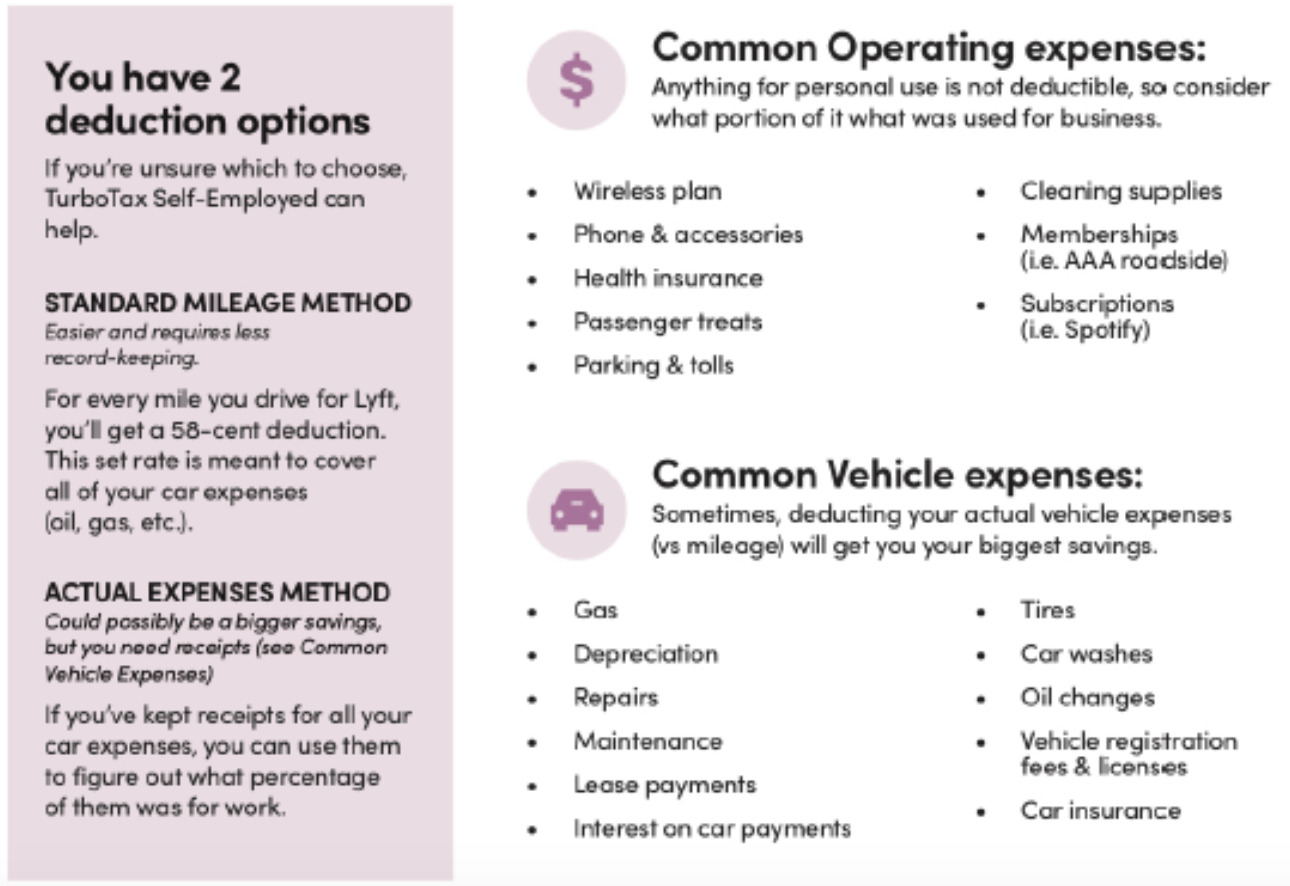

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Independent Contractor Tax Help Taxhub

Independent Contractor Tax Help Taxhub

Independent Contractor Taxes Guide 2021

Independent Contractor Taxes Guide 2021

Taxes For Substitute Teachers Mileage Tracking Tips Swing Education

Taxes For Substitute Teachers Mileage Tracking Tips Swing Education

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Three Surprise Car Expenses To Claim On Top Of Miles Entrecourier

Three Surprise Car Expenses To Claim On Top Of Miles Entrecourier

How To Fill Out The Schedule C

How To Fill Out The Schedule C

What Can Independent Contractors Deduct

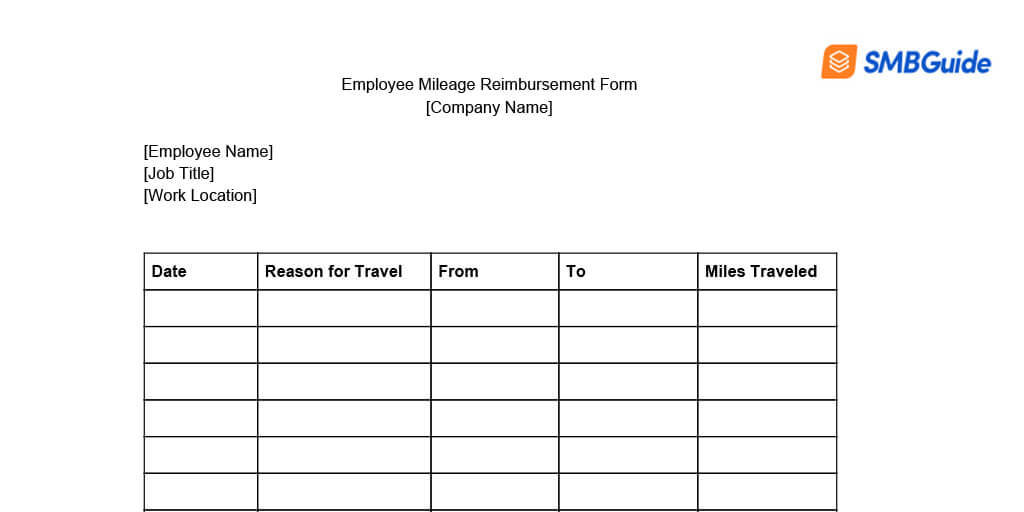

Mileage Reimbursement For Employees Info Free Download

Mileage Reimbursement For Employees Info Free Download

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

11 Deductions For Independent Insurance Agents Hurdlr

11 Deductions For Independent Insurance Agents Hurdlr