How Much Should You Reimburse Employees For Mileage

So if you administer a flat car allowance of 400 to your employees youre. Employees will receive 575 cents per mile driven for business use the previous rate in 2019 was 58 cents per mile Employees will receive 17 cents per mile driven for moving or medical purposes this is a substantial increase from just 2 cents per mile in 2018.

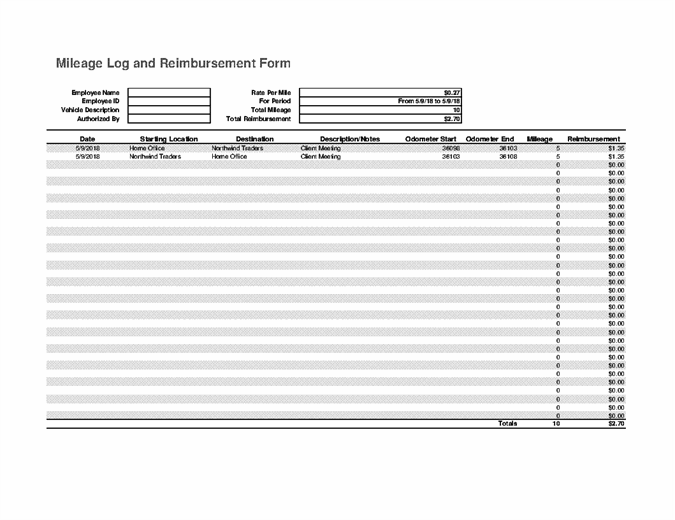

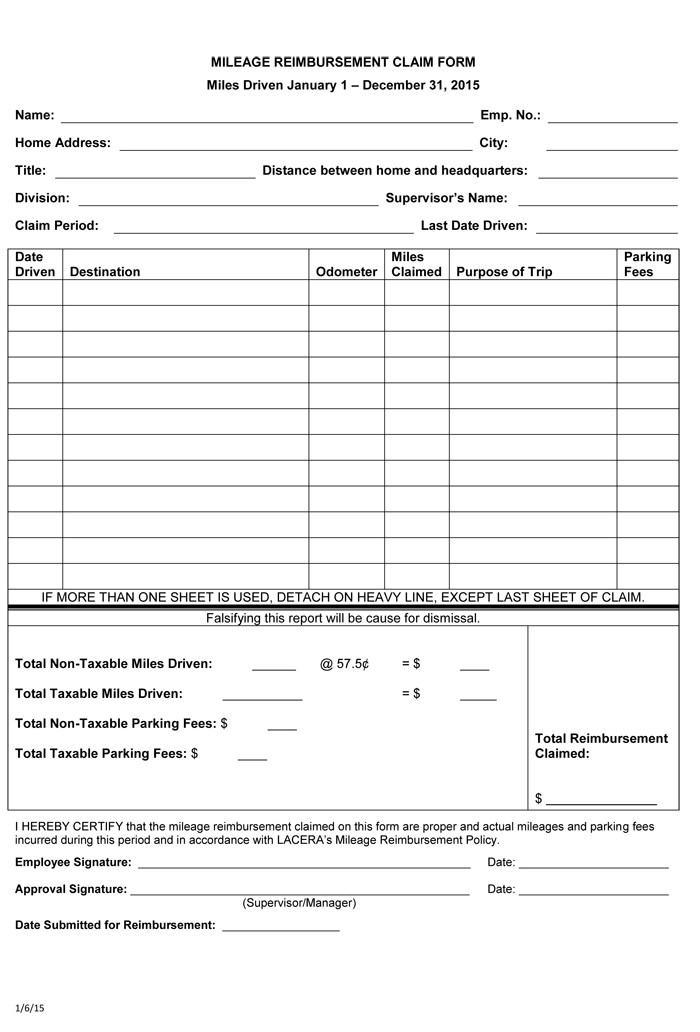

Expense Reimbursement Form Template Fresh Mileage Reimbursement Form 9 Free Sample Example Mileage Invoice Template Excel Templates

Expense Reimbursement Form Template Fresh Mileage Reimbursement Form 9 Free Sample Example Mileage Invoice Template Excel Templates

What are the Differences Between the Mileage Reimbursement and Car Allowance Methods.

How much should you reimburse employees for mileage. Accordingly the 2020 IRS standard mileage rates are. 575 cents per mile for regular business driving. Employers dont have to pay the IRS recommended rate Each year the IRA releases its optional standard mileage rate.

The 575 is calculated by using the 2020 IRS standard mileage rate reimbursement amount of 575 cents per mile. These are known as the standard mileage rates and they vary by type of mileage. How to calculate mileage reimbursement.

Mileage can only be deducted if it exceeds 2 of the tax payers AGI. The 2019 IRS Standard Reimbursement Rates are. If employers reimburse more however which is perfectly acceptable employees have to claim this mileage excess as wages on their taxes.

The standard mileage rates for 2021 are as follows. 575 cents per mile for business miles 58 cents in 2019 17 cents per mile driven for medical or moving purposes 20 cents in 2019. The IRS releases annual guidelines on how much to reimburse employees and taxpayers per mile.

The amount the employer does not reimburse is the amount employees can deduct on their taxes. Theres no required federal reimbursement rate but many companies reimburse at the standard mileage rate. If the employer were to reimburse at the full IRS rate he would be giving the employee 2700 based on the 2016 rate of 54 cents per mile.

For this year the mileage rate in 2 categories have gone down from previous years. Each year the IRS sets the rate each mile driven for work is worth. Employees can either claim the deduction or receive a.

575 cents per business mile 17 cents per mile for medical or moving. Many employers reimburse employees at this rate but the IRS rate is. For 2020 the standard IRS mileage rates are.

The Internal Revenue Service announced gas mileage reimbursement rates for 2020 in December. What records you need While the calculation is simple the records you need to prove it often arent. For example if its estimated that an employee will drive 1000 miles next month their car allowance amount should be no more than 575.

Each year the IRS sets its mileage reimbursement rate. 58 cents per mile for business miles driven up from 545 cents in 2018 20 cents per mile driven for medical or moving purposes up from 18 cents in 2018 14 cents per mile driven in service to a charitable organization currently fixed by. This is the one that applies to most companies.

56 cents per mile driven for. Thats down 05 cents from 58 cents per mile in 2019. Each year the IRS sets a standard mileage reimbursement rate so contractors employees and employers can use them for tax purposes.

This 2020 rate is down from 2019s. For 2020 thats 575 cents per business mile whereas the 2019 rate was 58 cents per mile. It does not matter if your employee uses more than one.

In 2020 the standard mileage rate is 0575 per mile. For tax purposes the IRS announces this rate for businesses in 2019 it is 58 cents per mile that employers can use to issue reimbursements or employees can use to claim a deduction during tax season. This rate applies to both cars and trucks and fluctuates year by year.

This is quite a bit more than the employee needs to be reimbursed unless the employer just wants to help with the car payment. Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p. The mileage reimbursement rate for 2018 is 545 cents for business miles driven up from 535 cents in 2017.

The standard mileage rate in 2020 for the use of a personal vehicle for business purposes is 575 cents per mile driven.

The Right Way To Reimburse Employee Expenses In 2020

The Right Way To Reimburse Employee Expenses In 2020

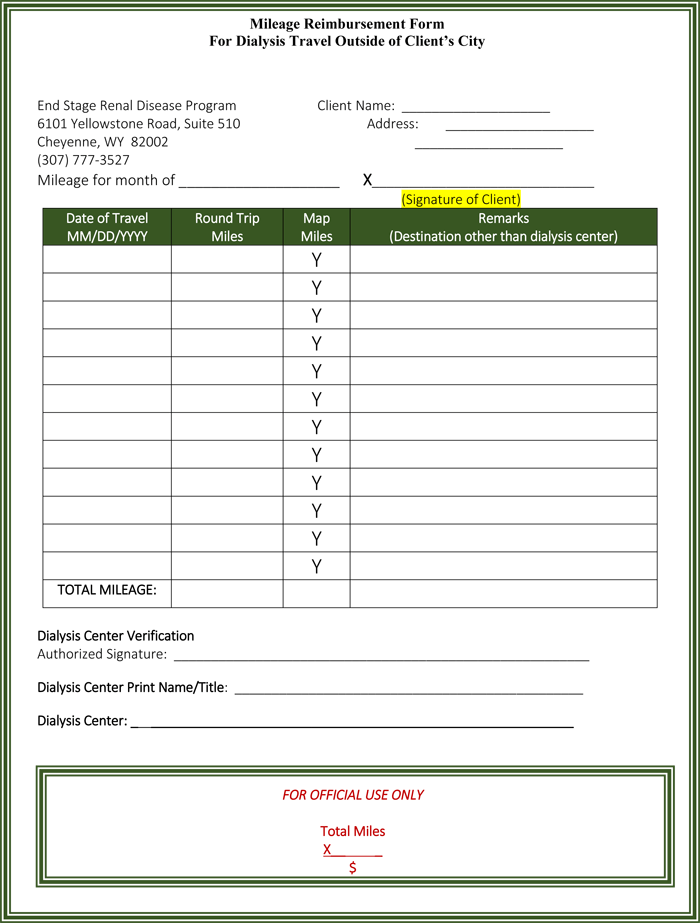

28 Printable Employee Mileage Reimbursement Form Templates Fillable Samples In Pdf Word To Download Pdffiller

28 Printable Employee Mileage Reimbursement Form Templates Fillable Samples In Pdf Word To Download Pdffiller

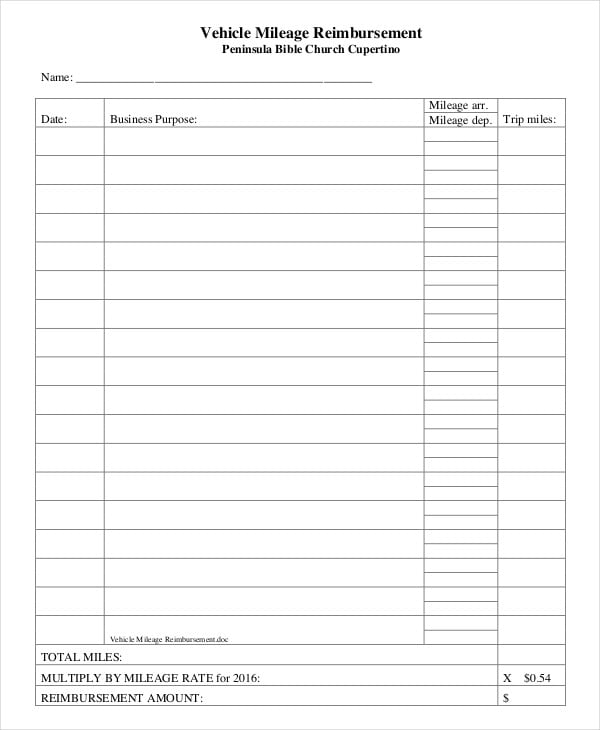

Free 11 Sample Mileage Reimbursement Forms In Ms Word Pdf Excel

Free 11 Sample Mileage Reimbursement Forms In Ms Word Pdf Excel

The Basics Of Employee Mileage Reimbursement Law Companymileage

The Basics Of Employee Mileage Reimbursement Law Companymileage

Follow These Employee Mileage Reimbursement Rules Avoid Penalties

Follow These Employee Mileage Reimbursement Rules Avoid Penalties

What Do Most Companies Pay For Mileage Reimbursement

What Do Most Companies Pay For Mileage Reimbursement

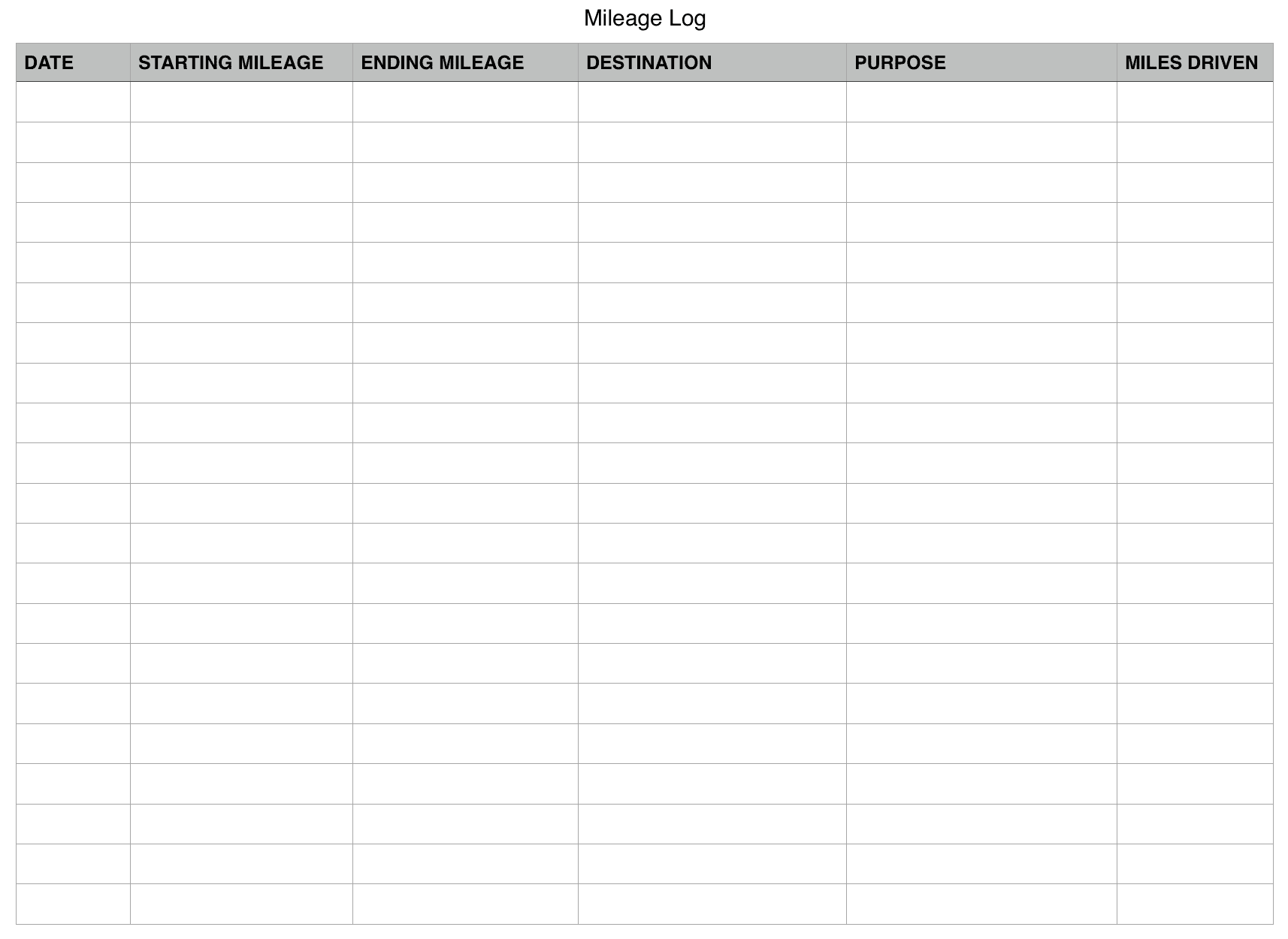

Mileage Log And Expense Report

Mileage Log And Expense Report

Irs Announces The 2021 Standard Mileage Rate Cfo Daily News

Irs Announces The 2021 Standard Mileage Rate Cfo Daily News

![]() Free Mileage Tracking Log And Mileage Reimbursement Form

Free Mileage Tracking Log And Mileage Reimbursement Form

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

How To Track And Reimburse Mileage In Gusto Timeero

How To Track And Reimburse Mileage In Gusto Timeero

Mileage Reimbursement For Employees Info Free Download

Mileage Reimbursement For Employees Info Free Download

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

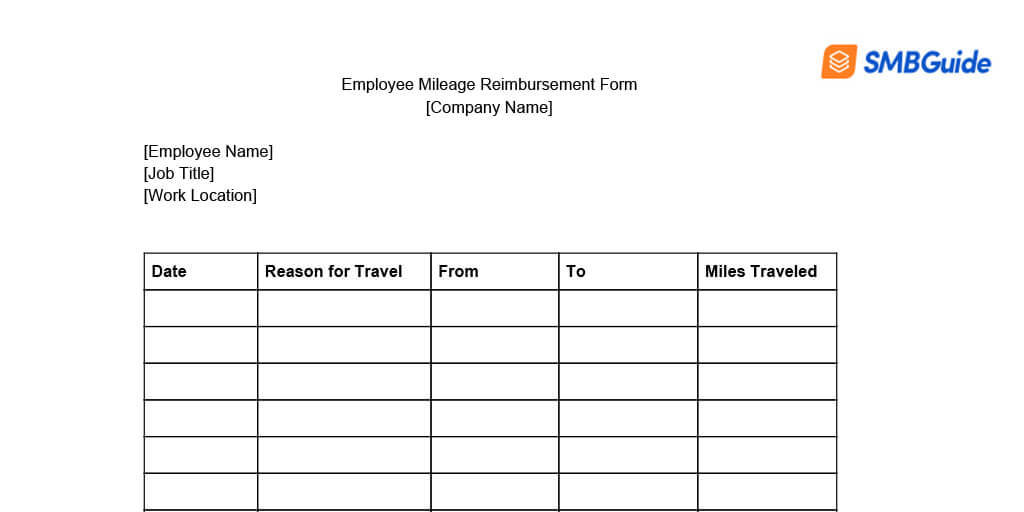

How To Reimburse Employees For Mileage Expenses Car Allowance Vs Mileage Reimbursement

How To Reimburse Employees For Mileage Expenses Car Allowance Vs Mileage Reimbursement

Mileage Reimbursement Form 9 Free Sample Example Format Free Premium Templates

Mileage Reimbursement Form 9 Free Sample Example Format Free Premium Templates

What You Need On Your Mileage Log

What You Need On Your Mileage Log

5 Mileage Reimbursement Form Templates For Word And Excel

5 Mileage Reimbursement Form Templates For Word And Excel

How Much To Reimburse For Employee Mileage Timesheets Com

How Much To Reimburse For Employee Mileage Timesheets Com

5 Mileage Reimbursement Form Templates For Word And Excel

5 Mileage Reimbursement Form Templates For Word And Excel