Does A Sole Proprietor Need A Business License In Oregon

If the name of the business doesnt include the full legal name of the business owner the business name must be registered as an assumed business name with Business Registry. To file you can use the SOSs Oregon Business Registry.

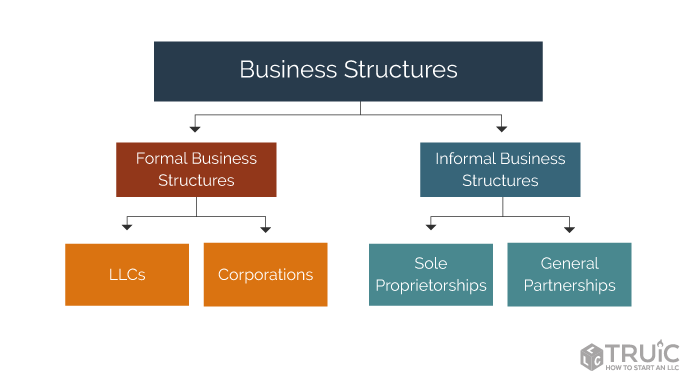

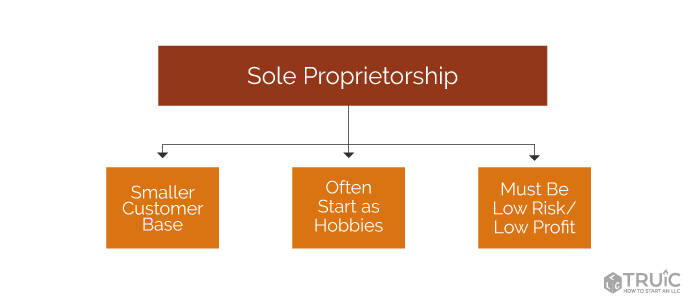

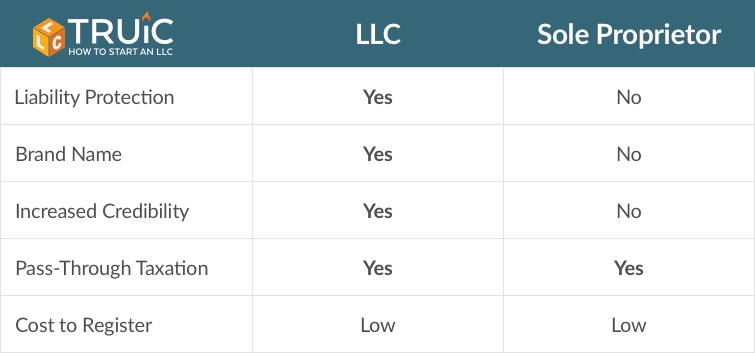

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

A sole proprietor is someone who owns an unincorporated business by himself or herself.

-(1).jpg?sfvrsn=0)

Does a sole proprietor need a business license in oregon. Sole proprietors dont have to be registered with Business Registry unless they are using an assumed business name. The form can be filed on the Oregon Secretary of State website or mailed to the States Corporation Division. Smith then list the actual business name under the Assumed business name section.

Your business may need to obtain business licenses or professional licenses depending on its business activities. Sole proprietors who list more than one ownerofficer and have registered the same way with the Secretary of State Business Registry will be. If you are a sole proprietor use the information in the chart below to help you determine some of the forms that you may be required to file.

In the majority of partnerships and sole proprietorships the business owner receives his share of income from the business directly and it does not. Oregon provides a comprehensive website of every profession and occupation that requires a license by any sole proprietorship. Depending on what falls under the domain of your business you might need to get a sole proprietor Oregon business license once you register the name of your company.

If you are a freelance writer for example you are a sole proprietor. Sole proprietorsList your legal name under the Business name section such as John M. Oregon has more than 1100 licenses permits and certifications.

They also need to file this form if business use of certain Section 179 or listed property drops to 50 or less. Handyman etc you will need to file an Assumed Name commonly known as a DBA or. Use the Licensing Permits tool to find a listing of federal state and local permits licenses and registrations youll need to run a business.

There isnt a requirement in Oregon for sole proprietors to acquire a general business license but depending on the nature of your business you may need other licenses andor permitsto operate in a compliant fashion. Yes all businesses in Oregon must be registered including those businesses operating as DBAs assumed names sole proprietorship LLC corporation or limited partnership. If you are a sole proprietorship or general partnership in Oregon and doing business under your full first and last name John Smith for example there is no filing but if the business will operate under a fictitious business name or DBA Doing Business As like John Smiths Handyman Service Mr.

While there are many different business organization structures you may choose for your business this guide will focus primarily on the five most common types used in Oregon - Sole Proprietor General Partnership Limited Liability Company Business Corporation and Nonprofit Corporation. In addition local regulations including licenses building permits and. While not a business license its common for Sole Proprietorships and Partnerships operating under a name that is different from the full name of the owner s to register for an Assumed Name also known as a Doing Business As or DBA with the Oregon Secretary of States Office.

Form 4797 Sales of Business Property if they sell or exchange property used in their business. Do Sole Proprietors Need A Business License In addition to getting licenses a sole owner must pay taxes on Income A sole owner needs to report all business income or losses on his or her individual income tax return -- IRS Form 1040 with Schedule C attached. Also with their Forms 1040 sole proprietors may need to file.

But like all businesses you need to obtain the necessary licenses and permits. However if you are the sole member of a domestic limited liability company LLC you are not a sole proprietor if you elect to treat the LLC as a corporation. Regulations vary by industry state and locality.

A business can obtain this information by going to the Oregon License Directory. The filing fee is. A sole proprietor must withhold and pay employment taxes for his employees.

Even though the State of Oregon doesnt require you to get a general business license specific occupations or activities will require a special license certificate or permission. Sole proprietorships and partnerships in Oregon must file an assumed name with the Oregon SOS if they use a business name that is different from the name of the business owner for a sole proprietorship or individual partners for a partnership.

How To Start Your Own Business All About Taxes And Recordkeeping Sole Proprietorship Business Checks Finance Saving

How To Start Your Own Business All About Taxes And Recordkeeping Sole Proprietorship Business Checks Finance Saving

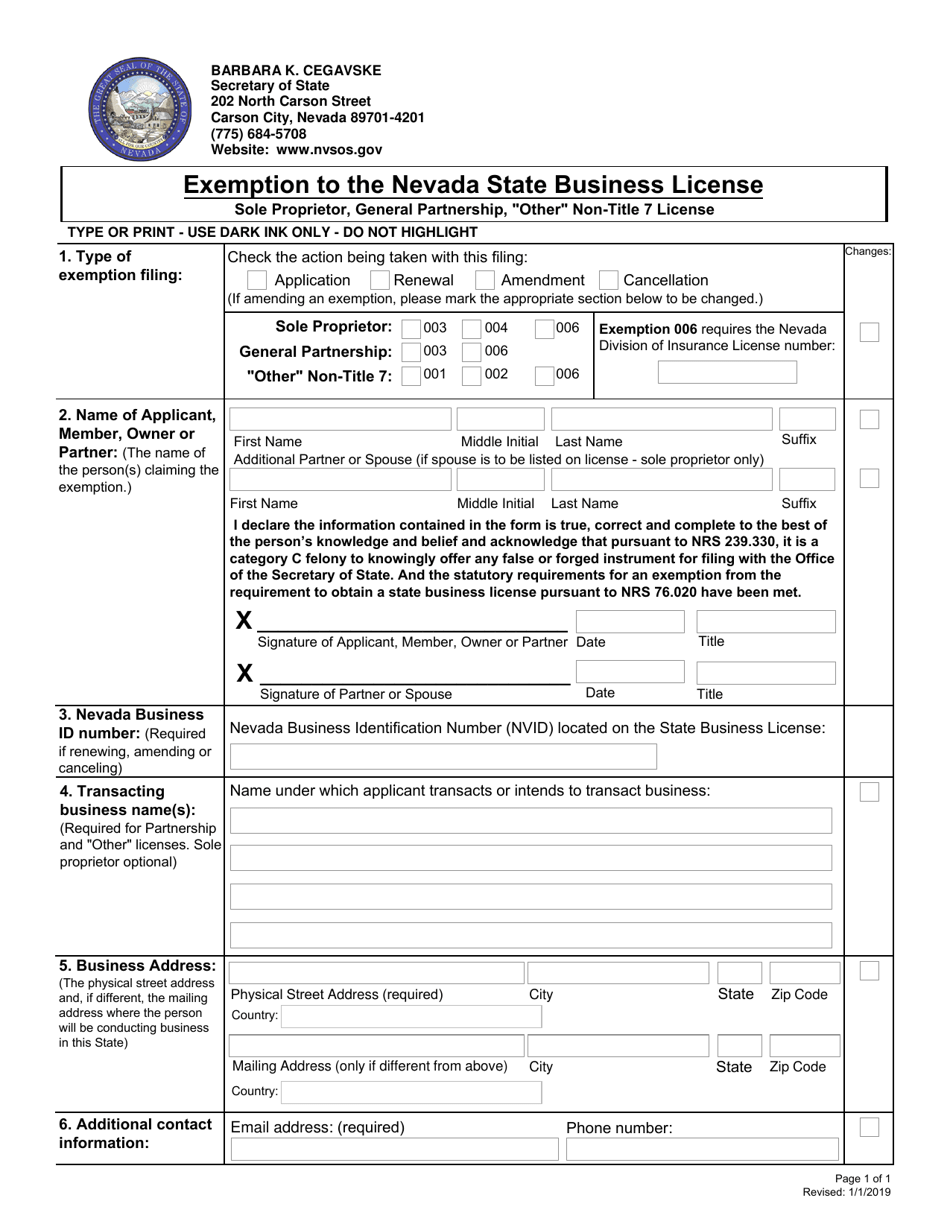

Nevada Exemption To The Nevada State Business License Sole Proprietor General Partnership Other Non Title 7 License Download Fillable Pdf Templateroller

Nevada Exemption To The Nevada State Business License Sole Proprietor General Partnership Other Non Title 7 License Download Fillable Pdf Templateroller

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

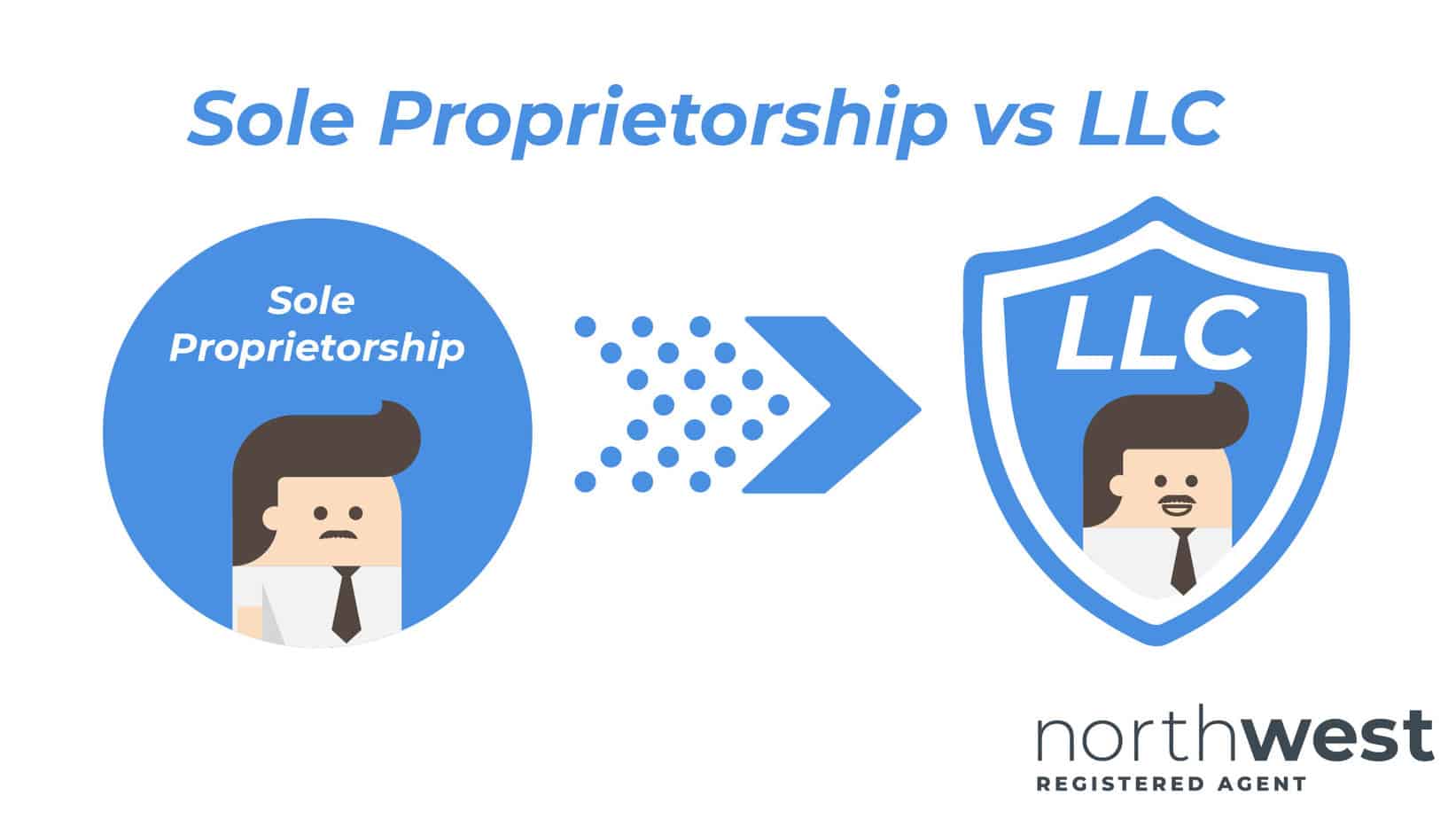

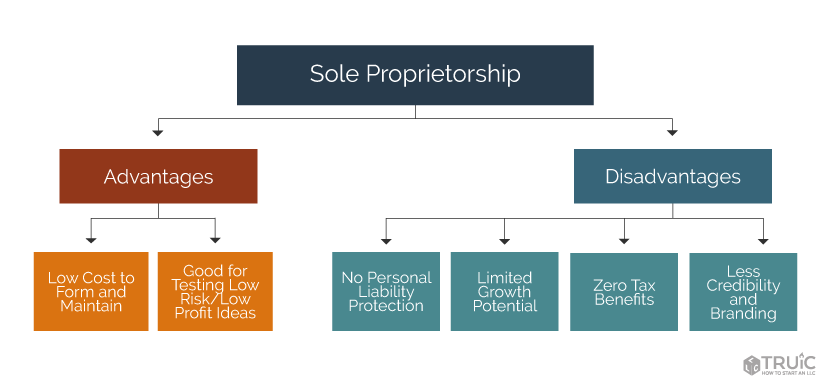

Why You Should Turn Your Sole Proprietorship Into An Llc

Why You Should Turn Your Sole Proprietorship Into An Llc

Business Taxes Llc Vs Sole Proprietorship

Business Taxes Llc Vs Sole Proprietorship

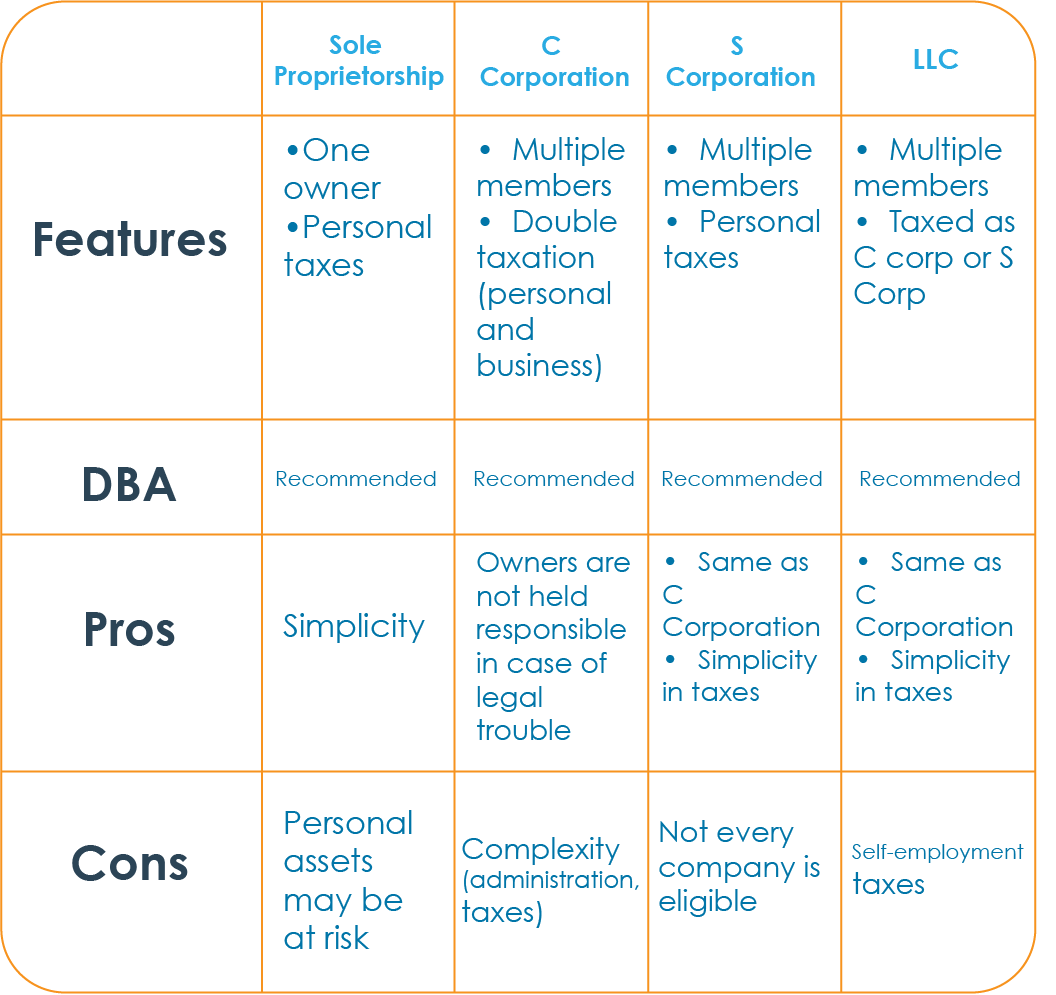

What S The Difference Between Dba Sole Proprietorship Llc And Corporation Camino Financial

What S The Difference Between Dba Sole Proprietorship Llc And Corporation Camino Financial

Register Texas Fictitious Business Name Texas Trade Name Texas Dba Business Names Sole Proprietorship Business Solutions

Register Texas Fictitious Business Name Texas Trade Name Texas Dba Business Names Sole Proprietorship Business Solutions

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

Online Sole Proprietorship Registration In India Sole Proprietorship Sole Registration

Online Sole Proprietorship Registration In India Sole Proprietorship Sole Registration

Utah Business Corporate Law Attorney Coulter Law Group Business Law Business Tax Small Business Law

Utah Business Corporate Law Attorney Coulter Law Group Business Law Business Tax Small Business Law

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Comparison Of Business Entities Startingyourbusiness Com

Comparison Of Business Entities Startingyourbusiness Com

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings