How To Lodge Activity Statement Ato

Once you are set up you can lodge your Activity Statement with the ATO from within Xero. Start AccountRight and open your online company file.

Fake Ato Online Activity Statement Email Links To Malware Hoax Slayer

You can also view print and list previously lodged statements.

How to lodge activity statement ato. Complete and return by the due date on your BAS along with any payment due. Even if you have a tax practitioner or agent lodge your statement on your behalf you can still access it yourself through ATO online services if you are registered. If you have a registered tax or BAS agent they can lodge vary and pay on your behalf through their preferred electronic channel.

Log in to the Business Portal. If you cant lodge or pay by the due date contact us as soon as possible. This is time-consuming as it requires double handling of data and the need for multiple systems.

You can lodge a nil business activity statement BAS from the Prepare activity statement screen. Lodge activity statements online. Usually arrangements can be.

Use it to lodge activity statements. ATO Community is here to help make tax and super easier. They can view activity statements sent to your myGov inbox.

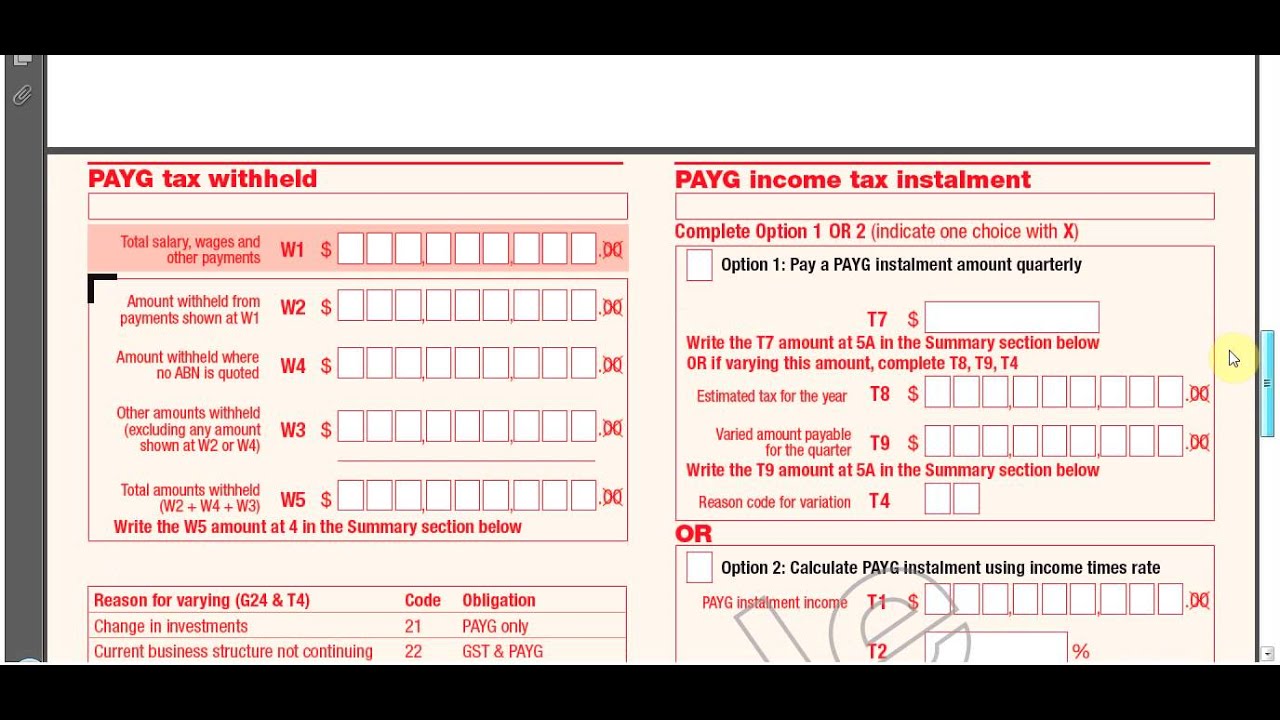

The Business Portal is a free secure website for managing your business tax affairs with us. If you hired a registered tax practitioner or BAS agent to complete your BAS for you they can lodge your statement for you. Under Activity Statement Reporting Method select Simpler BAS or Full BAS and click Save continue.

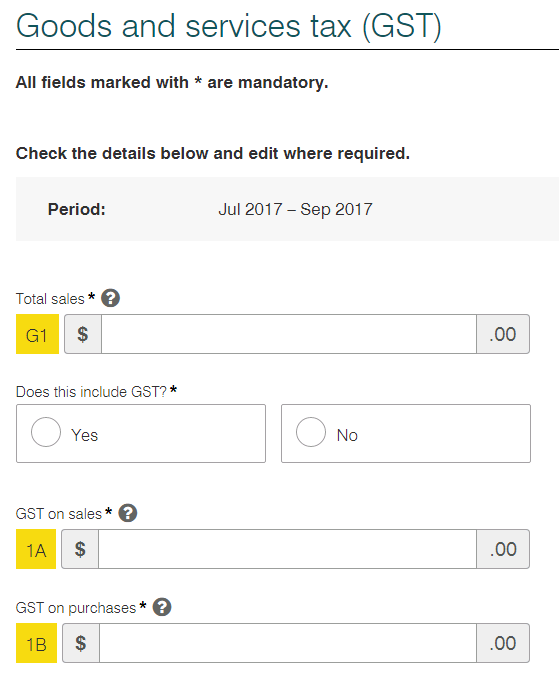

Select Tax and then Activity statements from the menu. Select No thanks I prefer to lodge manually. Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS.

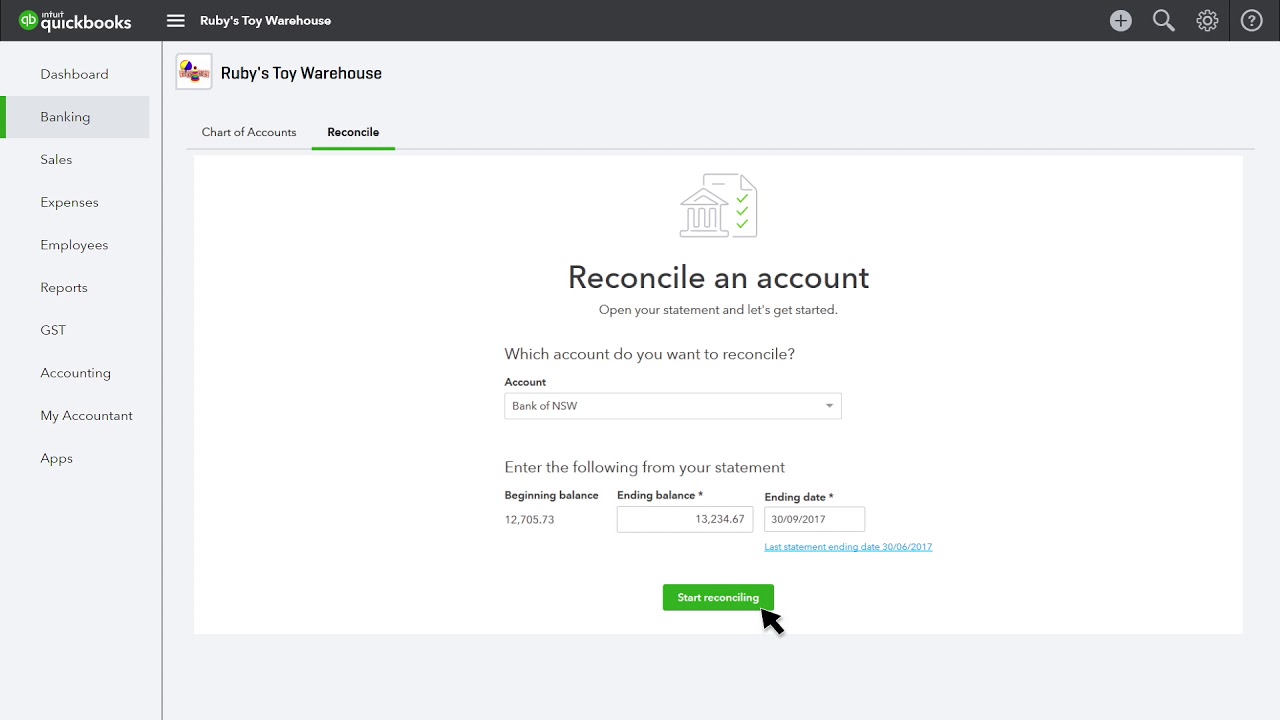

Activity statements that havent been lodged are displayed as Not lodged. Make sure that you have reconciled all your bank accounts in Xero and checked your other account balances before you lodge your BAS. To set up your online activity statement.

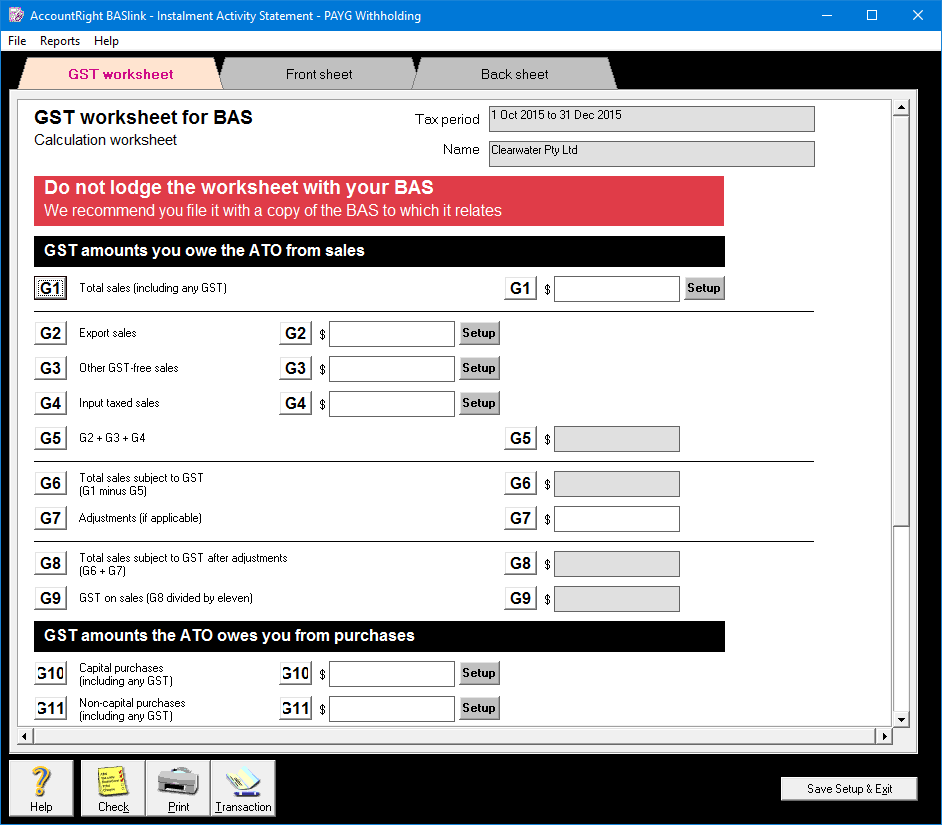

Click Prepare BASIAS in the Accounts command centre. How to lodge your BAS The Australian Taxation Office ATO will send your activity statement about 2 weeks before the end of your reporting period. When you use an agent.

To view or revise an already lodged activity. GST Calculation Period this determines the frequency that. You can lodge and revise most types of activity statements through Online services for business and youll get immediate confirmation that it has been lodged.

Click Prepare BASIAS in the Accounts command centre. Your BAS will help you report and pay your. In the Accounting menu select Reports.

In the Lodge Online tab click Prepare Statement. Currently Xero partners BAS agents and tax agents can use Xero Tax to lodge activity statements or manually re-enter information from Xero into a form either through the ATO portal using alternative software or filling in a paper form. You must lodge on time to avoid interest and penalties.

Hi I have a message telling me to lodge my activity statement but it isnt actually showing in the portal when I. Ask questions share your knowledge and discuss your experiences with us and our Community. Sign in to your MYOB account as you normally do when accessing your online AccountRight company files.

In the Lodge Online tab click Prepare Statement. To prepare your activity statement online Start AccountRight and open your online company file. You can lodge and pay electronically by mail or in person.

Lodging and paying your activity statement. Once you lodge your organisations activity statement online we will stop posting activity statements to you. Connect your organisation to the ATO.

3 Mail your BAS using the pre-addressed envelope. Business users Call the ATO and give them the software. You can lodge your BAS.

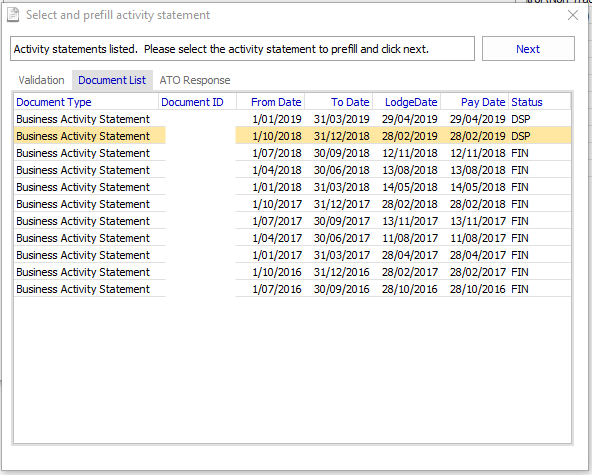

Under Tax click Activity Statement. Complete your Activity Statement and submit it to the ATO without leaving Xero. To complete your current activity statement click on it under Description.

Lodge activity statements with Xero About lodging from Xero. Once youre signed in to myGov access the ATO from My member services then. Lodge through your tax or BAS agent.

Once its past the due date activity statements will display as overdue. To lodge a new activity statement select Lodge activity statement.

Completing Your Bas Australian Taxation Office

Completing Your Bas Australian Taxation Office

Fillable Online Business Activity Statements Bas Fax Email Print Pdffiller

Fillable Online Business Activity Statements Bas Fax Email Print Pdffiller

Example Activity Statement Australian Taxation Office

Example Activity Statement Australian Taxation Office

Bas Lodgement Select The Business Activity Document Exalt

Bas Lodgement Select The Business Activity Document Exalt

Lodging An Activity Statement Through The Business Portal

Lodging An Activity Statement Through The Business Portal

Example Activity Statement Australian Taxation Office

Example Activity Statement Australian Taxation Office

Fake Ato Emails Spreading Malware General Services Business It

Fake Ato Emails Spreading Malware General Services Business It

Completing Your Bas Australian Taxation Office

Completing Your Bas Australian Taxation Office

How Do I Complete My Business Activity Statement Youtube

How Do I Complete My Business Activity Statement Youtube

Fake Ato Online Activity Statement Email Links To Malware Hoax Slayer

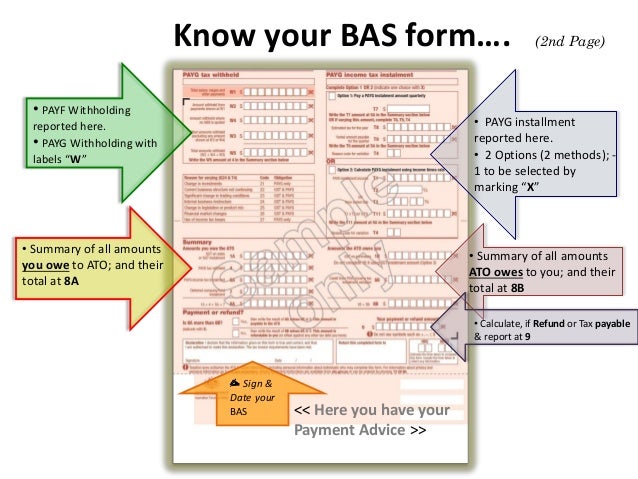

Bas Business Activity Statement Presentation

Bas Business Activity Statement Presentation

Lodge Your Activity Statement Australia Only Myob Accountright Myob Help Centre

Lodge Your Activity Statement Australia Only Myob Accountright Myob Help Centre

Lodging An Activity Statement Through The Business Portal Youtube

Lodging An Activity Statement Through The Business Portal Youtube

Lodge Activity Statements With Xero Is On It S Way Xero Blog

Lodge Activity Statements With Xero Is On It S Way Xero Blog

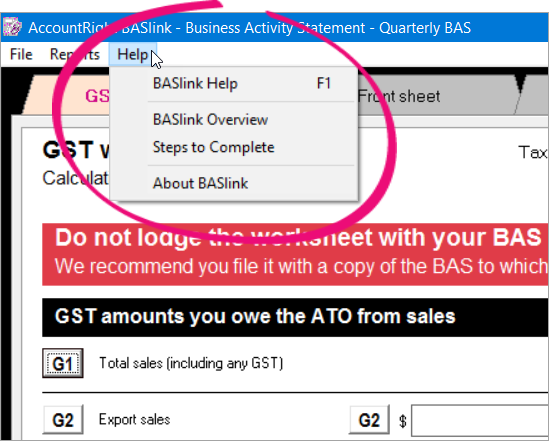

Baslink Faqs Myob Accountright Myob Help Centre

Baslink Faqs Myob Accountright Myob Help Centre