Define Forms Of Business Ownership

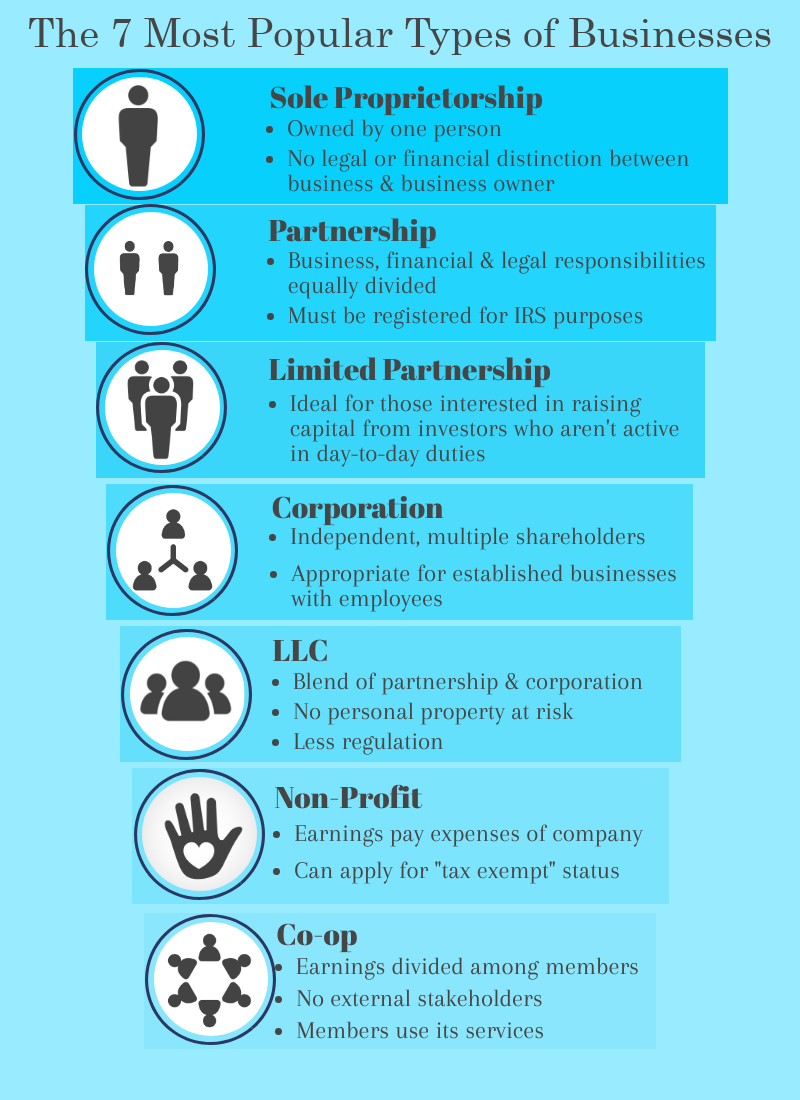

The most common form of business structure for small businesses is a limited liability company or LLC which is defined as a separate legal entity and may have an unlimited amount of owners. Control and flexibility with few government regulations on how the business must be run.

Forms Of Ownership Chapter Ppt Video Online Download

The owner operates the business alone and may hire employees.

Define forms of business ownership. The vast majority of small businesses start out as sole proprietorships. A sole proprietorship is a firm that is owned by one person. A sole proprietorship also known as a sole trader is owned by one person and operates for their benefit.

A sole proprietor has unlimited liability for all obligations incurred by the business whether from operating costs or judgments against the business. Ease of dissolving the business. Sole proprietors own all the assets of the business and the profits generated by it.

Low cost of formation. 3 Identify the different types of partnerships and explain the. Ownership of all business profits.

The most common forms of business enterprises in use in the United States are the sole proprietorship general partnership limited liability company LLC and corporation. Owners have limited liability greater credibility for obtaining financing and no double taxation as all profits pass directly to the owners and the corporation pays no taxes. 2 Describe the sole proprietorship and partnership forms of organization and specify the advantages and disadvantages.

Forms of Business Ownership Learning Objectives 1 Identify the questions to ask in choosing the appropriate form of ownership for a business. These firms are owned by one person usually the individual who has day-to-day responsibility for running the business. On the plus side this means that all profits are the property of the owner after taxes are paid of course.

From a legal perspective the firm and its owner are considered one and the same. There are however restrictions on the. A form of ownership that is the best of both partnerships and corporations.

The option to keep some things about the business private. They are typically taxed as a sole proprietorship and require insurance in case of a lawsuit.

4 Most Common Business Legal Structures Pathway Lending

Contract For Virtual Assistant And Independent Contractor Services Virtual Assistant Online Business Contract

The Seven Most Popular Types Of Businesses Volusion

Chapter 4 Forms Of Business Ownership Introduction To Business

The Seven Most Popular Types Of Businesses Volusion

Small Business Accounting Kit Bookkeeping Forms Balance Etsy In 2021 Small Business Accounting Tax Prep Checklist Business Checklist

Chapter 4 Forms Of Business Ownership Introduction To Business

Sample Business Plan Template Business Plan Template Business Planning How To Plan

Business Structure How To Choose A Business Structure Truic

Chapter 4 Forms Of Business Ownership Introduction To Business

Business Structure Overview Forms How They Work

Chapter 4 Forms Of Business Ownership Introduction To Business

Small Business Ownership In The Us The Foundation Of The Us Economy And The Engine Of Innova Small Business Ownership Business Ownership Business Infographic

Business Organization Cengage Learning Business Organization Business Ownership

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Free Printable Partnership Agreement Legal Forms Legal Forms Contract Template Partnership

Legal Forms Of Business Organization

8 Main Types Of Business Ownership Best Business Ownership Classification