Business Travel Meal Allowance Policy

It covers your expenses for business meals beverages tax and tips. Employees in travel status may be reimbursed for two 2 or three 3 separate meals per day providing that the daily meal limit for the travel area is not exceeded including tax and tips.

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

A University employee can incur a business meal expense while on travel status.

Business travel meal allowance policy. All air travel andor accommodation requirements will be coordinated through the City Procurement Organisational Services subject to receipt of the necessary approvals. Lesedi Local Municipality Subsistence and Travel Allowance Policy Page 3 of 13 1. The amount of the allowance varies depending on where and when you travel.

The standard meal allowance is based on what federal workers are allowed to charge for meals while traveling and is therefore relatively modest. The approach to an allowance will vary from one company to the next depending on the corporate travel policy that is in place. As of April 7th 2019 the official HMRC meal allowance rates for UK business travel are.

A daily travel allowance will be paid to travellers. A business travel allowance is a payment made to a corporate traveler by an employer to cover expenses incurred on a business trip. The deduction for business meals is generally limited to 50 of the unreimbursed cost.

DEFINITIONS Allowance an amount of money granted by an employer to an employee in circumstances where the employer is certain that the employee will incur business. Business Meal While on Travel Status. This policy is to be implemented in accordance with Attachment A Corporate Travel and Accommodation Policy Standards Employees and Contractors.

12day for breakfast and lunch combined. The meal must be. If youre self-employed you can deduct travel expenses on Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship or if youre a farmer on Schedule F Form 1040 Profit or.

See 1502 Policy on Allowable Travel Expenses Lodging and Per Diem Rates for additional information. The most common expenses are accommodation food drink and transportation. HR Manual section 2203 Allowances and Travel Reimbursements provides additional information including travel timeframes fractional day of travel trip of less than 24 hours trip of more than 24 hours etc.

The per diem is intended to offset costs for meals when traveling. It is not a meal reimbursement. Per diem is a daily allowance employees receive to cover business travel-related expenses.

Excess meals may be allowed dependent on funding source. Traveler qualifies for an extended day meal reimbursement limit of 19 if in travel status twelve 12 or more consecutive hours. There should not be more than 1 stoppage in case of domestic travel and the stoppage must not exceed more than 2 times in the case of international travel.

Per diem only covers meals lodging and incidental expenses eg dry cleaning. It must not increase the travelling time for more than 2 hours in case of domestic travel and more than 4 hours when it comes to international travel. The travel policy should also spell out which amenities such as checked luggage meals and in-flight entertainment are and are not covered by the organization.

The following reimbursement rates for meals and incidentals are maximums not allowances. Meals Personal meals are defined as meal expenses incurred by the traveler when dining alone on an out-of-town business trip. This amount is called the standard meal allowance.

These expenses must be documented in accordance with the procedures specified in this policy with a clear business purpose. Traveler qualifies for a single day meal reimbursement limit of 12 if their travel exceeds six 6 hours or more but fewer than twelve 12 consecutive hours. Approximate meal expense guidelines are as follows.

Business Meals Taken With Other Employees. Travel meals occur when an employee is on an authorized work assignment that requires an overnight stay away from his or her home. 5 for travel of 5 hours or more 10 for travel of 10 hours or more 25 for travel of 15 hours or more or if the travel is ongoing after 8pm.

If you offer employees per diem pay include per diem rates and information in your travel and reimbursement policy. Updating your travel policy. In the event of an audit employees must be able to produce receipts substantiating the amount claimed.

Expenses incurred on meals while traveling on OMVIC business are reimbursed up to a daily maximum of 9000 per person following the meal limits of 20 for breakfast 25 for lunch 45 for dinner excluding applicable taxes and maximum gratuity of 15. The fixed meal allowance begins the day the traveler departs for business and continues through the day of return as long as all days in between are business-related Generally travel includes the day before business is set to begin and ends the day after business concludes.

7 Travel Expense Policy Examples Pdf Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

When Do I Need To Attach A Receipt To My Expense Reports

When Do I Need To Attach A Receipt To My Expense Reports

Expense Reimbursement Policy Best Practices And 3 Templates

7 Travel Expense Policy Examples Pdf Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Memo Travel Amp Entertainment Expense Policy

Memo Travel Amp Entertainment Expense Policy

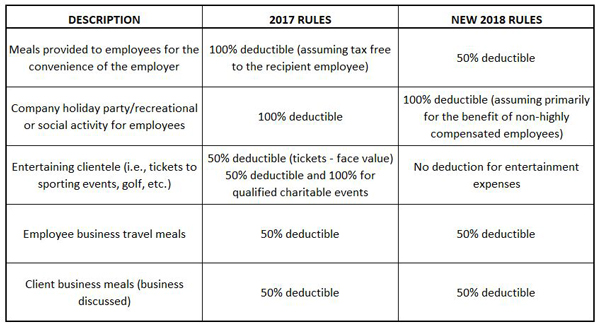

Reduced Tax Benefits For Meals Entertainment In 2018 Kruggel Lawton Cpas

Reduced Tax Benefits For Meals Entertainment In 2018 Kruggel Lawton Cpas

7 Travel Expense Policy Examples Pdf Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

4 Employee Reimbursement Policy Templates Pdf Free Premium Templates

4 Employee Reimbursement Policy Templates Pdf Free Premium Templates

Https Www Smu Edu Businessfinance Officeofbudgetandfinance Travelandexpense Travel Travel Procedures

Https Workful Com Blog Wp Content Uploads 2017 10 Expense Policy Pdf

How To Create An Expense Report Policy Free Template

How To Create An Expense Report Policy Free Template

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Expense Reimbursement Policy Best Practices And 3 Templates

7 Travel Expense Policy Examples Pdf Word Examples

7 Travel Expense Policy Examples Pdf Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples

Free 22 Travel Policy Examples In Pdf Google Docs Pages Word Examples