What Forms Do I Need To File For A Sole Proprietorship In Texas

However there is a requirement to register a trade name or report the use of a fictitious name if using a business name. Report income or loss from a business you operated or a profession you practiced as a sole proprietor.

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Sole proprietors need to file Form 941 Employers Quarterly Federal Tax Return or Form 944 Employers Annual Federal Tax Return for the calendar quarter in which they make final wage payments.

What forms do i need to file for a sole proprietorship in texas. If you are a sole proprietor you or your authorized representative have to file a T1 return if you. Schedule F 1040 or 1040-SR Profit or Loss from Farming. If you have an employee or employees you need to apply for an Employment Identification Number EIN from the IRS.

You do not have to take any formal action to form a sole proprietorship. File an assumed business name. If you are a freelance writer for example you are a sole proprietor.

Firstly theres Form 1040 which is the individual tax return. Secondly theres Schedule C which reports business profit and loss. Choose a business name.

Texas Registered Agent Service. This is where you will input a traditional income. If you add any words to your personal name John Smith Pottery instead of John Smith for instance your business name becomes an assumed name and you must file the appropriate paperwork.

You can apply for an EIN online. If the Sole Proprietor is married and the spouse does not have community property interest in the business you are required to provide a partition agreement or other evidence indicating the spouse does not have community. Determine what tax and other regulatory obligations your sole proprietorship has and take care of any necessary registrations.

And LLC Stock Certificates. Order Texas Corporate Seal. Income is reported on Schedule C which is part of the individual tax return Form 1040.

Texas Unclaimed Money Claim-It-TexasOrg. Sole proprietors who wish to have employees need to obtain an Employer Identification Number or EIN. The form for a sole proprietor.

Form 1040 reports your personal income while Schedule C is where youll record business income. File it with Form 1040 or 1040-SR 1041 1065 or 1065-B. This is a nine digit number issued by the IRS for tax reporting purposes.

Sole proprietors file need to file two forms to pay federal income tax for the year. There are four simple steps you should take. Have to pay tax for the year disposed of a capital property or had a taxable capital gain in the year.

An LLC not only has initial registration and filing fees but also has an annual fee. In fact you may already own one without knowing it. You may apply for an EIN even if you have no employees.

You need to register for a motor fuel permit You already hold one or more other permits with the Department of Revenue Otherwise - Click on the One Stop Business Registration to register your business with multiple agencies including the Department of Financial Institutions and the Department of Workforce Development. A sole proprietorship only needs a DBA and that typically costs 50-100. Foreign Qualification Order Form.

Obtain licenses permits and zoning clearance. All businesses with employees are required to report wages to the IRS using their EIN. Incorporate A Texas Non Profit.

In Texas you can establish a sole proprietorship without filing any legal documents with the Texas state government. Form a Texas Limited Liability Company. Many Texas sole proprietorships use DBAs but state law does not require it.

You can conduct business under your personal name. To file taxes as a sole proprietor you need to complete Profit or Loss From Business Form 1040 Schedule C as part of your individual personal taxes. On top of that taxes can be completed in one of 3 ways which further adds to the confusion.

Also use Schedule C to report wages and expenses you had as a statutory employee. A sole proprietor pays taxes by reporting income or loss on a T1 income tax and benefit return. What form do I use.

They check the box and enter the date final wages were paid on line 17 of Form 941. Sole proprietorships are not required to register the business entity therefore there is no form to complete. As long as you are the only owner this status automatically comes from your business activities.

Order Texas Certificate of Good Standing. Sole proprietorship taxes come in a variety of forms. Report farm income and expenses.

Affidavit Of Sole Proprietorship Fill Out And Sign Printable Pdf Template Signnow

Affidavit Of Sole Proprietorship Fill Out And Sign Printable Pdf Template Signnow

How To Set Up A Sole Proprietorship In Virginia 14 Steps

How To Set Up A Sole Proprietorship In Virginia 14 Steps

How To Set Up A Sole Proprietorship Using A Dba Legalzoom Com

How To Set Up A Sole Proprietorship Using A Dba Legalzoom Com

How To Start A Sole Proprietorship 14 Steps With Pictures

How To Start A Sole Proprietorship 14 Steps With Pictures

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Utah Business Corporate Law Attorney Coulter Law Group Business Tax Business Law Sole Proprietorship

Utah Business Corporate Law Attorney Coulter Law Group Business Tax Business Law Sole Proprietorship

Sole Proprietorship Vs S Corp Truic

Sole Proprietorship Vs S Corp Truic

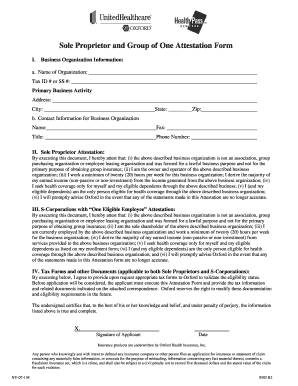

Sole Proprietorship Vs Llc A Truic Small Business Guide

Sole Proprietorship Vs Llc A Truic Small Business Guide

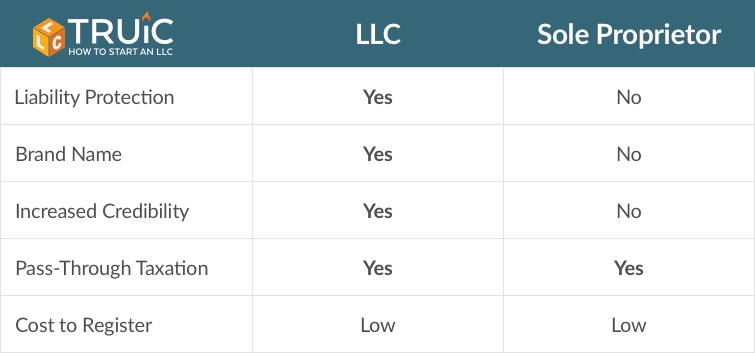

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Can I Operate A Sole Proprietorship Without A Dba In Texas Legalzoom Com

Can I Operate A Sole Proprietorship Without A Dba In Texas Legalzoom Com

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

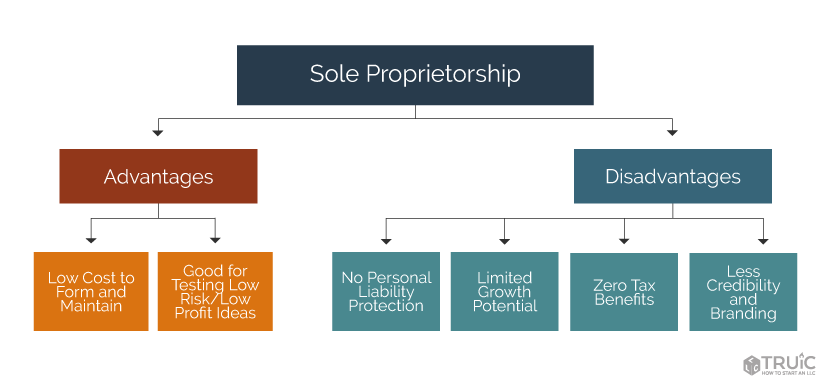

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

How To Set Up A Sole Proprietorship In Texas 13 Steps

How To Set Up A Sole Proprietorship In Texas 13 Steps

Board Of Resolution For Sole Proprietor Fill Online Printable Fillable Blank Pdffiller

Board Of Resolution For Sole Proprietor Fill Online Printable Fillable Blank Pdffiller

Starting A Sole Proprietorship In San Mateo County Sole Proprietorship San Mateo County San Mateo

Starting A Sole Proprietorship In San Mateo County Sole Proprietorship San Mateo County San Mateo

How To Set Up A Sole Proprietorship In Texas 13 Steps

How To Set Up A Sole Proprietorship In Texas 13 Steps

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

How To Set Up A Sole Proprietorship In Texas 13 Steps

How To Set Up A Sole Proprietorship In Texas 13 Steps