Should Llc Companies Get A 1099

Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation. You dont need to report payments for merchandise telegraphs telephone freight storage and other similar items.

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income

In general you dont have to report payments made to corporations including LLCs taxed as corporations but there are some exceptions described above.

Should llc companies get a 1099. If they are a single-member LLC that is not taxed as a corporation they would check the Individualsole proprietor or single-member LLC box. Use form 1099-NEC to report payments to independent contractors. There are two types of LLCs - a single owner LLC called a single-member LLC and a multiple-owner multiple-member LLC.

As a general rule a business is not required to issue a 1099 to a corporation or other entity taxed as a corporation. However if an it is taxed as a partnership the IRS requires it to issue Form 1099-MISC. There are a few narrow exceptions to the rule including medical and health care payments made to a corporation attorneys fees and fish purchased for cash.

If they write P for partnership you issue a 1099-MISC with their EIN on it. They dont have to report payments that were made for personal reasons. But not an LLC thats treated as an S-Corporation or C-Corporation.

In a 2 member LLC being issued 1099-MISC using or EIN and We will both be salaried employees of the LLC how do we file our taxes The business will file its own tax return - a partnership return. However see Reportable payments to corporations later. An LLC that is taxed as a corporation files different forms that replace the use of Form 1099-MISC.

If the LLC has multiple members and is not taxed as a corporation the LLC is taxed as a partnership. If a business buys or rents products or services that amount to more than 600 from one person or LLC during the year it has to file a 1099 for that contractor or vendor. Sole proprietor Do send 1099-MISC.

In addition to that your taxes wont become much more complicated and youll enjoy the limited liability of any other LLC or corporation. If you are 1099 you will pay the same amount of taxes as if you formed a corporation and then paid yourself essentially you are doing this as a 1099 contractor just not formally. Even though an LLC can file an election with the IRS to be taxed like a corporation your business may not be aware of the LLCs current tax status so its usually safer to issue a 1099 to any LLC that you pay more than 600 on an annual basis.

Basically you do not have to issue a 1099 MISC to a LLC that has elected to be taxed as a corporation. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate. You do need to issue the LLC a 1099 MISC.

This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs. The LLC owners are called membersEach member is paid from the business as an owner not as an employee. 1099 contractors need to treat their service as a business.

The limited liability company LLC is a peculiar form of business type and a recent addition to the types of businesses. The IRS uses Form 1099-MISC to keep track of how much money or other benefits the LLC has paid an independent contractor subcontractor or other nonemployee. Who are considered Vendors or Sub-Contractors.

For that you will need TurboTax Business which is not the same as Home and Business. Form 1099-MISC although they may be taxable to the recipient. Filing a 1099-MISC applies only to the rent you pay for business property not your personal.

If taxed as a corporation they would have to enter C or S near the Limited liability company box on line 3 of the W-9. Legally I dont know the answer. If their LLC is taxed as an S- or a C-Corp you do not unless an exception applies as described above.

It makes no difference for tax purposes. Do LLC Companies You Pay Rent to Need to Get 1099 Forms. Payments for which a Form 1099-MISC is not required include all of the following.

1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd. When your total rent payments require a 1099-MISC you will first need to. If the W-9 indicates they are an LLC that is taxed as a sole proprietorship you need to send a 1099.

Heres another way to remember. If you did business with a corporation you typically do not need to send them a Form 1099 MISC even if you did do over 600 in business with them. The majority of small businesses which operate as sole proprietorships partnerships and LLCs require these 1099s if the amounts exceed 600.

And a great way to prove youre contracting work is a business is by forming an LLC. Business owners only have to report payments for services or rent that were earned for business purposes. Otherwise they or their clients could get into trouble.

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Do Owners Of Llc Get 1099 Business Finance

Do Owners Of Llc Get 1099 Business Finance

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Do Brokers Need To Issue A 1099 For Commission Paid To A Llc Berkshirerealtors

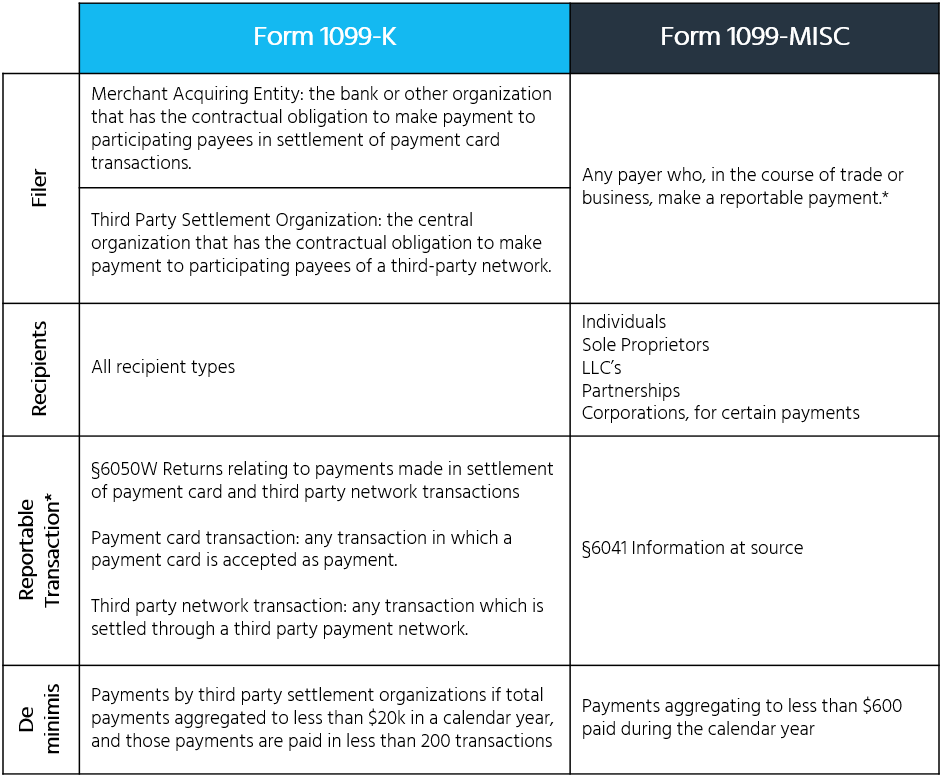

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Do Llcs Get A 1099 During Tax Time Incfile

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

What Does It Mean When You Get A 1099

What Does It Mean When You Get A 1099

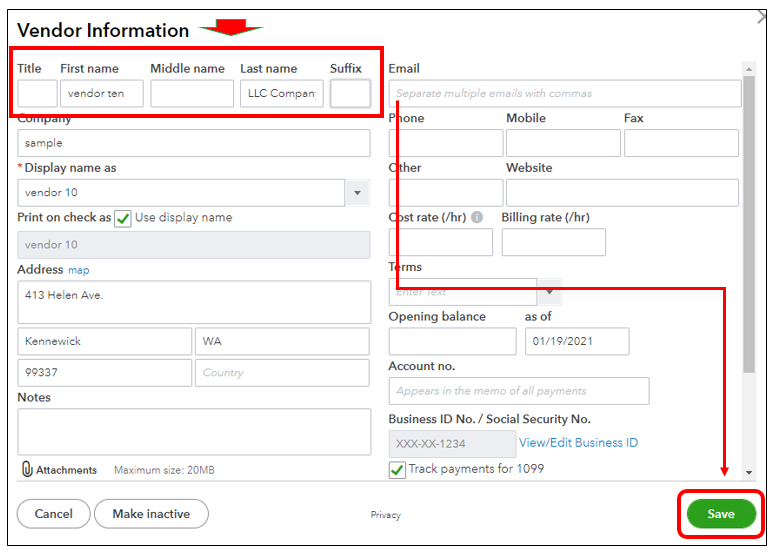

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax