Sba Ppp Loan Application Pdf

Small Business Tax Credit Programs. Gross Receipts Applicant Ownership.

Ppp Small Business Loan Application Sba Downloadable Coronavirus Relief Form Cpa Practice Advisor

The Emergency Capital Investment Programs support the efforts of low- and moderate-income community financial.

Sba ppp loan application pdf. SBA PPP Loan Number. SBA PPP Loan Application Document Checklist Applicant Document Checklist The lender is required to confirm the information presented by the applicant demonstrates the amount of average monthly payroll costs for the year ending December 31 2019. Apply now for a Paycheck Protection Program loan.

2020 Quarter eg 2Q 2020. For eligible payroll costs the applicant must provide documentation supporting the calculated amount. Reduction in Gross Receipts of at Least 25 Applicants for loans of 150000 or less may leave blank but must provide upon or before seeking loan forgiveness or upon SBA request.

PPP Loan Forgiveness Calculation Form. Is the Applicant or any owner of the Applicant presently suspended debarred proposed for debarment declared ineligible. Company and Loan Information of Borrower Business Legal Name must match the name on the PPP Loan Application DBA or Tradename if applicable Business Address Street City State Zip Business TIN EIN SSN Business Phone Primary Contact E-mail Address SBA PPP Loan Number 10 digits assigned by the SBA.

Enter the loan number assigned by SBA at the time of loan approval. Use this form to apply for the Paycheck Protection Program PPP with an eligible lender for a First Draw loan. Paycheck Protection Program PPP Loan Forgiveness Application Form 3508S revised January 19 2021 SBA Form 3508S 0121 Page 2.

The American Rescue Plan extends a number of critical tax benefits particularly the Employee Retention Credit and Paid Leave Credit to small businesses. We support Americas small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan start and grow their business.

Request this number from the Lender if necessary. _____ PPP Loan Amount. Amount of Loan Spent on Payroll Costs.

Paycheck Protection Program Second Draw Loan Borrower Application Form. An SBA-backed loan that helps businesses keep their workforce employed during the COVID-19 crisis. Lender PPP Loan Number.

1st Draw PPP Loan Enrollment Schedule C Navigating to your Dashboard Navigate to the portal with your browser Chrome is the preferred internet browser the application will not work in Internet Explorer If this is your first time applying for a PPP loan click the. Emergency Capital Investment Program. PPP First Draw SBA Loan Number.

Employees at Time of Loan Application. 1 2312023 Business Legal Name Borrower DBA or Tradename if applicable Business Address Business TIN EIN SSN Business Phone - Primary Contact E-mail Address SBA PPP Loan Number. 116- 260 requires borrowers that received First Draw PPP Loans before December 27 2020 to disclose whether a.

Enter the loan number assigned to the PPP loan by the Lender. Enter the disbursed principal amount of the PPP loan the total loan amount you received from the Lender. The Applicant has not and will not receive another loan under the Paycheck Protection Program section 7a36 of the Small Business Act 15 USC.

PPP Loan Forgiveness Application Form 3508EZ OMB Control No. Borrowers are generally eligible for forgiveness for the payroll costs paid and. Reference Quarter eg 2Q 2019.

LOAN INFORMATION SBA PPP Loan Number Date Loan Forgiveness Application Submitted to Lender MMDDYYYY PURPOSE OF THIS FORM DEFINITIONS. The Economic Aid to Hard-Hit Small Businesses Nonprofits and Venues Act Pub. _____ Lender PPP Loan Number.

All SBA loan proceeds will be used only for business-related purposes as specified in the loan application and consistent with the Paycheck Protection Program Rule. Link and fill in. SBA Form 2483 321 2 If questions 1 2 5 or 6 are answered Yes the loan will not be approved.

This form is to be completed by the authorized representative of the applicant and submitted to your SBA. Paycheck Protection Program First Draw Borrower Application Form for Schedule C Filers Using Gross Income. Question Yes No 1.

636a36 this does not include Paycheck Protection Program second draw loans section 7a37 of the Small Business Act 15 USC. To the extent feasible I will purchase only American-made equipment and products.

Common Loan Forgiveness Application Errors Coasthills Credit Union

How To Fill Out The Ppp First Draw Application Form Tom Copeland S Taking Care Of Business

Sba Ppp Forgiveness Fresno First Bank

Fill Sba Paycheck Protection Program Ppp Form Sba 2484 Bot Store

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Pin On Jerrybanfield Com Blog Posts

Ppp Loan Forgiveness Assistance Tarlow Cpas

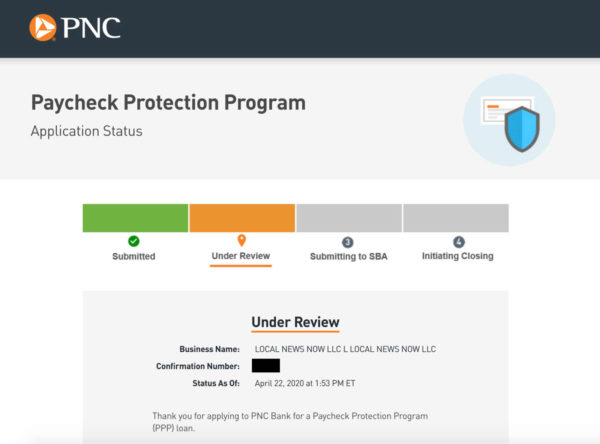

Arlnow S Experience Applying For A Paycheck Protection Program Loan Arlnow Com

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Ppp Small Business Loan Application Sba Downloadable Coronavirus Relief Form Cpa Practice Advisor

Ppp Loan Forgiveness Application Updated 6 16 2020 C Brian Streig Cpa

Get Our Sample Of Employee Payroll Register Template For Free Payroll Template Payroll Spreadsheet Template

2018 2021 Form Sba 1244 Fill Online Printable Fillable Blank Pdffiller

Ppp Loan Forgiveness Scry Analytics

Ppp Loan Forgiveness Application Step By Step Guide To Get 100 Ppp Loan Forgiveness Youtube