How Much Business Expenses Can I Claim Without Receipts

All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts. In most cases in order to claim the VAT from a purchase you need a VAT specific invoice or receipt.

Tax Deductions For Your Online Business Expenses

Tax Deductions For Your Online Business Expenses

Jun 28 2018 To claim for this purchase as a business expense keep a thorough record including information about the item who you bought it from and how much it cost.

How much business expenses can i claim without receipts. Political party and independent candidate donations. You can also claim for any dry-cleaning fees youve incurred to keep work-related clothing clean. Small business expenses of 10 or less as long as the total of these expenses does not exceed 200 If you were unable to acquire written documentation eg.

Jan 01 2017 The maximum amount you can claim for food beverages and entertainment expenses is 50 of the lesser of the following amounts. Can I claim it as an expense. However with no receipts its your word against theirs.

The amount you incurred for the expenses an amount that is reasonable in the circumstances These limits also apply to the cost of your meals when you travel or go to a convention conference or similar event. May 13 2015 Evidence recorded by you without a receipt is only acceptable for. This includes the cost of buying branded uniforms protective gear such as boots or sunglasses and high-visibility clothing.

The expense must have been for your business not for private use. May 16 2018 You can claim up to 150 each year on clothing you buy for work. This could boost your tax refund considerably.

Expenses can potentially be claimed if they are not receipted but they must be genuine business expenses which you have actually incurred. If the expense is for a mix of business and private use you can only claim the portion that is used for your business. If your home is 100 square metres and your working space is 10 square metres 10 of the total area you can claim 10 of expenses that are not solely.

Chances are you are eligible to claim more than 300. If your expense is less than 75 you do not have to keep the receipt. For example if you buy a laptop and you only use it for your business you can claim a deduction for the full purchase price.

However if the item is under 25 you can often claim back the VAT without any need for the receipt. To claim contributions of more than 10 you need a receipt. You may not have to keep receipts for business-related food expenses.

Is a few to several hundred dollars receipt or not. However if youre traveling and claiming food and other nonlodging incidentals you. Anything over 1000 and I would definitely want to have a receipt.

You must have records to prove it. Jun 07 2019 Realistically if youre randomly audited youre not going to have any problems if the value of all of your donated items at a place such as Goodwill etc. VAT claimed on items under 25.

Any items valued over 150 and youll need a receipt. Uniforms and Clothes 150 Laundry. Mar 07 2019 Generally speaking you should have a receipt for every expense if youre self-employed and itemize deductions.

Without the evidence from receipts for your claimed business expenses the Canada Revenue Agency CRA may decide to reduce the number of expenses you have deducted. However if its a home office only a portion of the Internet can. However if you use the laptop 50 of the time for your business and 50 of the time for private use you can only claim 50 of the amount.

If you made donations of 2 or more to bucket collections for example to collections conducted by an approved organisation for natural disaster victims you can claim a tax deduction for gifts up to 10 without a receipt. For example you may travel on a tube and be. May 15 2017 If your total expense claims total less than 300 the provision of receipts is not required at all.

How much can I claim with no receipts. HMRC rules state that expenses can be claimed provided they are wholly and exclusively for the purposes of your contract. Valid expense claims and receipts.

Jan 03 2020 Generally you cant make tax claims without receipts. It can be claimed 100 at your principal place of business. The ATO generally says that if you have no receipts at all but you did buy work-related items then you can claim them up to a maximum value of 300.

There are however a range of claims for eligible work related expenses that can be made without the need for receipts.

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Tax Deductions Small Business Tax Tax Prep Checklist

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Tax Deductions Small Business Tax Tax Prep Checklist

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Schedul Small Business Bookkeeping Business Expense Small Business Planner

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Schedul Small Business Bookkeeping Business Expense Small Business Planner

Keep Track Of Your Business Expenses With This Download Techrepublic

Keep Track Of Your Business Expenses With This Download Techrepublic

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Small Business Tax Business Tax Business Tax Deductions

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Small Business Tax Business Tax Business Tax Deductions

Expense Printable Forms Worksheets Expenses Printable Spreadsheet Business Business Expense

Expense Printable Forms Worksheets Expenses Printable Spreadsheet Business Business Expense

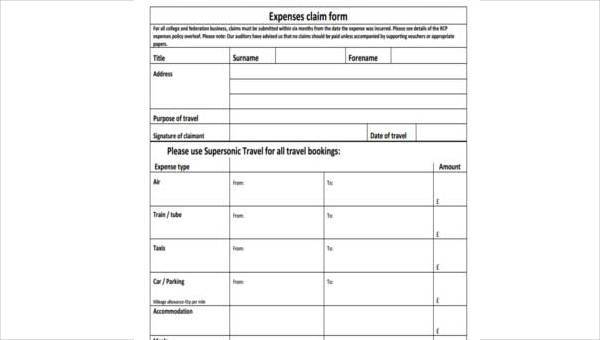

Expense Claim Form Template Double Entry Bookkeeping

Expense Claim Form Template Double Entry Bookkeeping

Free 7 Sample Business Expense Claim Forms In Pdf Ms Word

Free 7 Sample Business Expense Claim Forms In Pdf Ms Word

Writing Off Business Expenses With Schedule C Ride Free Fearless Money

Writing Off Business Expenses With Schedule C Ride Free Fearless Money

Form 2106 Instructions Information On Irs Form 2106

Form 2106 Instructions Information On Irs Form 2106

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Home Business Tax Deductions Are Just One Reason Of Many That A Home Based Business Is So Attractive Small Business Tax Business Tax Deductions Business Tax

Home Business Tax Deductions Are Just One Reason Of Many That A Home Based Business Is So Attractive Small Business Tax Business Tax Deductions Business Tax

Home Office Expense Costs That Reduce Your Taxes Home Office Expenses Work From Home Business Business Expense

Home Office Expense Costs That Reduce Your Taxes Home Office Expenses Work From Home Business Business Expense

Download A Free Business Expense Reimbursement Form For Excel Give Your Employees A Simple Way To Submit Reimburs Expense Sheet Templates Spreadsheet Template

Download A Free Business Expense Reimbursement Form For Excel Give Your Employees A Simple Way To Submit Reimburs Expense Sheet Templates Spreadsheet Template

Free Business Expense Spreadsheet Small Business Tax Deductions Small Business Tax Business Tax Deductions

Free Business Expense Spreadsheet Small Business Tax Deductions Small Business Tax Business Tax Deductions

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Tax Printables Receipt Organization Tax Deductions

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions All About Planners Tax Printables Receipt Organization Tax Deductions