How Do Small Business Loans Work Coronavirus

Heres everything you need to. Small business owners in all US.

Rescuing Small Businesses To Fight The Coronavirus Recession And Prevent Further Economic Inequality In The United States Equitable Growth

Rescuing Small Businesses To Fight The Coronavirus Recession And Prevent Further Economic Inequality In The United States Equitable Growth

Build Your Personal and Business Credit Scores.

How do small business loans work coronavirus. If you follow the guidelines your loan may be forgiven. Paycheck Protection Program PPP The Paycheck Protection Program PPP offers loans to help small businesses and non-profits keep their workers employed. Coronavirus Small Business Loan Application Process Heres how small businesses can apply for an EIDL.

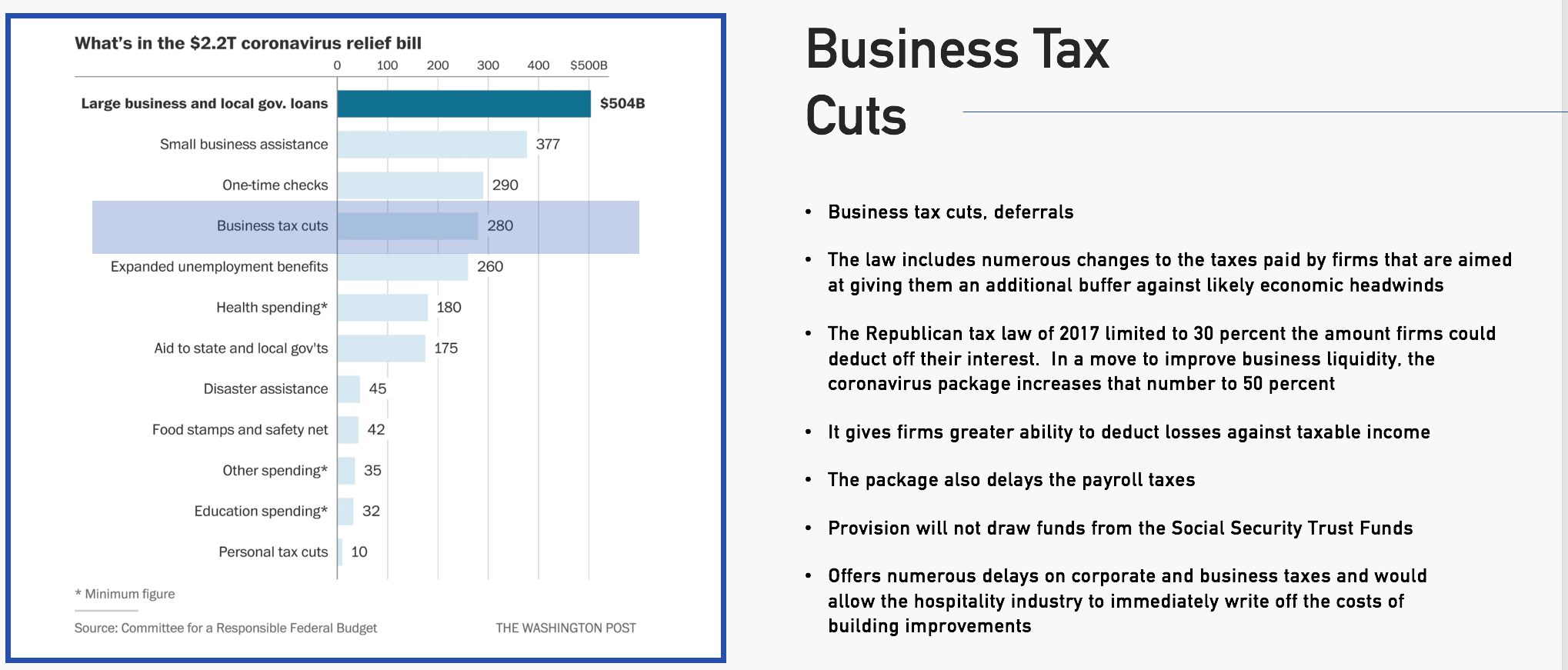

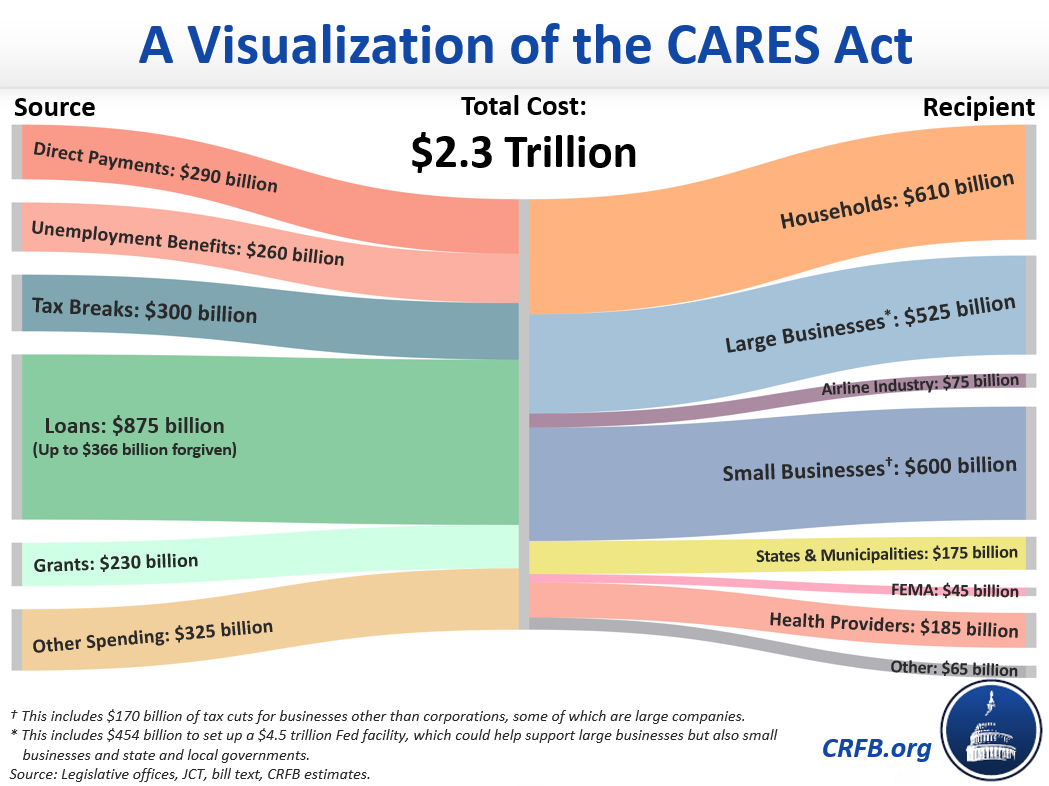

The Paycheck Protection Program PPP offers loans to help small businesses and non-profits keep their workers employed. The process of qualifying for a small business loan involves several steps that well outline below. With the Coronavirus Aid Relief and Economic Security CARES Act being signed into law in late March the government approved 350 billion in forgivable loans that could be obtained by small businesses including 1099 earners.

Just about every lendercredit card companies mortgage lenders student loan servicers and othershas been offering some sort of assistance. In response the federal government has created and expanded several assistance programs for certain impacted businesses including a paycheck protection program PPP. Small businesses that export directly overseas or those that export indirectly by selling to a customer who then exports their products.

COVID-19 Economic Injury Disaster Loan. Businesses pay an interest. Lenders that offer small business loans will take a look at your personal credit score to help them determine whether they should lend you money.

The PPP authorizes up to. COVID-19 Small Business Loans and Assistance. Through the Coronavirus Relief Fund the CARES Act provides for payments to State Local and Tribal governments navigating the impact of.

SBA provides an array of trade tools and export finance programs to help small businesses increase international sales and respond to opportunities and challenges associated with trade such as COVID-19. NFIB Research found that three-quarters of small business owners have applied for loans due to the negative impact of the COVID-19 outbreak. States territories and Washington DC are currently eligible to apply for a low-interest loan of up to 2 million due to COVID-19.

And if your business has gotten its first PPP loan draw it may be eligible for a second draw. Those affected can describe their losses Eligible small businesses must complete an Economic Injury Worksheets detailing the economic losses they have suffered due to the coronavirus. The interest rate for PPP loans are 1.

The Coronavirus Small Business Loan Program. This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue. The American Rescue Plan provides 10 billion to state and Tribal governments to fund small business credit expansion initiatives.

Small-business owners independent contractors sole proprietors and others who are eligible can start applying for loans through the Small Business Administrations Paycheck Protection Program and the expanded Economic Injury Disaster Loan Program which are part of the 2 trillion coronavirus stimulus package signed into law last week. Small Business Loans for COVID-19 The coronavirus of 2019 COVID-19 has caused unprecedented disruption for small businesses in the United States. The loans can be used for.

Coronavirus Small Business Relief Programs Paycheck Protection Program PPP Loans The PPP loans small businesses 25 times their average monthly payroll costs excluding pay in excess of 100000 per employee up to 10 million. The Small Business Administration SBA offers programs that can help your business if its been affected by the coronavirus pandemic. The Small Business Administration issued new guidance Tuesday on how firms with fewer than 500 employees can secure fully forgivable federal loans.

What You Need To Know Congress has made 349 billion available in loans to small businesses much of. The EIDL program provides working capital to small businesses via low-interest loans in amounts of up to 2 million. The following loans are available to US.

The forgivable loans aim to incentivize small businesses to maintain their head count and payroll.

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Frequently Asked Questions On Small Business Loans In Coronavirus Relief Cares Act

Frequently Asked Questions On Small Business Loans In Coronavirus Relief Cares Act

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Top Ppp Loan Lenders Updated Approved Banks Providers

Millions Of Small Businesses May Struggle To Tap Emergency Sba Loans

Millions Of Small Businesses May Struggle To Tap Emergency Sba Loans

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Not So Small Businesses Continue To Benefit From Ppp Loans Npr

Not So Small Businesses Continue To Benefit From Ppp Loans Npr

Big Concerns About Small Business Loan Pitches Federal Trade Commission

Big Concerns About Small Business Loan Pitches Federal Trade Commission

Paycheck Protection Program How It Works Funding Circle

Paycheck Protection Program How It Works Funding Circle

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 15 2020 10am Pdf

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Sba Official Common Mistakes Small Businesses Make Applying For Loans

Sba Official Common Mistakes Small Businesses Make Applying For Loans

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

Small Business Loans Ppp Site Crashes On First Day Of Reopening Coronavirus Updates Npr

Small Business Loans Ppp Site Crashes On First Day Of Reopening Coronavirus Updates Npr

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

:max_bytes(150000):strip_icc()/smallbusinessadministration_AP090602023294-834c0e1acade4e8c94da93ca26d279b2.jpg) How Sba Loans Can Help Your Small Business

How Sba Loans Can Help Your Small Business

New Data Shows Small Businesses In Communities Of Color Had Unequal Access To Federal Covid 19 Relief

New Data Shows Small Businesses In Communities Of Color Had Unequal Access To Federal Covid 19 Relief

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Banks Took Billions In Fees To Process Small Business Loans Amid Pandemic Crisis Npr

Banks Took Billions In Fees To Process Small Business Loans Amid Pandemic Crisis Npr