How Do I Get My 1099-g Form Virginia

Get Your 1099 Form Now Electronically To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link. Virginia How do I obtain my 1099-G form for receiving unemployment in 2020.

Michigan 1099 G Form 2017 Vincegray2014

Michigan 1099 G Form 2017 Vincegray2014

Once there you may be able to sign in to your account and view it or request another one be sent to you.

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

How do i get my 1099-g form virginia. To access this form please follow these instructions. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. Select the appropriate year and click View 1099G.

If you cant download your 1099-G online or you have technical issues with it contact your states Department of Revenue. This is the fastest option to get your form. Box 26441 Richmond VA 23261-6441.

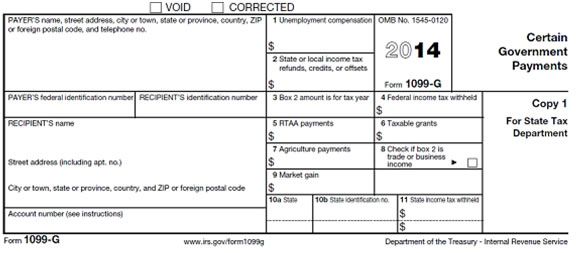

Form 1099G1099INT Now Available Online. Request Your 1099 By Phone. The Internal Revenue Service IRS requires government agencies to report certain payments made during the year because these payments or refunds may be considered taxable income for the recipients.

You may download a copy of your current IRS Form 1099-G through your online account at desncgov at no charge. By providing your information below you consent to receive your 1099G information electronically. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. Any advice would be appreciated. This 1099-G does not include any information on unemployment benefits received last year.

If you do not have an online account with NYSDOL you may call. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. All individual income taxpayers now have access to Form 1099G1099INT electronically.

Written requests for a hard copy of your 1099-G form from 2018 2019 2020 or 2021 may be. View solution in original post 0. If you are not sure exactly where just type 1099G then your state in google for example - you may find an option to retrieve 1099-g online.

Get Your 1099 Form Now Electronically To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link. Some states only issue the form by mail so youll have to request it and wait for it to arrive if you never received a copy. Your adjusted gross income Line 1 If you filed a part-year return add together the amounts from both columns Line 1.

You can download Form 4506-T at IRSgov or order it from 800-TAX-FORM. If youve lost or cant find your 1099-G select your state below to go to your local unemployment website. Virginia Relay call 711 or 800-828-1120.

If its convenient consider stopping by the state unemployment office. You may choose one of the two methods below to get your 1099-G tax form. Please provide one of.

To look up your Form 1099-G1099-INT online youll need the following information from your most recently filed Virginia tax return. It doesnt look like the new unemployment website has it. The Form 1099G is a report of the income you received from the Virginia Department of Taxation.

Request Your 1099 By Phone. If you cannot access your 1099-G form you may need to reset your password within IDESs secure website. You can also use Form 4506-T to request a copy of your previous years 1099-G.

1099-Gs for years from 2018 forward are available through your online account. You can view or print your forms for the past seven years. Im trying to file my taxes and have no idea where to get it.

If you filed a part-year return add together. If you received a 1099-G from the Virginia Employment Commission for the tax year 2020 and want to request a corrected form 1099-G be sent to you and the IRS you will need to submit your request in writing to the address listed below. This new service is available through the VATAX 1099G Lookup application at httpswwwindividualtaxvirginiagov1099Gloginjsf.

Mail the completed form to the IRS office that processes returns for your area. If the payment reported on the 1099-G somehow relates to a business you are running then yes. This is the fastest option to get your form.

If your responses are verified you will be able to view your 1099-G form. However most state governments offer to access the form online on the unemployment benefits website. To look up your 1099GINT youll need your adjusted gross income from your most recently filed Virginia income tax return Line 1 or the sum of both columns of Line 1 for a part-year return.

But the most common use of Form 1099-G is to report state tax refunds or unemployment compensation. How to Get Your 1099-G online.

Unemployment Fraud Causes Issues With 1099 G Forms For Kansans

Unemployment Fraud Causes Issues With 1099 G Forms For Kansans

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 G Form Copy B Recipient Discount Tax Forms

1099 G Form Copy B Recipient Discount Tax Forms

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Income Ta Tax Forms The Secret Book Payroll Checks

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Income Ta Tax Forms The Secret Book Payroll Checks

Unemployment 1099 G Form Page 1 Line 17qq Com

Unemployment 1099 G Form Page 1 Line 17qq Com

Check Out This Overview Of 2020 Income Tax Documents And Common Mistakes To Help You Betaxprepsmart Federal Income Tax Tax Refund Money Smart Week

Check Out This Overview Of 2020 Income Tax Documents And Common Mistakes To Help You Betaxprepsmart Federal Income Tax Tax Refund Money Smart Week

1099 G Form Copy C State Discount Tax Forms

1099 G Form Copy C State Discount Tax Forms

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

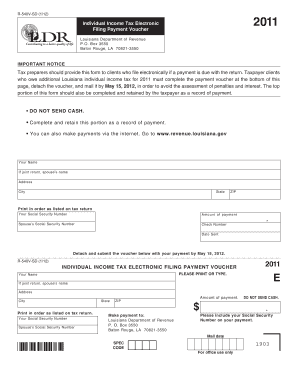

1099 G Louisiana Fill Online Printable Fillable Blank Pdffiller

1099 G Louisiana Fill Online Printable Fillable Blank Pdffiller

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Wv Tax Department No Longer Sending 1099s Business Wvgazettemail Com

Wv Tax Department No Longer Sending 1099s Business Wvgazettemail Com

W2 G Copy B Winner Federal Discount Tax Forms

W2 G Copy B Winner Federal Discount Tax Forms

How To Avoid An Irs Audit Debt Relief Programs Irs Credit Card Relief

How To Avoid An Irs Audit Debt Relief Programs Irs Credit Card Relief

Explore Our Sample Of Direct Deposit Sign Up Form Social Security For Free Social Security Certificate Of Deposit Deposit

Explore Our Sample Of Direct Deposit Sign Up Form Social Security For Free Social Security Certificate Of Deposit Deposit

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition