Former Employer Refuses To Send W2

Q How do I get a copy of my W-2 when my former employer refuses to send me one. A 1 If the employer does not comply the first step is to contact the IRS and report the issue to them.

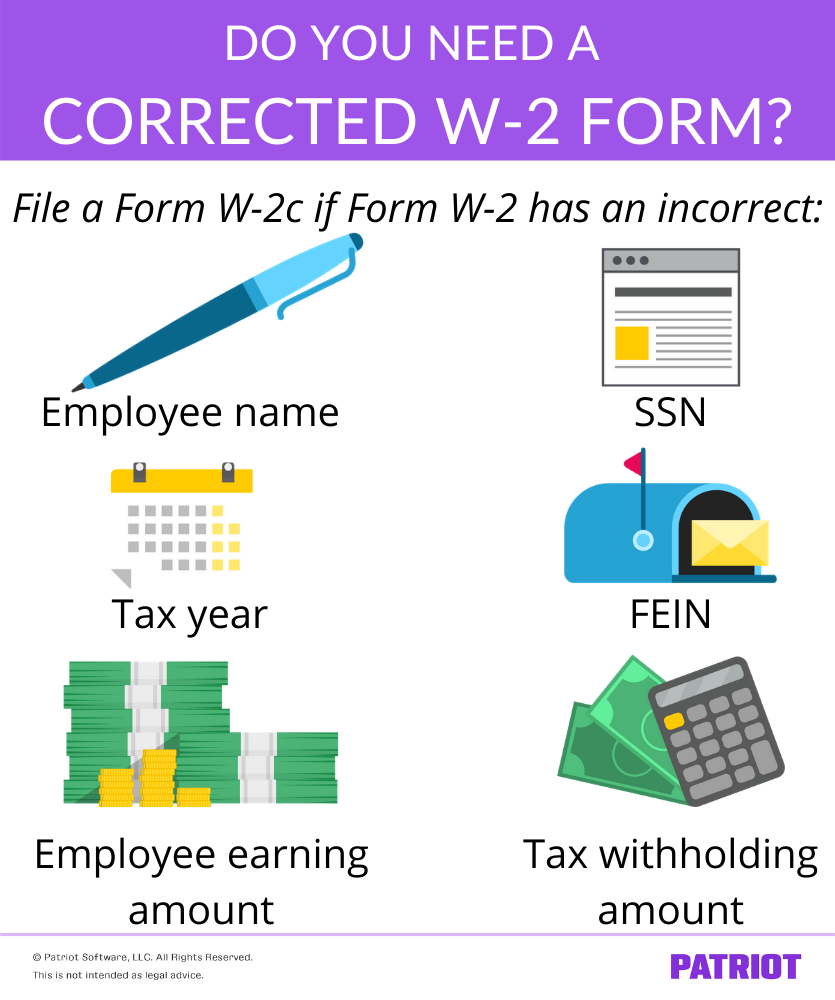

How To Correct A W 2 Form Irs Form W 2c Instructions

How To Correct A W 2 Form Irs Form W 2c Instructions

Ask your employer or former employer for a copy.

Former employer refuses to send w2. If the employee is unable to secure a W-2 from the employer the employee should complete and attach Form 4852 Substitute for W-2 to their tax return using the best information available to calculate the wages and the withholding. If you are unable to get a copy from your employer you may call the IRS at 800-829-1040 after Feb. Call the IRS If you do not receive the missing or corrected W-2 form by the end of February from your employer you may call the IRS at 800-829-1040 and ask for assistance.

The IRS will send your former employer a letter requesting that they furnish you a W-2 within ten days. The sealed envelope with its postmark serves as proof that you attempted to send the Form W-2 on time. Contact the IRS for help if your W-2 is obviously and significantly wrong and you suspect dishonesty on the part of your employer or simply cant get the company to cooperate.

Tell your employer to send you the W-2 by the end of February at the latest. If youre unable to get your Form W-2 from your employer contact the Internal Revenue Service at 800-TAX-1040. Your name address Social Security number and phone number.

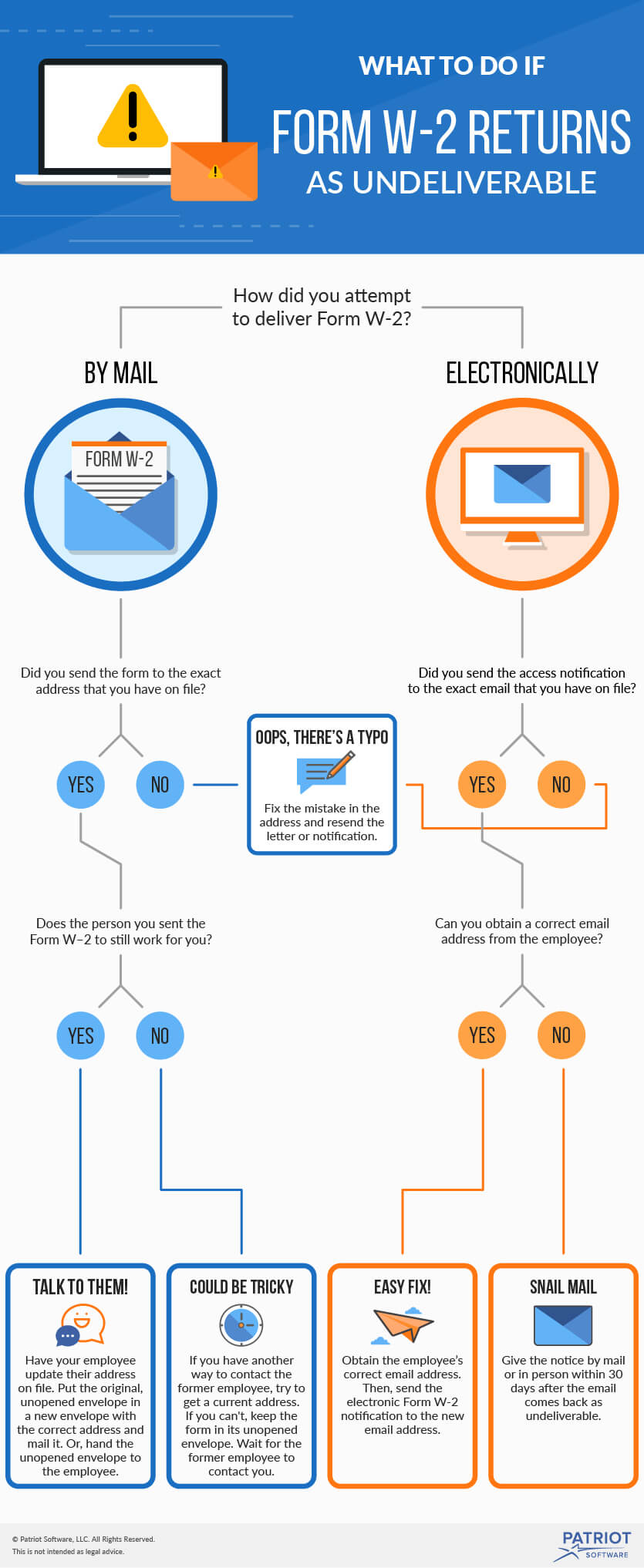

Returned W-2 Forms. Form W -2 Wage and Tax Statement to file an accurate federal tax return. Tell your employer that the IRS will fine her for not issuing the W-2 on time.

If my former employer refuses to send my w2 what can I do. Also what you do depends on if the worker is a current or former employee. Make sure they have your correct address.

Be sure they have your correct address. 31 the fine is 15. The IRS will send you a letter with instructions and Form 4852 Substitute for Form W-2 Wage and Tax Statement or Form 1099-R Distributions from Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc.

If you havent received your form by mid-February heres what you should do. If your employer refuses to give you your W-2 let her know that the IRS requires her to issue it to you by Jan. It advises the company of their responsibilities to provide an error free W-2 to any persons employed during.

If necessary ask for a new copy. The IRS will also send you a Form 4852 Substitute for Form W-2 Wage and Tax Statement or Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc along with a letter containing instructions. The IRS will investigate the matter directly.

The IRS will send a letter to your employer for you and request the missing W-2. The IRS will send a letter to your employer on your behalf. Make a copy of the envelope and keep the copy in your.

If your former employer does not act on your request for following up on your W-2 or you are unable to reach them then it is time to reach out to the IRS. Under federal law employers must send employees their prior years W-2 statement by Jan. If one of the forms is returned to you as undeliverable do not open the envelope.

You can mail paper copies of Form W-2 to employees. The IRS will send your employer a letter requesting that they furnish you a corrected Form W-2 within ten days. If you have not received your W2 at this point and have made an effort you will need to use your paystubs to complete a substitute W2.

If your former employer is bankrupt you can contact the bankruptcy attorney to obtain your W-2 or contact the state for limited wage information suggests the State of California Franchise Tax Board. The IRS will contact the employerpayer for you and request the missing or corrected form. The phone number for this is 1-800-829-1040.

31 so employees can use the information to. You can call toll-free at 1-800. That increases to 30 if its more than 30 days late or 50 if.

You will explain to the IRS that your former employer refused. Call the Internal Revenue Service at 800-829-1040. You can use the Form 4852 in the event that.

Employers name address and phone number. This information can often be secured from pay stubs. If you do not have your W-2 by early February call your previous employer to verify your address and ask what date the employer sent your W-2.

Provide the IRS with. If your employer hasnt sent you the form yet contact them and ask for a copy. As they are required to provide threaten them with this before you file.

What Employers Need To Know About W 2s And W 3s Resourcing Edge

What Employers Need To Know About W 2s And W 3s Resourcing Edge

How To Correct A W 2 Form Irs Form W 2c Instructions

How To Correct A W 2 Form Irs Form W 2c Instructions

Wage Tax Statement Form W 2 What Is It Do You Need It

Wage Tax Statement Form W 2 What Is It Do You Need It

What Are The Penalties To Employers For Late W 2s

What Are The Penalties To Employers For Late W 2s

Form W 2 Returned To Employer Follow These Steps

Form W 2 Returned To Employer Follow These Steps

How To Get Your W2 Form Online For Free 2020 2021

How To Get Your W2 Form Online For Free 2020 2021

Didn T Get Your W2 Here S What To Do Now The Motley Fool

Didn T Get Your W2 Here S What To Do Now The Motley Fool

Wage Tax Statement Form W 2 What Is It Do You Need It

Wage Tax Statement Form W 2 What Is It Do You Need It

How To Get Your W2 Form Online For Free 2020 2021

How To Get Your W2 Form Online For Free 2020 2021

Is Your Employer Legally Obligated To Give You Your W2 Form Quora

When To Switch Employees From A W2 To A 1099

When To Switch Employees From A W2 To A 1099

3 Steps To Take If You Re Missing A W2 And You Want To File Taxes

3 Steps To Take If You Re Missing A W2 And You Want To File Taxes

Understanding Your Tax Forms 2017 Form W 2 Wage And Tax Statement

Understanding Your Tax Forms 2017 Form W 2 Wage And Tax Statement

W 2 Deadline Penalties Extension For 2020 2021 Checkmark Blog

W 2 Deadline Penalties Extension For 2020 2021 Checkmark Blog

Replacing A Missing W 2 Form H R Block

Replacing A Missing W 2 Form H R Block

Wage Tax Statement Form W 2 What Is It Do You Need It

Wage Tax Statement Form W 2 What Is It Do You Need It

Editable 1099 Form 2016 Beautiful Irs Fillable Tax Forms 2016 Models Form Ideas Tax Forms Employee Tax Forms Irs Forms

Editable 1099 Form 2016 Beautiful Irs Fillable Tax Forms 2016 Models Form Ideas Tax Forms Employee Tax Forms Irs Forms