Covid 19 Business Loan Td Canada Trust

Lets find a solution together. Customers who open a TD Basic Business Plan and switch to a TD Business Every Day A B or C plan will be eligible and have 90.

The EDC BCAP includes.

Covid 19 business loan td canada trust. CERS Canada Emergency Rent Subsidy Open Rent and mortgage support for qualifying organizations affected by COVID19. TORONTO April 3 2020 CNW - In response to COVID-19 TD has made unprecedented efforts to support Canadians during this difficult period providing deferrals credit relief and other solutions to tens of thousands of Canadians in financial need. These actions will likely save many Canadian businesses at least short term.

Also Prime Minister Trudeau has announced assistance with commercial rent for businesses that are struggling. The Canada Emergency Business Account CEBA provides interest-free partially forgivable loans of up to 60000 to small businesses and not-for-profits that have experienced diminished revenues due to COVID-19 but face ongoing non-deferrable costs such as rent utilities insurance taxes and wages. With flexible payment options depending on your business needs TD small business loans can support your purchases and upgrade your small business assets.

A 40000 interest-free until December 31 2022 government guaranteed loan to help businesses pay for operating costs that are not able to be deferred as a. He has made it easier for Canadian businesses to qualify for the 40000 COVID-19 business loan. Trudeau continues to earn my admiration.

Open Low-interest loans to cover operational needs for hardhit businesses. Export Development Canadas Business Credit Availability Program BCAP offers eligible customers with credit financing to help sustain operations impacted by COVID-19. The CEBA loan through TD includes.

Effective immediately Bank of Montreal CIBC National Bank of Canada RBC Royal Bank Scotiabank and TD Bank have made a commitment to work with personal and small business banking customers on a. Please note that by deferring loan payments your term and amortization will be extended and deferred payments will be payable at the end of the term with accrued interest. Apply for a CEBA Loan Once you receive confirmation of account opening you may apply for a CEBA loan with TD here If you would like to switch the business banking account plan after your account is open please call the Small Business Advice Centre at 1-800-450-7318.

Consumer Loans with TD Auto Finance. Canada Emergency Business Account CEBA interest-free loans. CEWS Canada Emergency Wage Subsidy Open Help for businesses to keep or rehire employees.

75 to 80 of the loan guaranteed by the Federal Government through the EDC dependent on financing amount. TORONTO March 17 2020 CNW - Canadas six largest banks today announced plans to provide financial relief to Canadians impacted by the economic consequences of COVID-19. Visit TD Canada Trust today to learn more.

Financially impacted by COVID-19. Loans are guaranteed by the Government of Canada up to 85 of the amount borrowed to assist with financing expanding or modernizing your business. Request a payment deferral of up to the equivalent of two monthly payments for loans financed by TD Auto Finance through a dealership.

Starting on Friday December 4 2020 eligible businesses facing financial hardship as a result of the COVID-19 pandemic are able to access a second CEBA loan. Get answers to your questions regarding banking during COVID-19 including topics such as mortgage deferral payments loan payment extensions branch hours and more. Businesses can qualify for loans up to 40000 to help cover operating costs.

The TD logo and other trade-marks are the property of The Toronto-Dominion Bank. As a Prime Minister Mr. Read helpful FAQs from TD Canada Trust.

The Canada Emergency Business Account CEBA was created to help small businesses who are financially struggling because of COVID-19. Since the spring the Canada Emergency Business Account has helped almost 800000 small businesses and not-for-profits in Canada. Some things to consider when reviewing your financial goals in the age of COVID-19 Whether youre actively saving managing changes in your expenses or have had changes to your overall economic situation there are a few things to consider when reviewing your financial goals.

The CEBA loan through TD includes. Today the Deputy Prime Minister and Minister of Finance the Honourable Chrystia Freeland announced the expansion of the Canadian Emergency Business Account CEBA. An operating credit of up to CAD 80 million.

You can apply for a CEBA loan through the financial institution where your primary Business Operating Account is held. 10000 25 of the 40000 loan is eligible for complete forgiveness if 30000 is fully repaid on or before December 31 2022. A 40000 interest-free until December 31 2022 government guaranteed loan to help businesses pay for operating costs that are not able to be deferred as a result of COVID-19.

All trade-marks are the property of their respective owners. Agriculture Borrowing Solutions Several options for agricultural operations to cover everyday expenses or finance major purchases. BCAP Business Credit Availability Program Open Credit.

/cloudfront-us-east-1.images.arcpublishing.com/tgam/BIFZHIPKFVOU5NAHJPHN52HZYQ.jpg) Td And Cibc Cap Three Days Of Dismal Forecasts Of Economic Impact Of Covid 19 The Globe And Mail

Td And Cibc Cap Three Days Of Dismal Forecasts Of Economic Impact Of Covid 19 The Globe And Mail

Td Canada Trust And Planning For Parental Leave The Urban Daddy

Td Canada Trust And Planning For Parental Leave The Urban Daddy

Https Www Td Com Ca En Business Banking Documents Pdf Final Ceba Loan Agreementv7 Pdf

Td Canada Trust Financial Literacy

Td Canada Trust Financial Literacy

Online And Digital Banking Covid 19 Coronavirus Td Canada Trust

Online And Digital Banking Covid 19 Coronavirus Td Canada Trust

Td Expects Bigger Losses From Loans In Canada Than In The U S Bnn Bloomberg

Td Canada Trust Bank In Vancouver

Td Canada Trust Bank In Vancouver

Td Enhances Credit Card Travel Insurance Coverage For Cardholders Greedyrates

Td Enhances Credit Card Travel Insurance Coverage For Cardholders Greedyrates

Benefits Of Working At Td Td Canada Trust

Benefits Of Working At Td Td Canada Trust

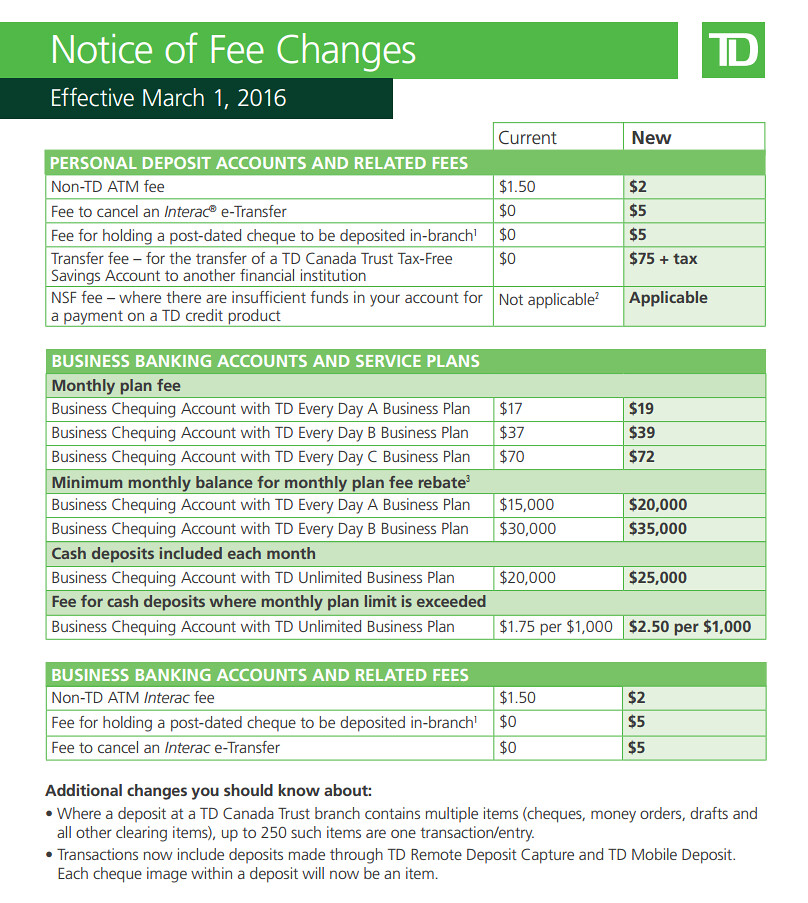

The Bullshitiest Of The Td Canada Trust Fee Increases

The Bullshitiest Of The Td Canada Trust Fee Increases

Ceba Loan Application Available April 9th At Td Apr 8 2020

Online Canada Revenue Agency Cra Direct Deposit Enrollment

Online Canada Revenue Agency Cra Direct Deposit Enrollment

Td Canada Trust Small Business Our Small Business Banking Commitment

Td Canada Trust Small Business Our Small Business Banking Commitment