Can An Agent Register A Client For Vat Online

When you receive your VAT number from HMRC you can sign up for a VAT online. You can appoint an accountant or agent to submit your VAT Returns and deal with HMRC on your behalf.

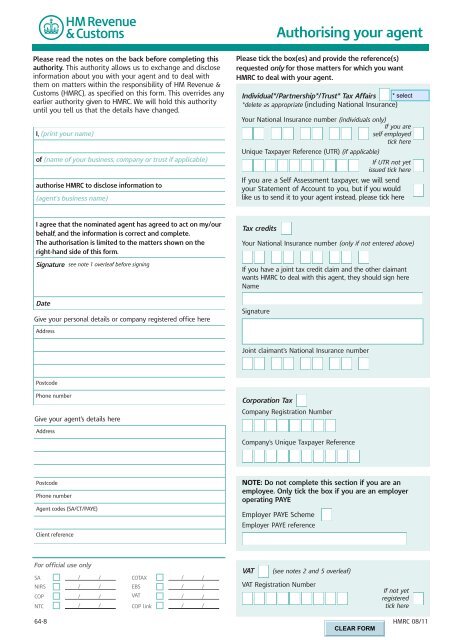

Form 64 8 Authorising Your Agent Hm Revenue Customs

Form 64 8 Authorising Your Agent Hm Revenue Customs

You and your client can set up the authorisation securely online.

Can an agent register a client for vat online. Select Appoint an Agent. The hmrc site then generates a user ID and you create a password. On the agent services homepage click Allow this account to access existing client relationships.

Click Start now enter the old Government Gateway credentials that you previously used to submit VAT on behalf of your clients then click Sign in. One thing worth noting is it can take around a month or even longer to process a VAT application. Once they have their VAT number go back into Agent account and authorise client for VAT.

If you do not have a user ID you can create one when you register. In order to file VAT online for your clients using HMRC new Making Tax Digital for VAT also here shortened to MVD as in Making VAT Digital tax agents have to set up a new online account with HMRC. This is a straightforward process though and is done on the HMRC website when registering online.

An organisation can only VAT register and recover VAT if they make VATable supplies and the VAT that they seek to recover is incurred for the purposes of making VATable supplies. Youll need a Government Gateway user ID and password. Effective date of registration.

The system will then ask for the Agents Gateway Agent ID. You can appoint a VAT agent using VAT online services. Then go onto the government gateway site and log in with the user id generated by hmrc.

1An agent services account - this is different to your HMRC online services for. Follow the procedure and you can register the partnership for VAT. A legal adviser or solicitor can also help with issues like Inheritance Tax and taxes on buying and selling property.

Cancelde-register clients under various tax types Income Tax VAT Employers PAYEPRSI CAT RCT and E-Levy re-register previously ceased tax clients provided an updated client permission is provided and manage AgentAdvisor client links register new links or cancel existing links. The Agent will now be able to submit for the client through VAT Online on the HMRC website using their Agent account. Businesses that pay VAT by Direct Debit cannot sign up in the 7 working days leading up to or the 5 working days after sending a VAT Return.

Why do I need an Agent Services Account ASA. Box 5 figure etc. Entering the usal info.

The link for agents to sign up clients. However in order to submit the VAT returns for your client under Making Tax Digital youll require the following. An agent services account allows tax agents to access certain HMRC online services including the Making Tax Digital VAT and income tax pilots and also gives agents the ability to communicate with HMRC directly through software.

Issues that arise when a trader is acting as a principal or an agent. Once they get their code you can enter it in and you can then file VAT returns for them through your agent account. You can register for VAT online although its also possible to use a VAT1 paper form to register if you need to.

Once confirmed the allocation is complete. Once set up you can use your ASA details to file VAT returns for your clients using their software. You dont have to wait for the client register the client for vat online via the hmrc site.

Go into your agent account and click on register for HMRC Taxes.

Amazon Seller Registration How To Create A Seller Account In 2021

Amazon Seller Registration How To Create A Seller Account In 2021

Sell Your Business Commercial Loans Sell Your Business Commercial Lending

Sell Your Business Commercial Loans Sell Your Business Commercial Lending

Set Up Vat Mtd End To End Service Guide Hmrc Developer Hub

What You Need To Do To Be Hmrc Agent Accountingweb

What You Need To Do To Be Hmrc Agent Accountingweb

Making Tax Digital Mtd Who Needs To Register And How To Comply Business Clan

Making Tax Digital Mtd Who Needs To Register And How To Comply Business Clan

What You Need To Do To Be Hmrc Agent Accountingweb

What You Need To Do To Be Hmrc Agent Accountingweb

What You Need To Do To Be Hmrc Agent Accountingweb

What You Need To Do To Be Hmrc Agent Accountingweb

How To Add An Accountant As An Agent On Hmrc Your Cloud Accountant

How To Add An Accountant As An Agent On Hmrc Your Cloud Accountant

Audit Firm In Raz Al Khaimah In 2020 Grow Business New Opportunities Common Law

Audit Firm In Raz Al Khaimah In 2020 Grow Business New Opportunities Common Law

What You Need To Do To Be Hmrc Agent Accountingweb

What You Need To Do To Be Hmrc Agent Accountingweb

What S A Registered Agent Does Your Business Need One

What S A Registered Agent Does Your Business Need One

Amazon Seller Registration How To Create A Seller Account In 2021

Amazon Seller Registration How To Create A Seller Account In 2021

How To Register For Ros Step 1 Apply For Your Ran Youtube

How To Register For Ros Step 1 Apply For Your Ran Youtube

Https Revenue Ie En Tax Professionals Tdm Income Tax Capital Gains Tax Corporation Tax Part 38 38 01 03b Pdf

Agent Provocateur Pink And Black Friday Black Friday Inspiration Black Friday Email Black Friday Email Design

Agent Provocateur Pink And Black Friday Black Friday Inspiration Black Friday Email Black Friday Email Design

![]() How To Add An Accountant As An Agent On Hmrc Your Cloud Accountant

How To Add An Accountant As An Agent On Hmrc Your Cloud Accountant

What You Need To Do To Be Hmrc Agent Accountingweb

What You Need To Do To Be Hmrc Agent Accountingweb

Looking For The Best Lead Generation Company Bold Lead Is Your Stop Commercial Loans Sell Your Business Commercial Lending

Looking For The Best Lead Generation Company Bold Lead Is Your Stop Commercial Loans Sell Your Business Commercial Lending

6 Best Offshore Banks For Opening Accounts Recommendations And Tips In 2020 Best Bank Accounts Offshore Bank Best Bank

6 Best Offshore Banks For Opening Accounts Recommendations And Tips In 2020 Best Bank Accounts Offshore Bank Best Bank